Syndicate Investing in 2025: What’s Changing and How to Stay Ahead

Syndicate investing is evolving fast. 2025 brings new challenges and opportunities, with investors prioritizing traction, data-driven decisions, and portfolio diversification.

Leading syndicate experts agree that this year will reward disciplined, strategic investing:

- Igor Shoifot, General Partner at Toloka.vc (200+ angel deals, 23 exits), predicts a shift toward late-stage, revenue-generating startups, with platforms like Quoroom expanding access to top deals.

- Jed Ng, Founder of AngelSchool.vc (1,400-member syndicate), highlights syndicates as the best way for investors to pool capital, scale networks, and secure high-quality investments without committing to a full VC fund.

- Nilanjay Ghura, Venture Partner at Startup Wise Guys (5 syndicate deals), emphasizes follow-on rounds, selective investing, and active investor engagement as keys to long-term success.

Their insights—shared on the Investor Returns Podcast—show how syndicates are shaping venture capital this year.

What trends will define syndicate investing in 2025? Let’s break them down.

Top Trends Driving Syndicate Investing in 2025

Syndicates are evolving as investors adapt to market shifts, capital constraints, and emerging technologies. This year is about scaling proven strategies and backing startups with real traction over speculation.

Investors can pool capital, share due diligence, and mitigate solo risks, making syndicates an even stronger alternative to traditional VC investing.

AI Goes Beyond the Hype—Now It’s About Execution

AI is a core investment category. Investors are no longer betting on concepts but on AI-driven businesses with real revenue and clear paths to profitability.

Case in point, AI accounted for 37% of VC funding in 2024, and in 2025, investors are focusing on AI startups with real traction and solid business fundamentals.

Sectors seeing the most significant gains:

- AI-driven logistics: Optimizing supply chains, reducing costs, and improving delivery efficiency.

- AI-powered enterprise tools: Automating decision-making in finance, HR, and cybersecurity.

Syndicates must now evaluate AI startups based on adoption rates and revenue impact, not just innovation potential.

Healthcare Tech Continues Its Expansion

The healthcare sector is undergoing massive digital transformation, with investors backing startups that:

- Expand telemedicine adoption beyond early adopters.

- Leverage AI for diagnostics and personalized treatments.

- Focus on regulatory-friendly digital health solutions.

Shoifot sees data-driven healthcare as a major opportunity, while Ghura warns against backing early-stage startups without proven traction.

Space Tech Moves from R&D to Revenue

Space startups are no longer just research-heavy projects. In 2025, they’re securing government contracts and commercial partnerships:

- Companies reporting $30M–$40M in annual revenue are attracting syndicate investors.

- AI-powered satellite data analytics is an emerging niche.

Late-stage syndicate deals in space tech are becoming more accessible, but selectivity remains key.

Sustainability Tech Gains Ground

Investor sentiment is shifting toward sustainable, impact-driven startups—but only those with clear revenue models. The focus is on:

- Energy efficiency solutions that reduce operational costs for businesses.

- Sustainable supply chain startups that integrate seamlessly into existing industries.

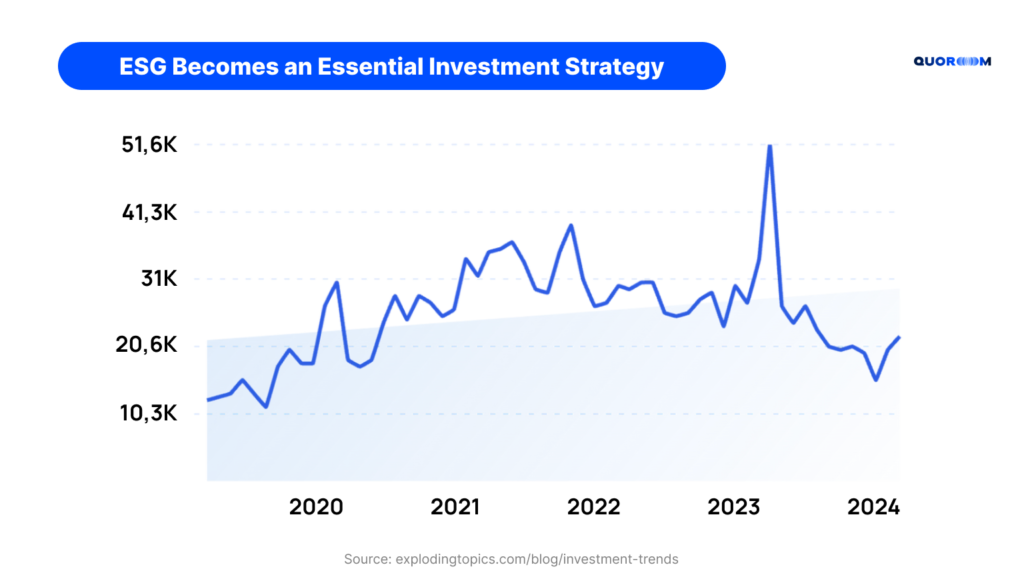

Ghura warns against hype-driven Environmental, Social, and Governance (ESG) investing, emphasizing the need for hard financials and apparent demand.

Rising ESG interest (Exploding Topics, 2024) signals 2025 syndicate opportunities in revenue-generating sustainability startups:

Syndicates as a Hedge in a Tight Capital Market

With VC funding still selective, syndicates offer a more flexible, lower-commitment alternative to full VC funds. Shoifot sees syndicates as a hedge against market uncertainty, allowing investors to:

- Diversify across sectors without locking capital into a traditional fund.

- Co-invest with experienced syndicate leads who have access to top-tier deals.

Syndicates that adapt to 2025’s funding environment—focusing on traction, revenue, and follow-on rounds—will thrive.

Strategies for Building and Managing Syndicates in 2025

Syndicate investing is maturing, and success now depends on structured execution rather than opportunistic deal-making. Investors who follow proven frameworks for deal sourcing, portfolio construction, and investor engagement will be best positioned in 2025.

Education First—Syndicate Leads Must Know the Game

Building a syndicate isn’t just about pooling capital. Investors expect structured deal flow, risk assessments, and clear investment theses.

- New syndicate leads should start by joining established groups to learn the ropes. Jed built his from zero to 1,400 members this way.

- Learning from experts—through platforms like AngelSchool.vc—helps avoid common mistakes.

Jed Ng emphasizes that syndicate investing isn’t a side hobby. Most new syndicates fail without a clear strategy and a strong investor base.

Deal Selection: Late-Stage Traction Over Early-Stage Hype

With capital markets tightening, syndicates must be more selective than ever. Shoifot’s strategy at Toloka.vc focuses on:

- Startups with $10M+ in revenue and 100%+ annual growth

- Valuations capped at 10x revenue to avoid overpriced deals

- Investments in markets with strong exit potential, like the US and UK

For 2025, syndicate leads should prioritize startups with clear revenue streams and follow-on investor interest.

Portfolio Diversification is Non-Negotiable

Nilanjay Ghura warns against over-concentration. To manage risk, syndicate leads should:

- Invest in 10–20 startups annually to improve chances of high returns.

- Mix industries to hedge against sector downturns.

- Favor follow-on rounds in startups that VCs are doubling down on.

Syndicates that balance their portfolio rather than chasing hot trends will perform better in 2025’s unpredictable market.

Investor Engagement: A Syndicate is Only as Strong as Its Network

Syndicate success depends on active investors who commit capital consistently. To keep LPs engaged:

- Send structured investment updates—concise memos, not endless pitch decks.

- Set clear expectations for deal flow frequency and ticket sizes.

- Use investor reporting tools like Investory (acquired by Quoroom) to maintain transparency.

Without a strong investor base, even great syndicates struggle to raise capital.

Adapting to 2025’s Market Conditions

The economic landscape is shifting, and syndicate leads need to be flexible. Ng sees syndicates gaining an edge over traditional VC funds due to their:

- Deal-by-deal flexibility, reducing long-term capital lockups.

- Ability to pivot between sectors based on market demand.

- Lower overhead compared to running a fund.

This year, stay lean, data-driven, and selective syndicates will outperform those that take on too much risk.

Best Practices for Syndicate Leads and Investors in 2025

With syndicate investing becoming more competitive, investors need a disciplined, data-driven approach to maximize returns and minimize risk. The most successful syndicate leads in 2025 will focus on diversification, financial fundamentals, and ongoing education.

Diversification is Essential in a Volatile Market

Nilanjay Ghura stresses that overconcentration is one of the biggest mistakes investors make. To balance risk and reward, syndicate investors should:

- Invest in 10–20 startups per year rather than placing large bets on a few.

- Distribute capital across multiple sectors to avoid downturn risks.

- Prioritize follow-on rounds where venture funds are doubling down.

A well-diversified portfolio increases the chances of landing a high-return exit.

Strong equity returns, like the S&P 500’s rare two-year peak (BMO Fund Central, 2024), highlight 2025 as a prime year for syndicate diversification into high-traction startups.

Numbers Matter More Than Narratives

Igor Shoifot warns against investing based on hype or a compelling founder story. Instead, he advises syndicates to focus on:

- Revenue growth—startups with strong, consistent growth are safer bets.

- Burn rate and cash reserves—ensuring a company isn’t running out of money.

- Market traction—customer retention and repeat business over vanity metrics.

Startups with clear financial fundamentals and objective performance indicators will attract more syndicate funding in 2025.

Syndicate Investors Must Stay Educated

Jed Ng highlights that learning never stops in syndicate investing. Investors who stay informed make better decisions. In 2025, syndicate members should:

- Study deal memos from top syndicates to improve investment analysis.

- Follow industry trends in AI, healthcare, and space tech to identify opportunities.

- Adopt structured decision-making frameworks rather than following hype cycles.

Investors who continuously improve their risk assessment and due diligence skills will outperform those who rely solely on gut instinct.

Transparency and Reporting Build Stronger Syndicates

Trust is key in syndicate investing. To maintain credibility and investor confidence, syndicate leads should:

- Provide clear, data-backed investment memos instead of forwarding pitch decks.

- Send structured portfolio updates rather than occasional check-ins.

- Use reporting tools like Investory to track startup performance.

Strong communication leads to more repeat investors and higher participation in future deals.

Adaptability is a Competitive Advantage

The best investors in 2025 will be those who adjust their strategy based on market conditions. Syndicates should:

- Stay flexible—pivot between sectors rather than sticking to a rigid thesis.

- Invest selectively—fewer, higher-quality deals are better than spreading capital too thin.

- Leverage collective intelligence—experienced syndicate leads offer valuable insights that individual investors may miss.

Those who stay disciplined, data-driven, and adaptable will have the best outcomes in 2025’s uncertain market.

What Startups Need to Attract Syndicate Funding in 2025

Syndicates are becoming more selective, favoring traction over potential. Startups seeking funding in 2025 must prove they are scalable, financially sound, and investor-ready.

Traction and Follow-On Investment Matter More Than Ever

Startups with strong momentum attract more syndicate backing. Nilanjay Ghura advises founders to focus on:

- Proven revenue growth—syndicates prioritize startups with steady, recurring income.

- Low churn rates—customer retention signals long-term viability.

- Follow-on rounds from top VCs—existing investor confidence makes syndicates more likely to join.

Without evident traction, securing syndicate capital will be significantly harder.

Financial Resilience is a Key Selling Point

Igor Shoifot warns that burn rate and cash flow management are top concerns for investors in 2025. Startups should:

- Show a clear path to profitability or at least sustainable growth.

- Have strong financial controls—reckless spending is a red flag.

- Demonstrate efficient capital use—every dollar raised should fuel measurable business growth.

Investors are looking for lean, well-managed startups, not those relying on endless fundraising cycles.

Data-Driven Storytelling Wins Over Hype

Investors are no longer swayed by big visions alone. Startups need data-backed pitches that highlight:

- Key metrics—growth rates, retention, revenue, and margins.

- Market validation—proof that customers need and pay for the product.

- Competitive edge—what sets the startup apart from others in the space.

Syndicates rely on numbers, not vague promises.

Founders Must Be Ready to Engage with Investors

Raising syndicate funding implies building trust with investors. Startups should:

- Be responsive to investor questions—syndicate members expect transparency.

- Provide structured updates—regular insights on progress, challenges, and strategy.

- Align with syndicate interests—targeting sectors that syndicates actively invest in increases the chance of securing funding.

Strong communication can make the difference between a funded and a passed-over startup.

Startups That Fit 2025’s Investment Themes Will Have an Advantage

Founders targeting hot sectors with clear revenue potential will find it easier to raise syndicate capital. Based on 2025 trends, the strongest opportunities are in:

- AI applications with real-world adoption—especially in logistics and enterprise automation.

- Healthcare startups leveraging technology for efficiency—such as AI-powered diagnostics and remote care solutions.

- Space tech companies with paying customers—securing commercial or government contracts.

- Sustainability startups focused on cost savings—rather than purely impact-driven models.

Startups that align with investor priorities and show financial discipline will attract more syndicate interest in 2025.

Wrapping Up

Traction, discipline, and strategy win in 2025 syndicate investing. Diversify your bets, target late-stage startups, and stay sharp—Shoifot, Ng, and Ghura showed this on the Investor Returns Podcast.

- Founders: Show revenue growth and lean ops to grab funding

- Investors: Pick data-backed deals to cash in

Ready to scale your syndicate network? Book a discovery call today and see how Quoroom can support your growth!