If you are a startup or scale-up seeking funding, you may be wondering how to raise capital quickly and efficiently. While there is no one-size-fits-all approach to fundraising, there are certain steps you must take to stand out from a crowd of unprofessional founders and increase your chances of success. Startups that fail to do their homework ultimately fail to raise capital on time. According to a study by CB Insights, 47% of startup failures in 2022 were due to a lack of financing, nearly double the percentage that failed for the same reason in 2021.

Unfortunately, many startups expect fundraising to be easy, they don’t do the homework necessary for each funding round, and they give up after just a few calls and rejections from investors. However, numerous case studies of funding rounds have shown that raising capital is a numbers game. This does not mean that bulk mailing will help you raise capital; in fact, it may cause you to waste time and lose potential investors.

Here are the most common mistakes we see made by startups:

🔴 Not setting a completion date target

Running a constant funding round is not the best approach. Investors need to see the urgency and having a clear deadline for the completion of your funding round is necessary to create an investor FOMO.

🔴 Approaching the wrong type of investors

Finding your investor is all about the match – sector, stage, and geography. Most VC and PE funds disclose their criteria/thesis on their website, and you should do your research to approach only relevant investors. Also, approaching investors with a conflict of interest, such as those who have invested in your competitors, can waste time and potentially harm your business.

🔴 Approaching inactive investors

It’s crucial to approach fresh funds which raised their fund recently or those who invested over the last year. Zombie funds or those that have already invested all money from their fund and are not making new investments, usually, funds that are 3+ old are at the end of their deployment cycle.

🔴 Underestimating or dismissing Analyst and Associates in VC funds

Associates and Analysts have KPIs to scout new opportunities, and they like good qualitative deals/founders that land in their inboxes. When you have a chance, you should speak with a fund Partner (especially those with a focus on your sector), but usually Partners will anyways refer you to their Associate or Analyst for initial screening. Associates and Analysts are your secret weapon.

🔴 Giving up too early

Talking to 5 investors is not enough. Even when you approach investors/funds which match your sector, stage, and geography, there are still other factors why your company is not a match for one fund but could be of interest to others. All investors have slightly or widely different approaches to investing, risk appetite, strategy and focus, all because they have different demands and promises to their fund investors (LPs). Listen to investors’ feedback, but do not seek from investors validation for your business. Your task in the funding round is approaching as many relevant investors as possible to find your match. Approach at least 60 relevant funds to close the funding round with 1 or 2 – it is indeed a numbers game.

🔴 Sending bad emails

A common mistake is sending out unpersonalised outreach to investors. If you haven’t explained why you are a match to a specific investor/fund thesis, you will never hear back from them.

🔴 Not building relationships

No one will invest in your company after receiving your pitch deck. Your pitch deck serves only one purpose – to catch the further interest and get an investor to the next meeting. You have to stay in touch with interested and even not interested investor prior to, during and after your funding round. The best way to do that is not to ask for advice and show progress by sending them Monthly Investor Updates.

🔴 Not sending investor updates

Only companies that send investor updates – stay on the radar of the investors, stand out from the crowd of startups, and familiarise investors with their brand, pop up in investor inboxes showing the company’s progress and help to build trust with investors. Yes, it’s correct – you should send monthly investor updates prior to, during and after your funding round.

🔴 Not knowing your numbers

Analysts or associates present selected companies on a weekly Committee of the fund. They have to prepare an investment memo for each company presented to Committee. On the first call with the investment analyst or associate, they will look for red flags to exclude your company from further discussion. You will be excluded in a benchmark to others because funds invest in the best out of the best opportunities, not just good opportunities. You have to tick all boxes to get presented to the fund’s Committee and get to the next meeting with Partners. So you should know your company’s financial inside out.

🔴 Overvaluation

Setting an unrealistic valuation for your business stage can be a major turnoff for investors, as they may not see the potential for a return on their investment at the proposed valuation. It is better to avoid setting a valuation altogether for now. Instead, focus on determining how much you need to raise to advance your business to the next stage and what percentage of ownership you are willing to relinquish. Ultimately, your final valuation will be determined by the level of demand or interest in your fundraising round. If you end up overfunded, you can leverage it to negotiate a higher valuation.

🔴 Lying to investors

During due diligence or eventually, in the future, all numbers and facts will get revealed. Laying will definitely lead to losing a deal or a fraud conviction, similar to the founders of Theranos, FTX and Frank.

To sum up, due to mistakes in the fundraising process, most startups fail to generate FOMO (Fear of Missing Out). Failing to generate FOMO can be a killer for your funding round. However, in pursuit of FOMO, don’t end up lying to investors. If you don’t have yet revenue growth to show focus on those metrics that conform to your business potential and market validation via testimonials, LOIs.

Avoiding mistakes and doing your homework are crucial to the success of a funding round.

Here is a proven workflow (your homework) to raise capital for your business:

1️⃣ Define your business stage and targets

✅ Target the right type of investors depending on your funding stage.

For an early-stage company, the best target is angel investors with expertise in your industry, e.g. top corporate managers. Target pre-Seed fund at the pre-revenue and early revenue stage or Seed fund if you got anywhere about $10k MRR, preferably $20k MRR. A seed stage round is possible if you have $5k monthly revenue but growing 30%+ each month, same with the Series A – you can start approaching Series A funds if you are $600k ARR but growing 30%+ per month and approaching $1M ARR soon.

✅ Avoid adding valuation to your pitch deck.

When launching a funding round, it’s important to determine the percentage of equity you’re comfortable giving up in the current and next funding stages. If you manage to create a fear of missing out (FOMO) and receive overfunding of your funding round, which can include multiple term sheets on the table or high demand from high net worth individuals (HNWI), you can increase your valuation. This means you can give up the same percentage of the company for more money. However, it’s important to keep in mind that in venture capital (VC) funding rounds, companies typically give up about 10-20% of the company to investors because each VC has its minimum target equity percentage they need to acquire in your company. For seed funds, it’s usually 10% or 15%, while for Series A funds, it’s 20%.

✅ Do not raise more than you need, large rounds ahead of the scaling stage are bad.

Raise enough money to build your product and attract early adopters, and then raise additional funds to accelerate sales and advance to the next stage. If you raise too much money too soon, you may face problems such as giving up too much ownership and control of your company, as well as difficulty raising money in subsequent rounds.

✅ Set a target completion date for your funding round, you need to create momentum.

Your funding round should be closed within 2-4 months, and you should inform the investors in your funding round that you will be closing it soon. Otherwise, you may fail to create FOMO. Many startups keep their funding rounds ongoing and never attract investments because they fail to create a sense of urgency for investors to make a decision.

✅ Set a minimum investment ticket, but not too high, $5000 or $50000 usually works well, depending on the stage and size of your funding round.

2️⃣ Build your Investor Pipeline

✅ Add to the list all relevant investors from your network, events, meetings, introductions and research.

Conduct research to identify potential investors who have a keen interest in your industry and the stage of development you’re in. Every VC fund has its investment thesis shared on its website, very often each VC partner has a specific specialisation they also share publicly. You need to contact roughly 30-60 VCs to get 12-25 meetings and 200-250 angel investors to get 80-100 meetings (approximately 40% of contacted people) to end up with 1-2 VCs and 6-8 angels (approx. 7.5% of meetings) investing in your funding round. So be aware of the investment target and minimum ticket size to understand how many investors you need at the end of the day.

✅ Strive for quality, not quantity, of investors.

✅ Create a list of the “ideal” investors and put them at the bottom of the list. You need feedback first to adjust your pitch before start contacting your “ideal” investors.

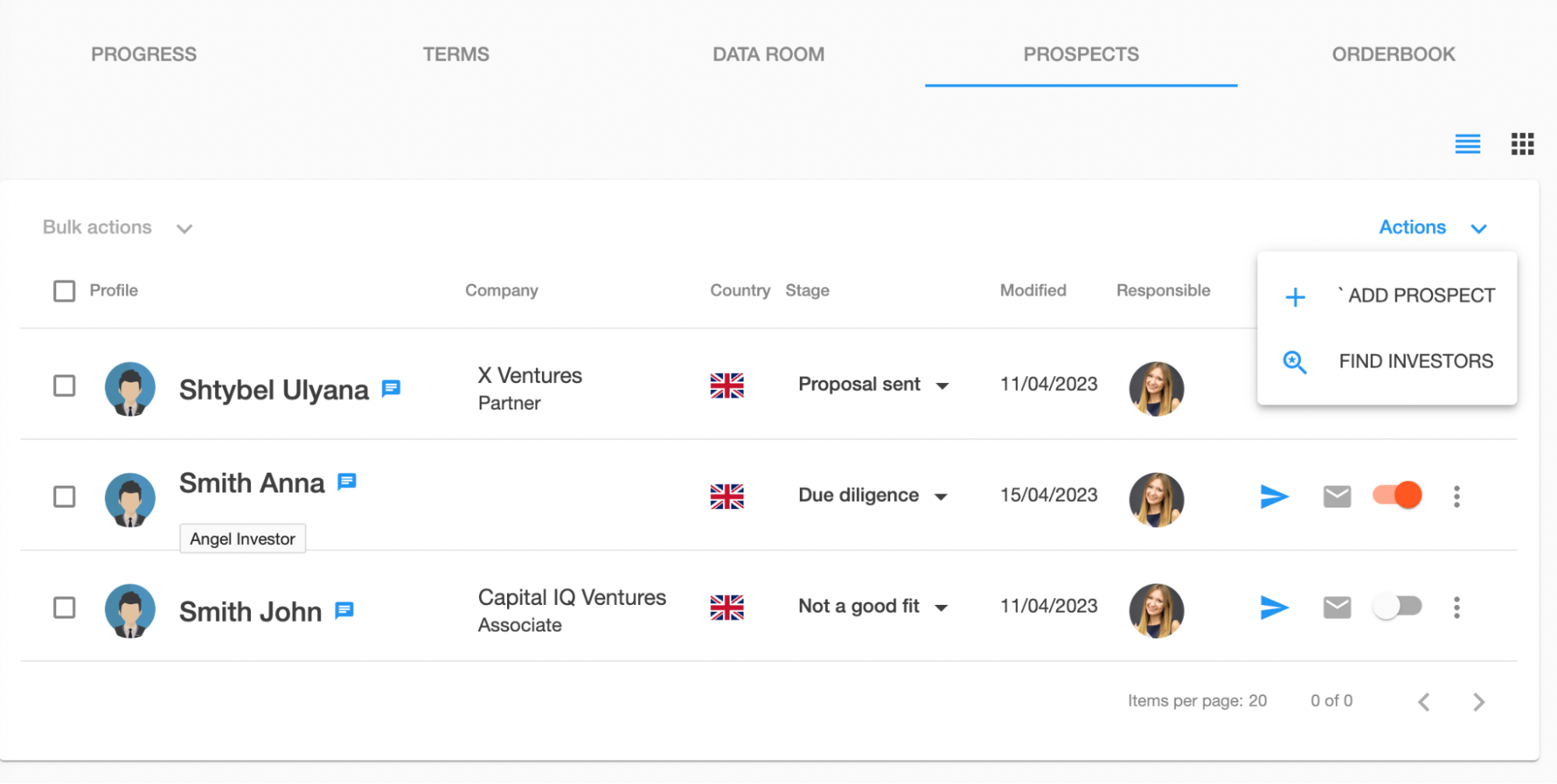

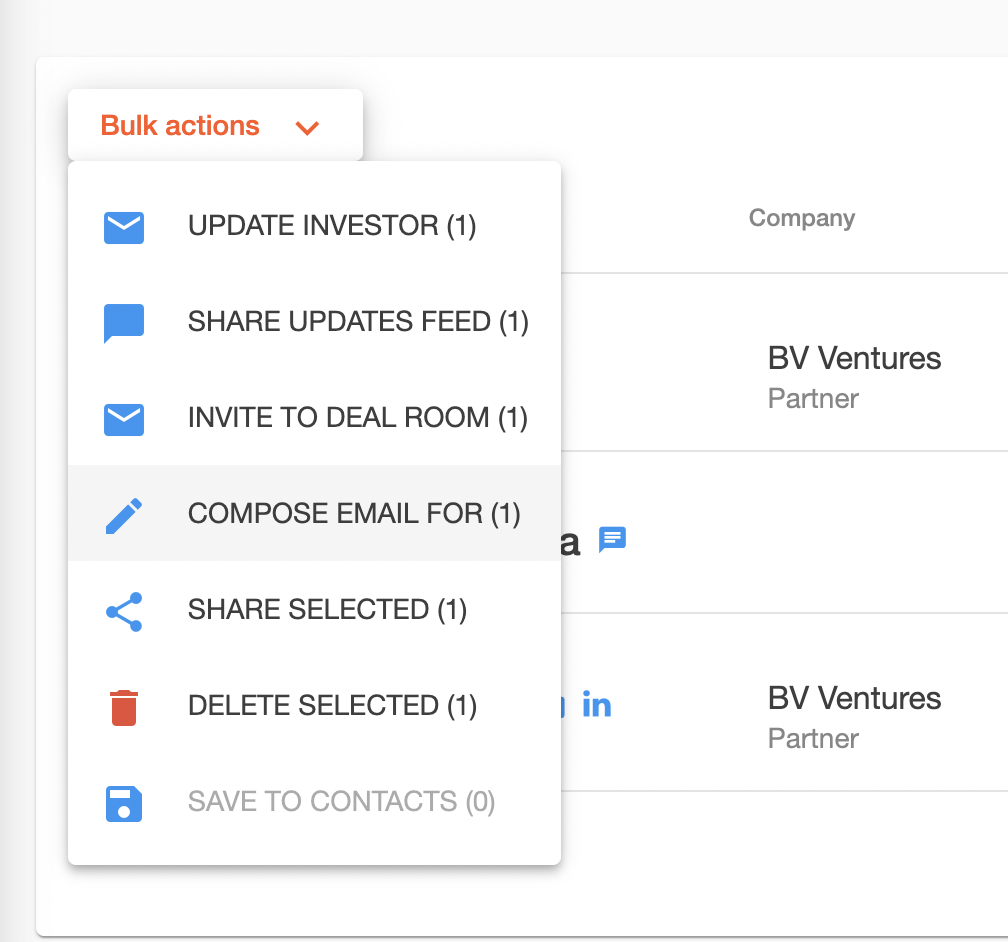

✅ Use the Quoroom investor matchmaking tool to get more highly relevant contacts.

✅ Manage investor statuses as a result of investor feedback, you will need this list soon.

✅ Understanding your investor funnel and timeline:

-

- 2 weeks: Building pipeline, sending personalised emails, getting intros

-

- 2 weeks: Meeting 1 Intro Call – 50% retention

-

- 1 week: Meeting 2 Deep Dive Call – 50% retention

-

- 4 days: Meeting 3 – Terms Review + Financials Review – 100% retention (they all want to see your data room)

-

- 3 days: Data Room Review + Sign Term Sheet – 30% retention

-

- 3 weeks: Draft Agreement Review

-

- 5 days: Signing Final Agreement

-

- 2 weeks: Wiring Money to You Bank Account

-

- 1 day: Filings and distribution of share certificates

In total, it takes 3 months from the start to the close of a funding round. For example, you must start on February 1st to close the funding round by May 1st.

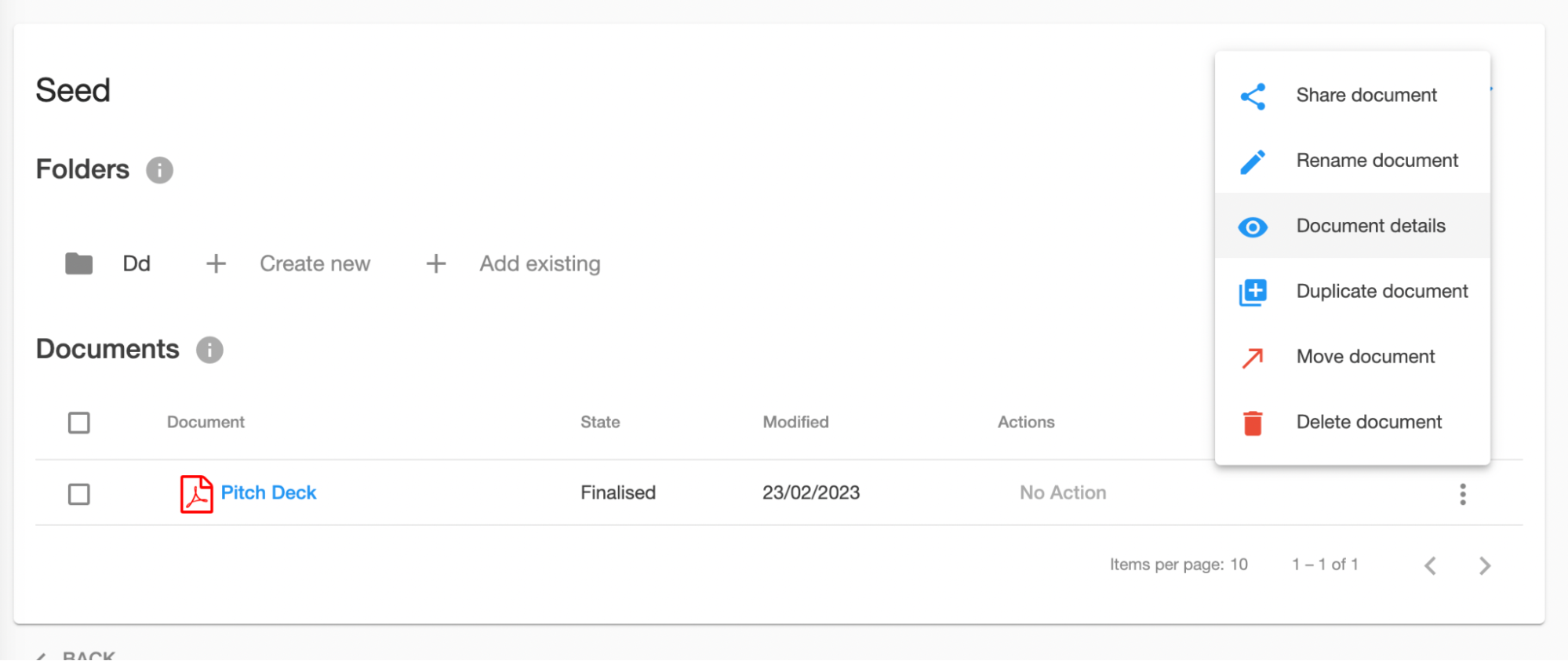

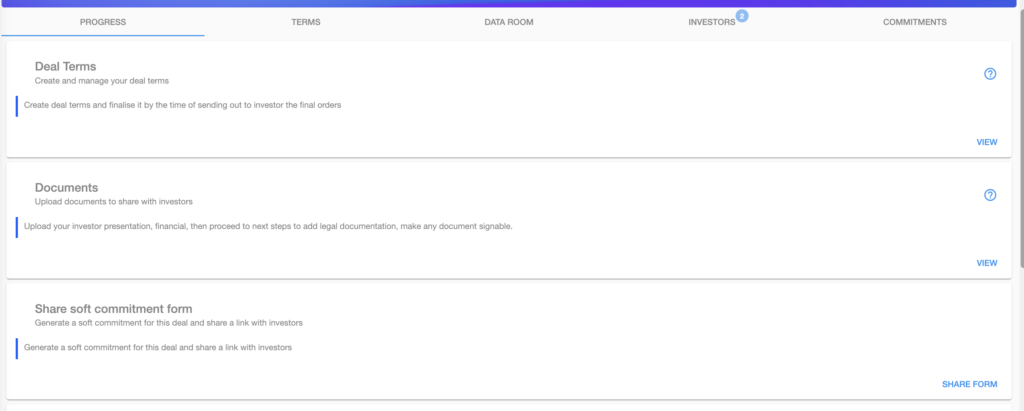

3️⃣ Create your Data Room

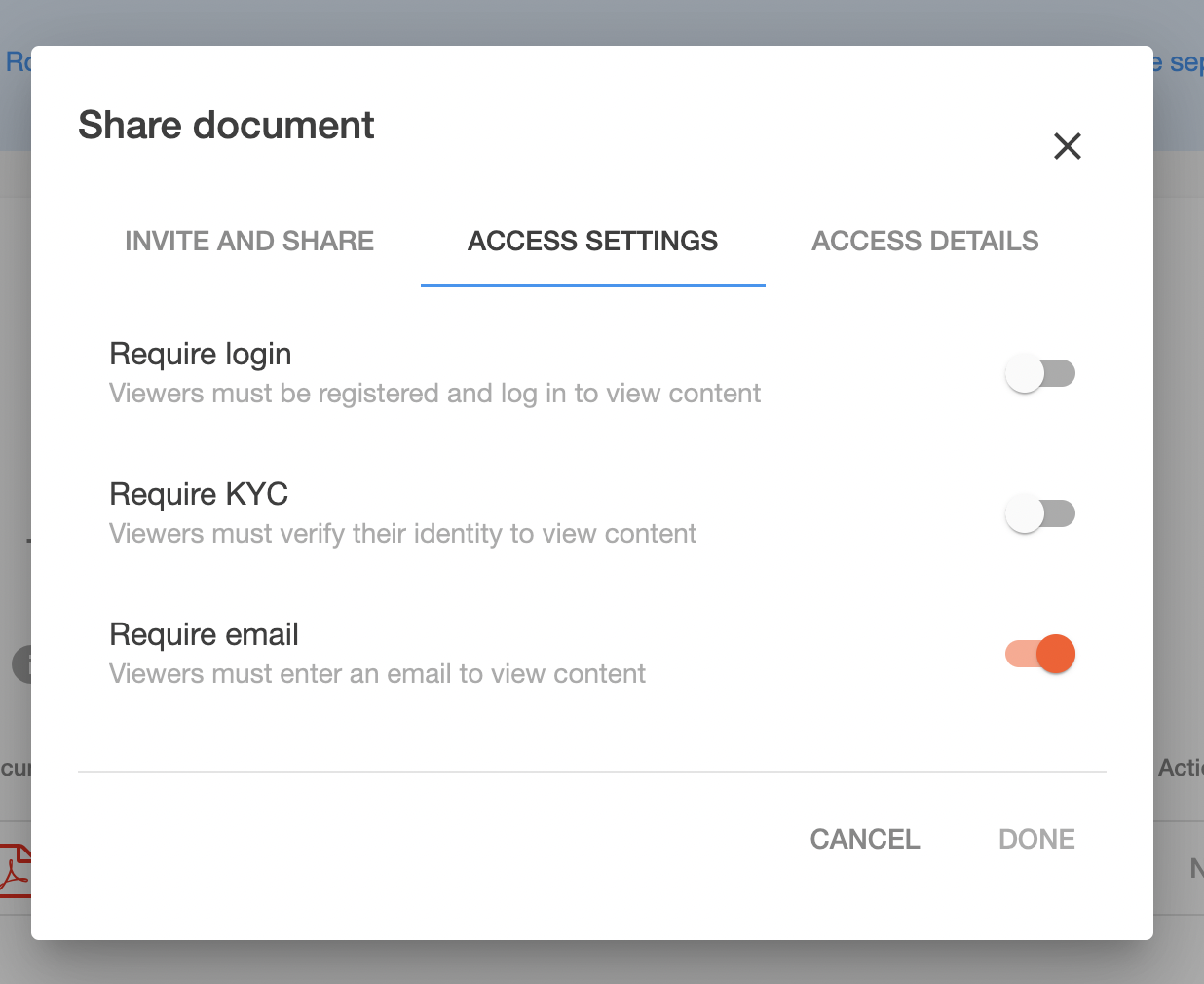

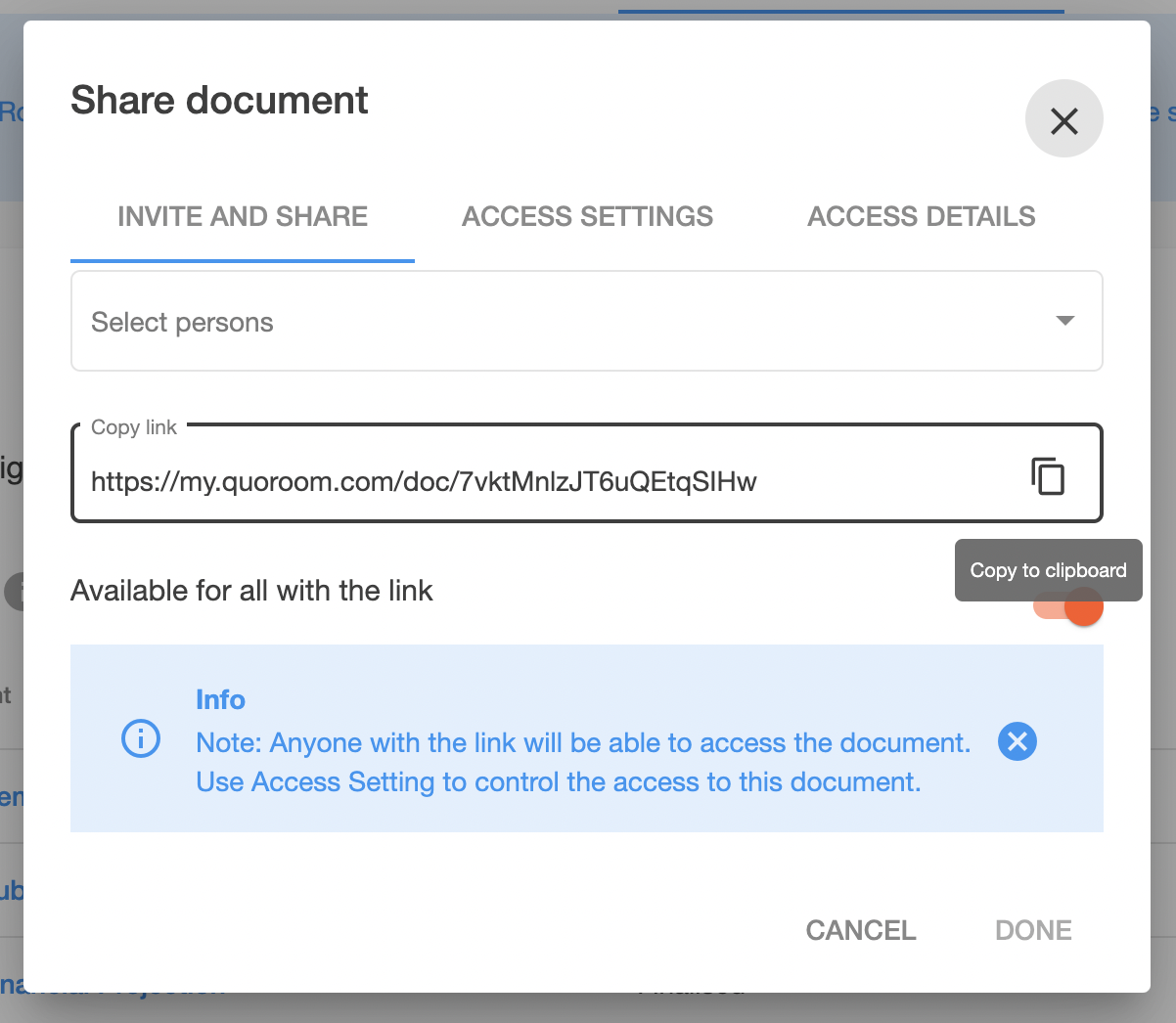

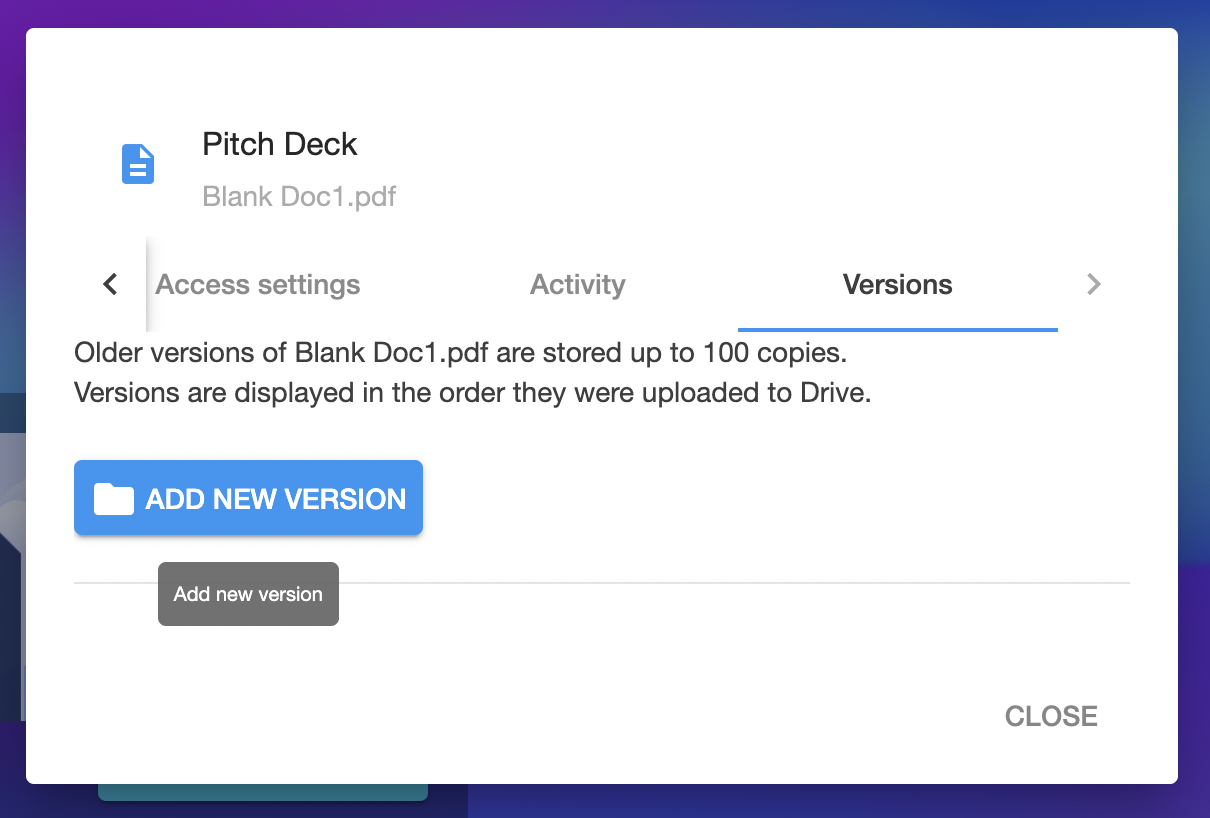

✅ Upload your pitch deck and share it with investors via a trackable link. In DATA ROOM on Quoroom upload your pitch deck and click on Share document. We suggest switching on Available for all with the link and Require email to view the document

Here in data room you will stope and financials and due diligence documents, provide access to data room once requested by investor.

4️⃣ Communicate Investor Proposals

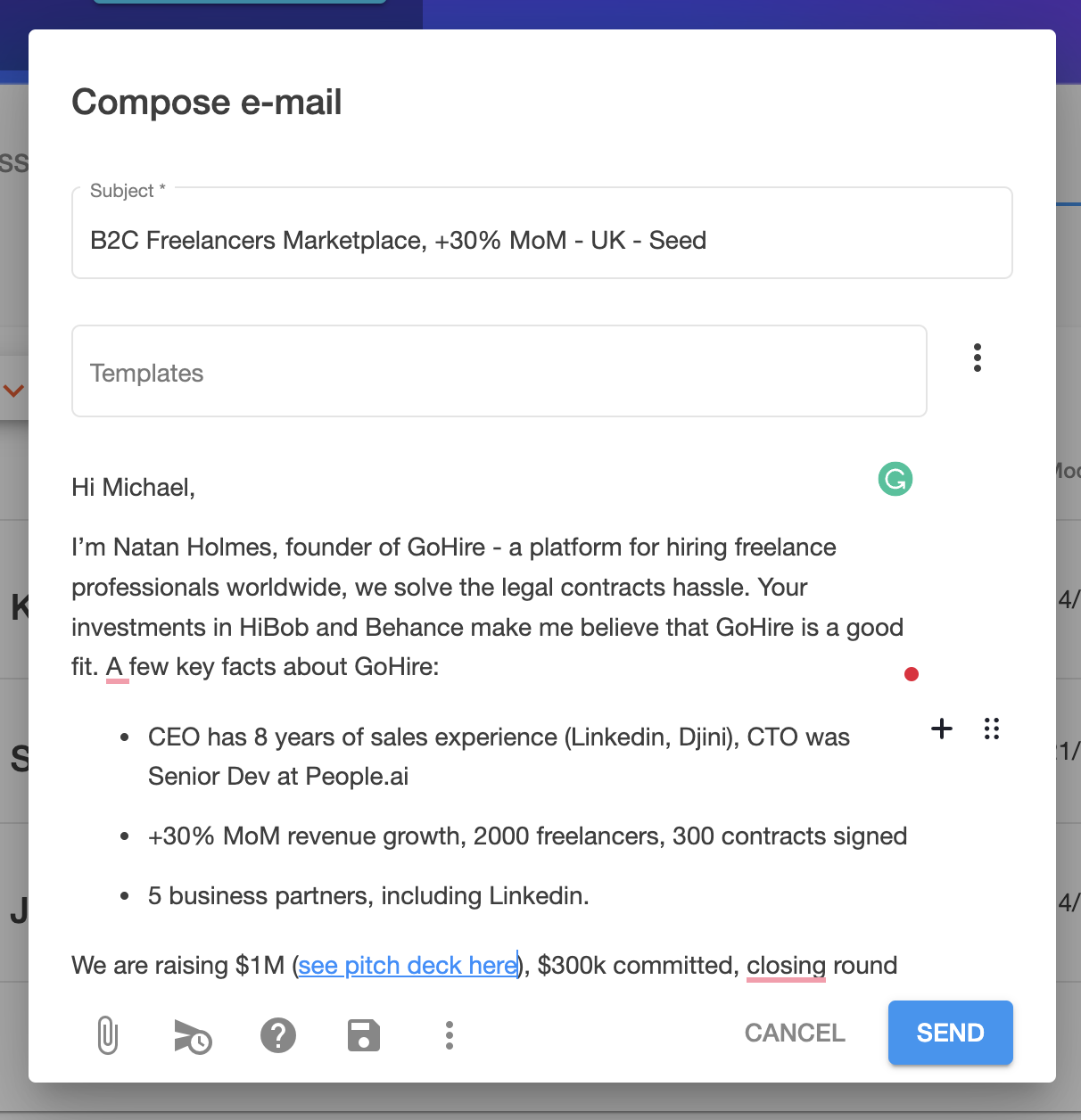

✅ Contact investors with your business highlights and trackable link to your pitch deck.

✅ Personalise emails by indicating why your company match this investor/fund’s thesis: geography, stage, sector. Make sure to look into their portfolio to avoid investors who invested in your competitors and choose complementary portfolio companies you can mention in the email.

✅ Reply to investor emails promptly.

✅ Ask for advice from top managers in your industry, and get them as angel investors.

✅ Build a real human connection with investors, they are people after all.

Don’t be a pitching machine, research investors, express interest in their activities, initiate short talk, listen, exit them with your product, make them want to talk with you again.

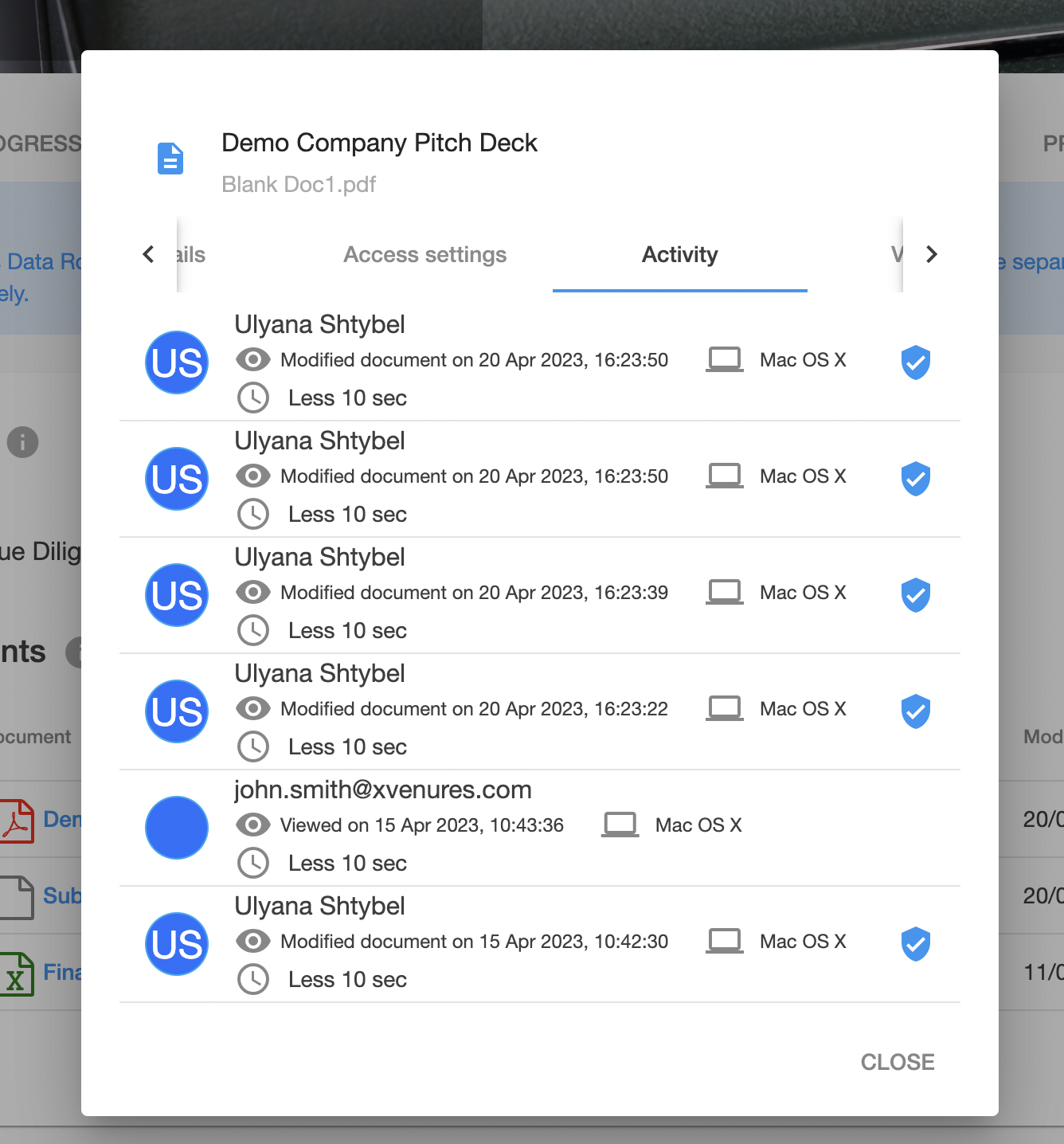

5️⃣ Track Pitch Deck Visitors

✅ Monitor who visited and spend time on your investor presentation.

✅ Provide updates with special attention to these sections where they spend most of the time.

✅ Improve your pitch deck after you receive feedback. Manage versions to keep your pitch deck at the same link up to date.

6️⃣ Send Investor Updates

✅ Send your Investor Updates regularly, at least every second week; at least once per quarter if you are not fundraising. This helps you to stand out from the crows of startups, improve your brand recognition by investors and war up investors during and or even 6 months before the funding round.

Customise the Investor Updates template and add your metrics.

You can add your metrics and Quoroom automatically visualise them at My Companies > Manage > Metrics.

✅ Still send Investor Updates if they said, “It’s not the right time”.

In Quoroom’s template, there is also an Unsubscribe button so investors can opt out from Investor Updates mailing if they are no longer interested.

✅ Cover your metrics, achievements, new hires, new partnerships, new clients in your update.

7️⃣ Come prepared for Investor Meetings

✅ Know your numbers. If you catch investor attention, be ready for 2-3 calls per day, roughly 40 meetings over 2 months. The investor will ask the most common questions, like your business model and the size of the market, but they will also ask questions related to your metrics: MRR and ARR, YoY and MoM revenue growth rates, Burn rate, Churn rate, CAC, LTV, CAC/LTV multiple, ACV, Incremental Profit Margin, Gross Margins, Contribution Margin, Runway, when you will reach profitability (breakeven). Plus your financial projections – how many new customers you will get with investors money and how you gonna grow in revenues and they will ask many questions about your go-to-market strategies. They don’t want to hear general answers, you should give precise and detailed answers about why and how your business gonna catch the market.

✅ Prepare the FAQ document or presentation to share with interested investors.

✅ Inform investors about who is joining the round and what is your target completion date. Create investor FOMO.

✅ Ask if they are interested in committing and at what conditions (revenue growth, relocation, new hire etc)

✅ For your meeting with angel investors, have a minimum ticket size in mind. Say something like: “our minimum ticket is £5,000, is that something that you could do?”

✅ In the answer is No, ask “At what conditions may you want to invest?”.

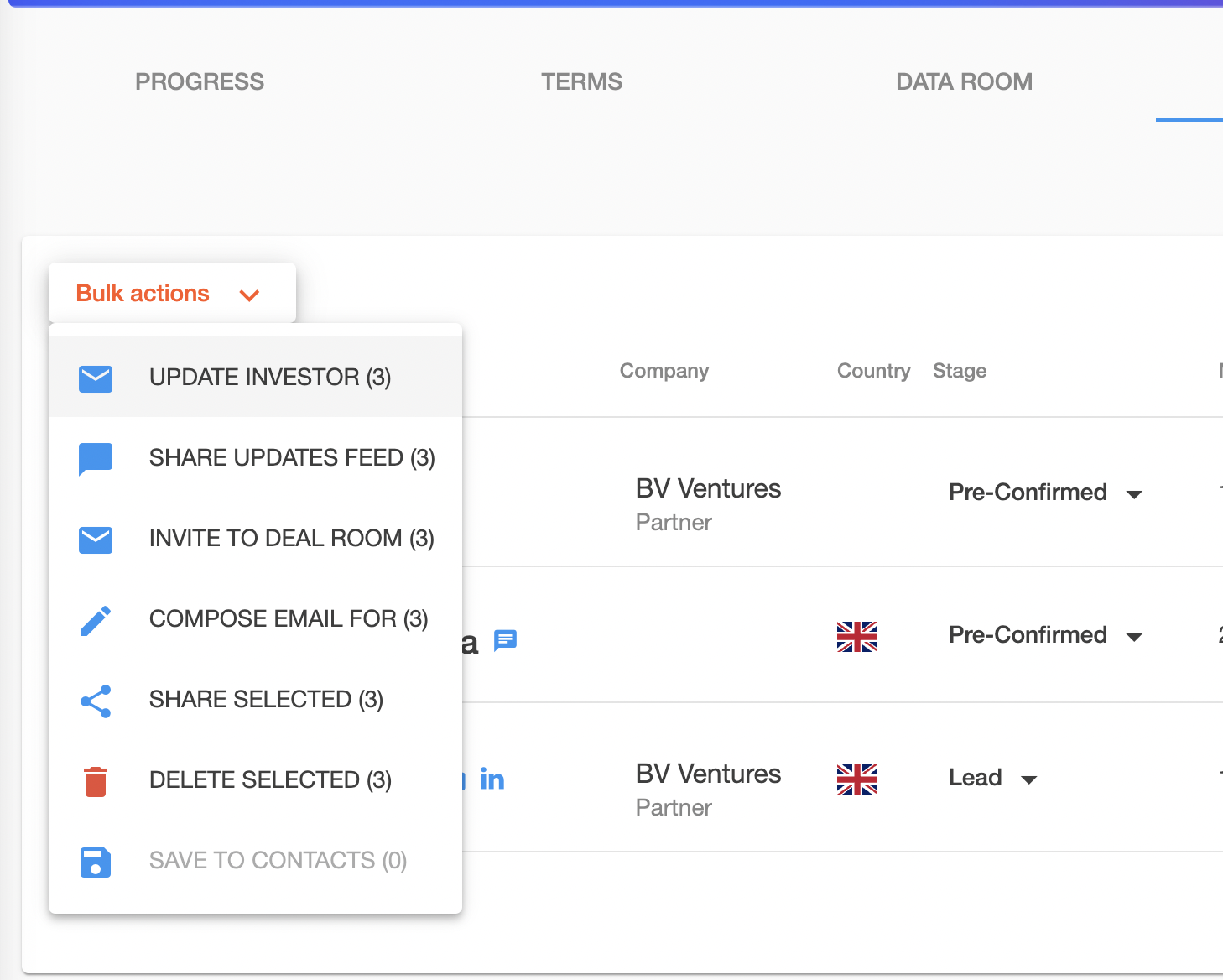

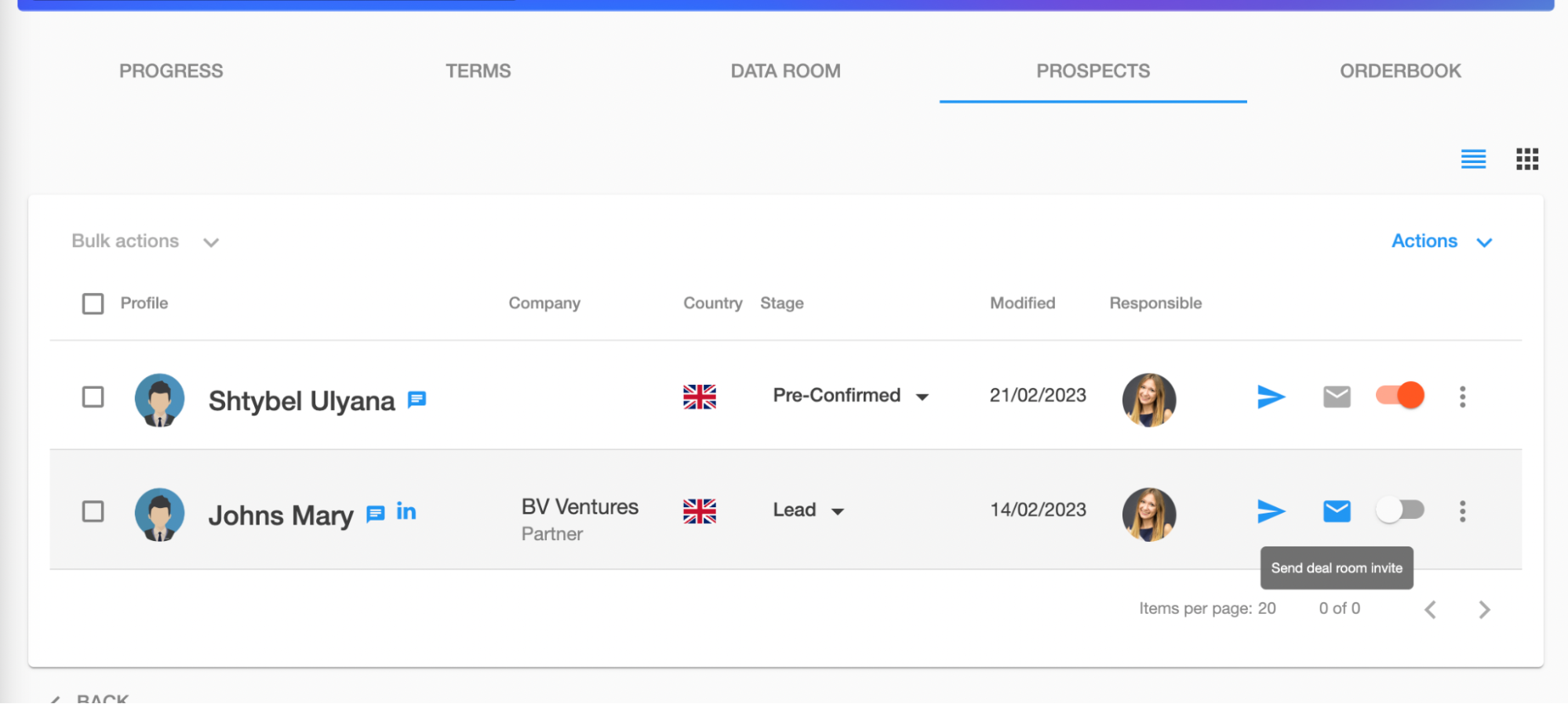

8️⃣ Invite investors to Data Room

✅ After a first or usually second deep dive meeting with investors, invite them to your data room where they can review your financials, request other documents and upload a term sheet.

✅ Share your financials usually requested as the next step after a successful call or meeting with investors.

When an investor asks to see your data room with financials, invite them to Quoroom, click on Send deal room invite, and customise the invite email, once send, access to your deal room will be automatically granted.

The investor will receive an email, they can sign up/log in and access the deal room in the Investor’s Deal section. Documents are automatically visible to all invited investors, but folders have to be additionally shared. We suggest cleating separate folders for Due Diligence.

✅ Proceed to due diligence by adding corporate and financial documentation at the following stages.

9️⃣ Negotiate investment terms

✅ Let investors offer your valuation. If it’s too low, negotiate, so founders can keep enough equity motivating them to run a company for many years.

✅ Try to negotiate a post-money option pool.

✅ Try to negotiate to give no more than 1-1.5 liquidation preference, and under any circumstances, do not agree to the participation rights of the investor.

✅ Negotiate that the company is run by most ordinary share owners and does not let preferred share owners (usually VC investors) block the decision.

🔟 Get soft commitments from investors

This is especially relevant if you are raising from angel investors.

✅ Create an environment for investors to invest together

Investors are unwilling to take risks and are more comfortable joining if they know others believe in your company. Don’t try to push investors to a final decision too early, allow them to express soft interest.

✅ Utilise soft commitment form

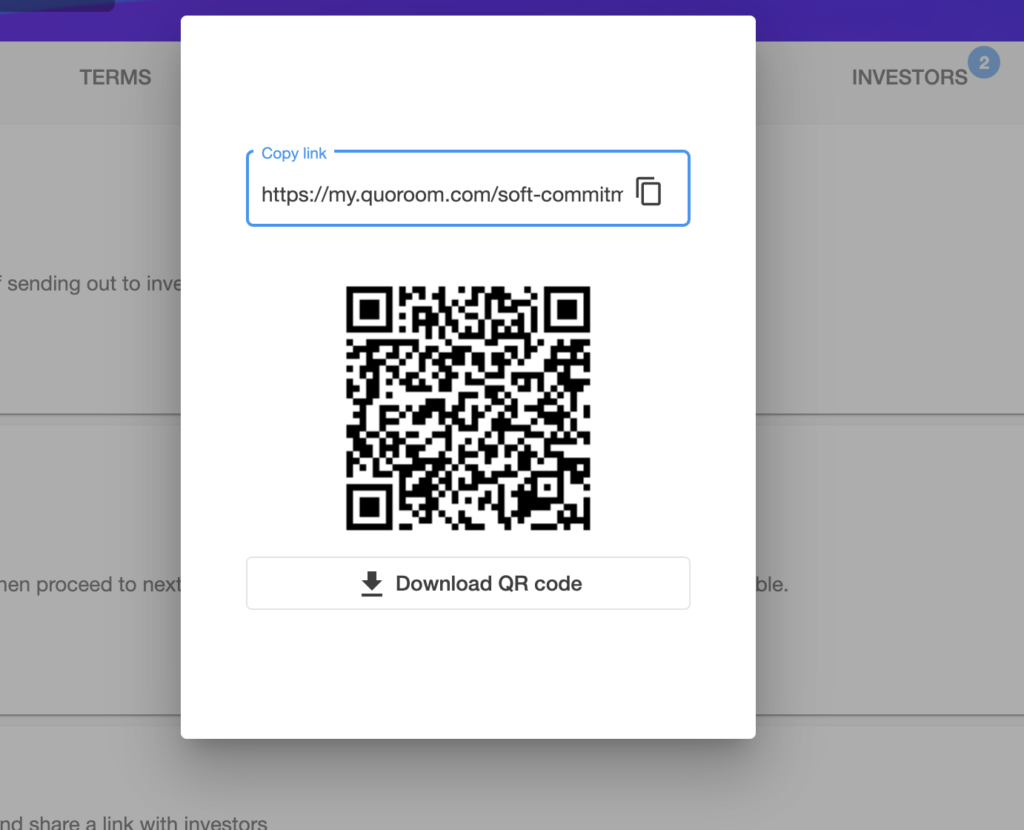

Quoroom generates a soft commitment form directly from your deal room.

Show the QR code after your pitch session, or copy a link to the form and share with investors, ask them to make soft commitment if they are interested. Assure investors that this is only a soft commitment and if the investment target is reached, you will contact them to ask if they would like to move forward with the investment. Encourage investors to secure their allocation because you only raising X at this X valuation. Your goal here is to have enough soft commitments to secure your target raise. Once you come back to investors with the news about the target being reached they are unlikely to drop off as there is already FOMO (Fear of Missing Out) created.

All soft commitments made will be reflected and stored in your deal room on Quoroom so you simply can select all investors and Invite to Confirm and sign.

✅ Create SPV (if angel round)

Your lead investor or you as a founder can utilise Quoroom to create a Special Purpose Vehicle (SPV) to organise all investors in one legal entity that will join your cap table.

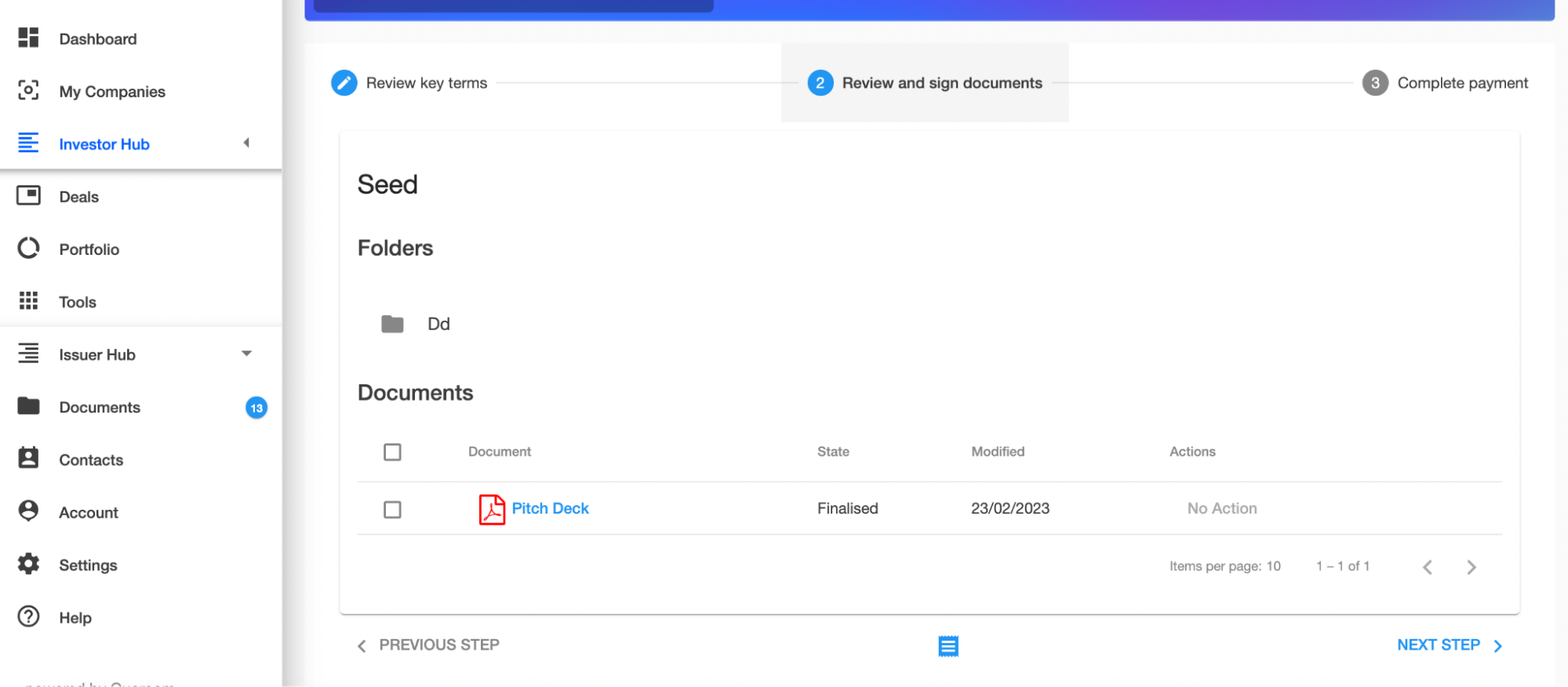

1️⃣1️⃣ Close the Deal

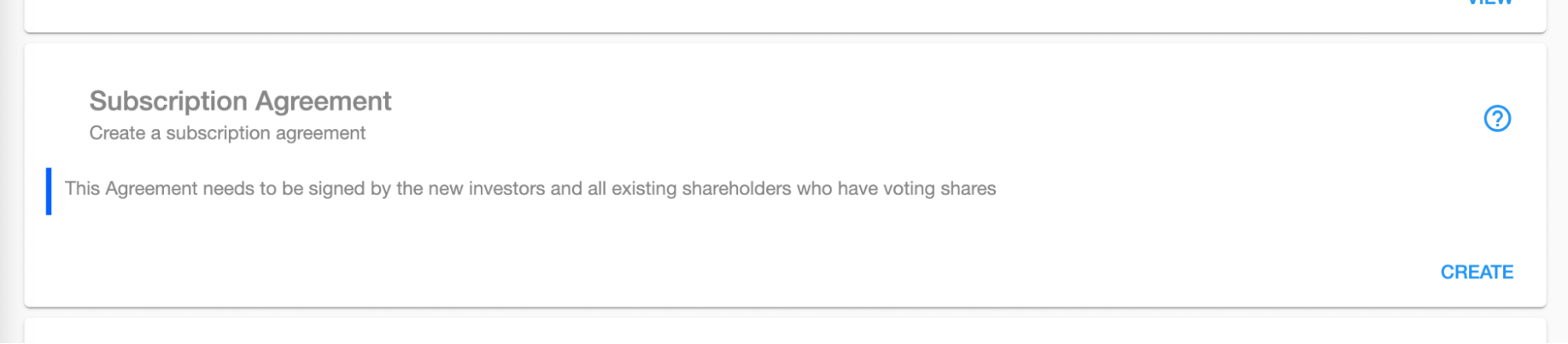

✅ Finalise and sign an Investment Agreement.

Quorooms automated template of the Subscription agreement (based on the BVCA template) is available in Progress. When you click CREATE, it automatically creates the agreement with investors who Accepted a deal (see the status in COMMITMENTS) and with the current structure of your cup table. Make sure you onboarded your cap table for an agreement to generate correctly.

This is a perfect agreement to be signed with angels, but very often VC/PE funds provide their own agreement, so you can import it to electronic documents in DATA ROOM, collaborate with lawyers and sign it on Quoroom.

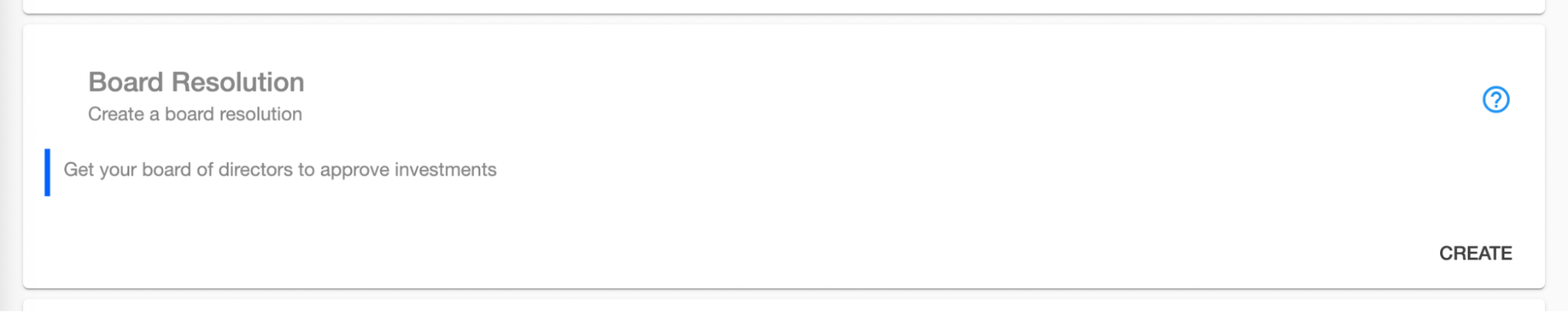

✅ Issue Board Resolution with the decision to issue new shares.

Board resolution also can be generated automatically on Quoroom.

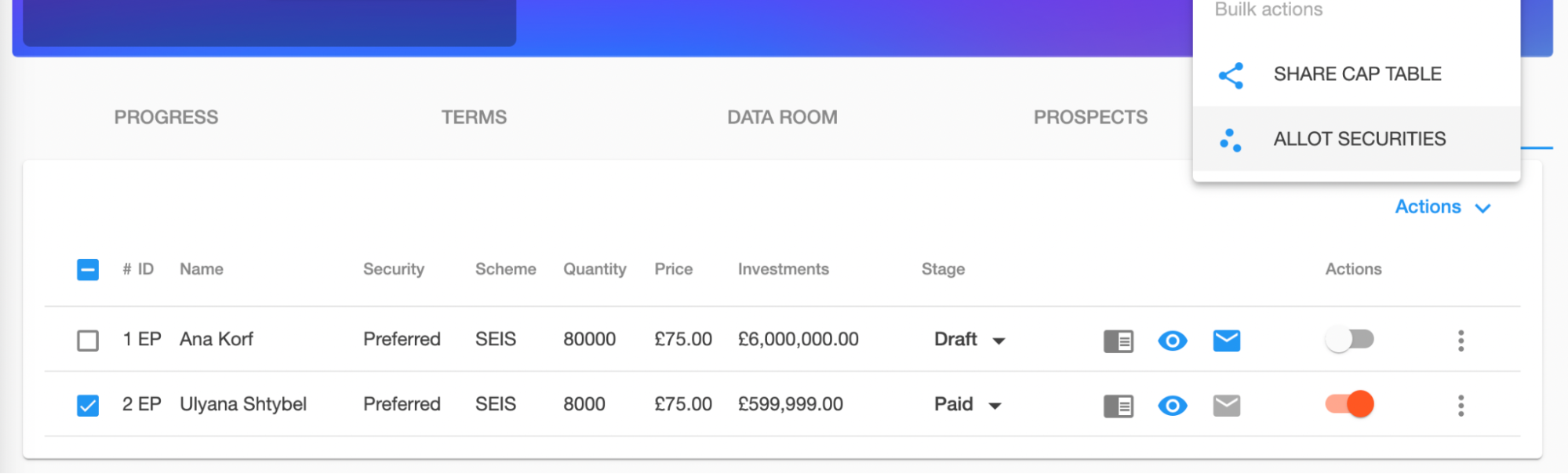

✅ Issue new shares to cap table.

In ORDERBOOK you select all investors who Paid and click on Allot Securities, this automatically adds investors to your cap table and issues them certificates.

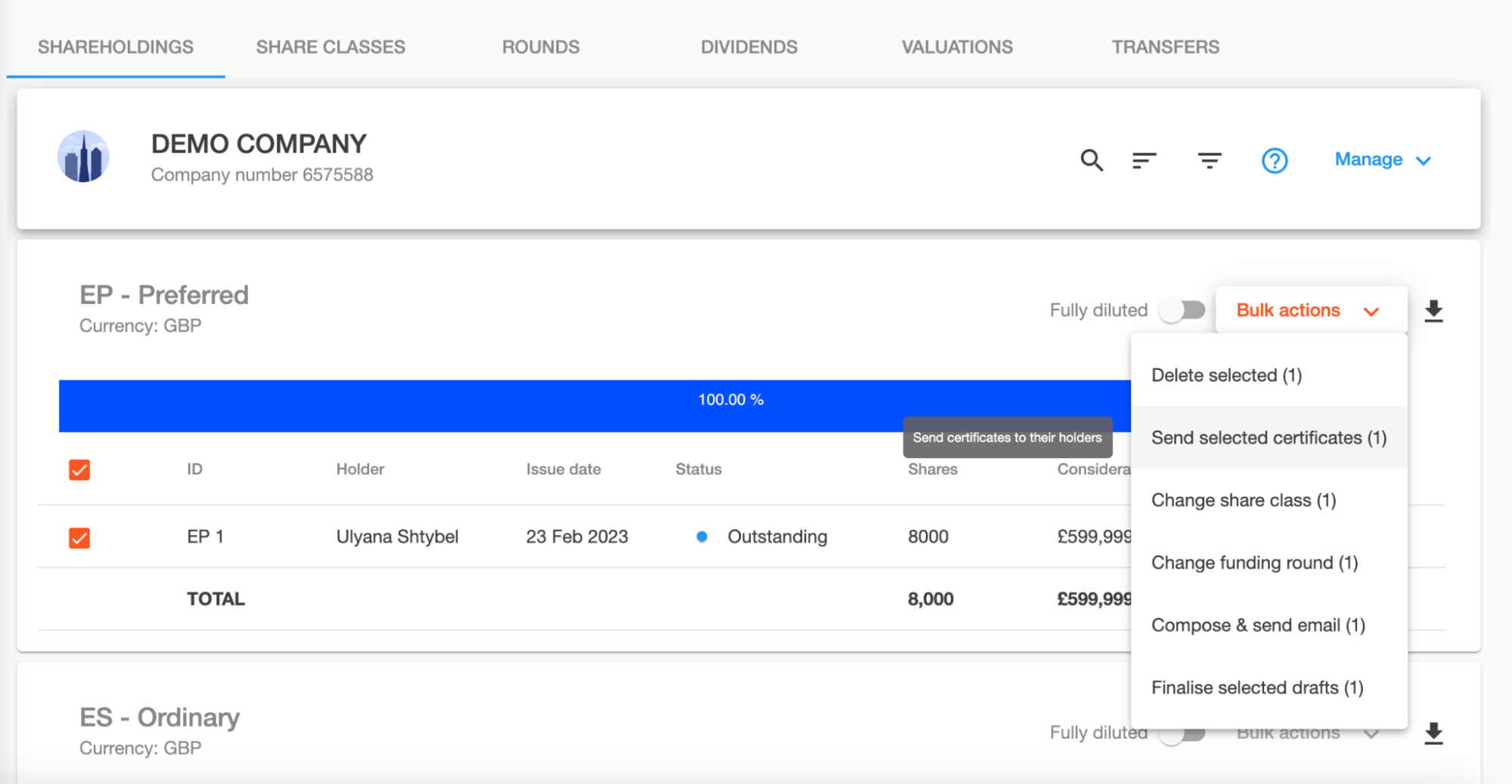

All you have to do now, it’s go to Issuer Hub> Securities > Shareholdings, sign and send certificates to new investors.

✅ Submit the SH01 form to the Companies House or filings under the US federal and state requirements, e.g. Certificate of Amendment to the Secretary of State of Delaware. Submission of SH01 is automated for UK-registered companies.

Before you proceed to submission make sure you added your CH authorisation key in My Compnies> Manage> Integrations

✅ Registering the investment with the SEC, e.g. Form D, within 15 days after the first sale of securities to US accredited investors (applies both to US and foreign issuers).

✅ Sign and send electronically Share Certificates within 2 months after issuing shares.

In Issuer Hub> Securities> Shareholdings (or Debtholdings if issued debt) select all new holdings added and click on Send certificates.

Raising capital for your startup can be a challenging process, but by following these steps, you can increase your chances of success. Remember to be strategic in your approach, focus on building relationships with investors, and always be prepared for investor meetings. With a bit of preparation and persistence, you can secure the funding you need to take your startup to the next level.

If you want to know more about how to use Quoroom for fundraising book a demo today and get a one-on-one session with our fundraising expert to answer questions more specific about your funding round.

Photo credits to Markus Winkler.