Introduction

In the world of investments, syndicates play a crucial role in collaborating and investing on deal-by-deal basis as a group. These collaborative groups bring together smaller and larger investors with a common goal, pooling money and expertise to achieve mutual financial benefits. Understanding what a syndicate is and how it operates is essential for navigating the complexities of modern finance.

What is a Syndicate?

A syndicate, in its simplest form, is a group of individuals that join forces to invest in a project, a startup or an operating business, predominantly a privately held, not a public business. . This could be investing in company shares or lending money to the company, sometimes syndicated pool money to buy a portion of shares on the secondary market or invest in funds.Members of a syndicate contribute funds, expertise, or both, with the aim of achieving shared success in their chosen venture. Syndicate or Special Purpose Vehicle (SPV) can also be created by a group of funds to invest together in the underlying opportunity.

How Does a Syndicate Work?

The workings of a syndicate revolve around collaboration and risk-sharing.By pooling resources, syndicate members can undertake projects that might be too large or risky for any single entity to handle alone.

Imagine stumbling upon a promising early-stage startup poised for significant growth. After engaging with the founder, you secure a commitment of $150,000 for their fundraising round. To facilitate this investment, you establish a deal-by-deal investment mechanism known as a Special Purpose Vehicle (SPV). Your next step involves soliciting funds for the SPV, aiming to fill your allocated amount to the maximum extent possible. Once the SPV accumulates its capital, it channels all funds into the startup. Upon the eventual exit event, the distribution of funds follows a predetermined structure, typically known as the waterfall model. Under this model, investors first recoup their initial investments in full, after which any remaining proceeds are divided, with 20% allocated to you as the syndicate organizer and 80% distributed among the investors.

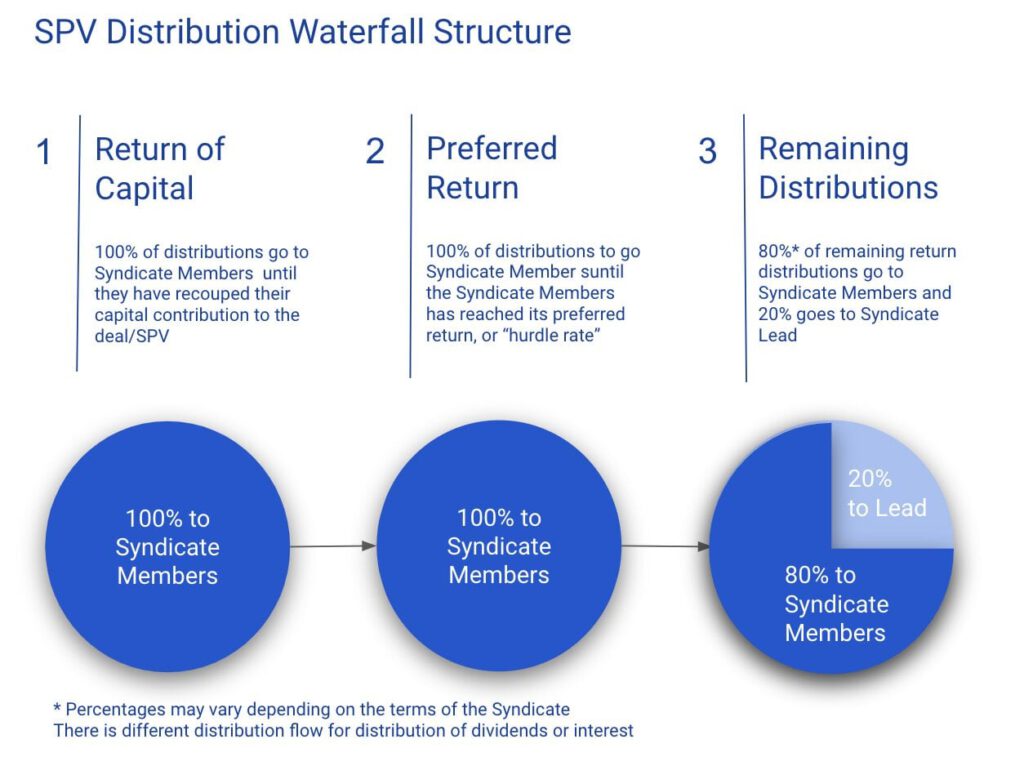

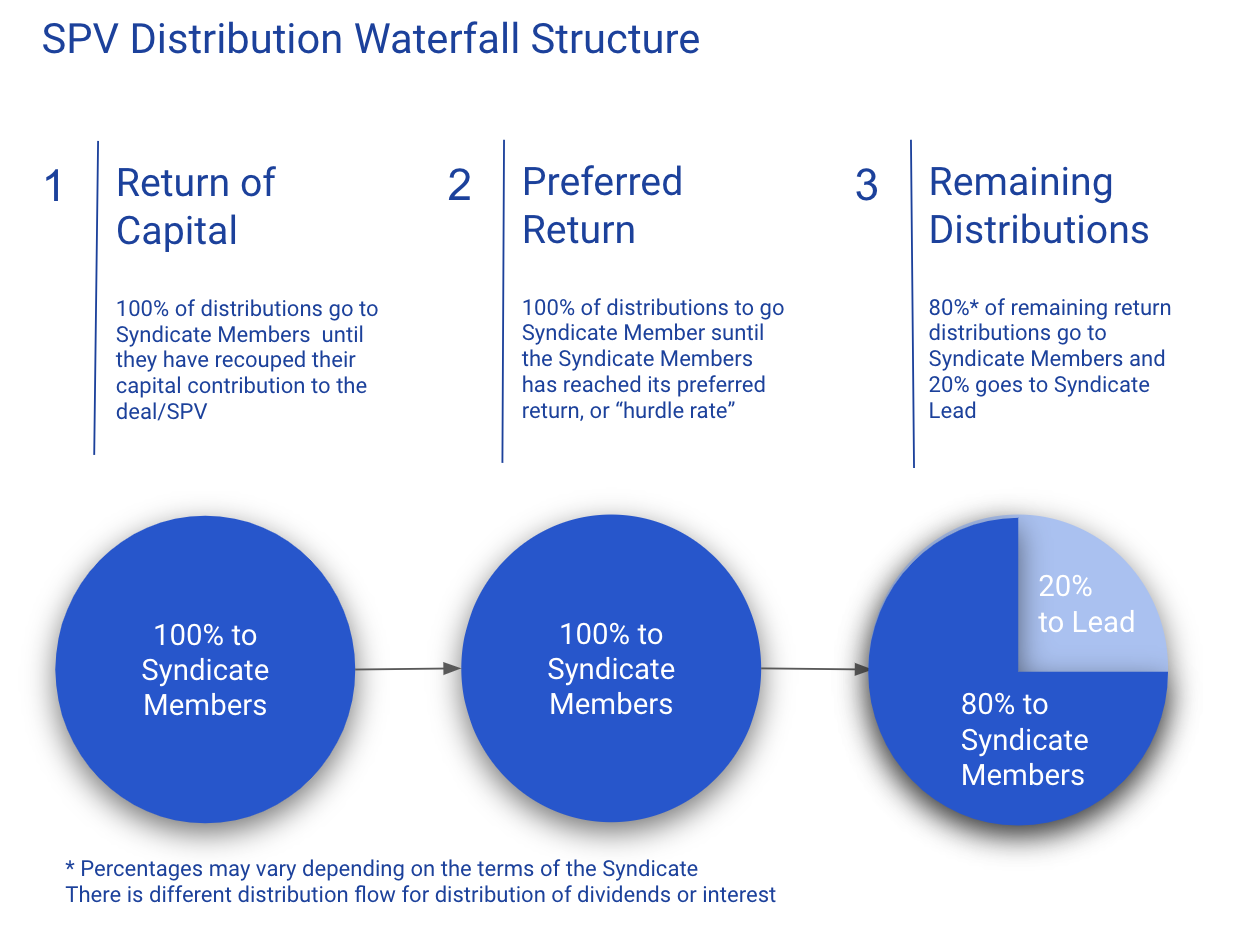

The diagram below illustrates a hypothetical distribution waterfall.

European-style waterfalls, also known as Global-style, prioritize investors by ensuring they receive all distributions from the fund until they’ve not only recouped their entire investment but also met the hurdle rate for returns. Only after this milestone is reached do general partners become eligible for any portion of the proceeds. Consequently, even as funds start flowing into the fund initially, general partners receive no incentive compensation until investors’ interests are fully addressed.

Roles and Responsibilities

Within a syndicate, roles and responsibilities are often defined based on each member’s expertise and contribution. For example, in a syndicate formed to invest in a new security offering, one member might take the lead in structuring the deal, while others contribute capital and market insights. Clear communication and coordination are essential to ensure that all participants understand their roles and obligations. Here are some common roles within a syndicate:

1. Syndicate Lead or Organizer: This individual or entity initiates the syndicate and takes on the primary responsibility for coordinating activities, facilitating communication among members, and ensuring that the syndicate operates smoothly. Syndicate leads may also play a significant role in sourcing investment opportunities, negotiating deals and managing due diligence process. Syndicate leads almost always participate with their own money in the selected investment deals. They often have a higher level of involvement in the syndicate’s activities and may receive fee to conver deal costs and compensation based on the performance of the investments.

2. Investors or Limited Partners: Investors in the syndicate contribute capital to finance the venture or investment opportunity. They may include individuals or smaller investment firms, or other entities seeking to participate in the syndicate’s activities. Investors typically have a passive role in pre-selection and due diligence of opportunities but take their own decision which deal they want to participate in.

3. Specialized Contributors: Depending on the nature of the venture, syndicates may include members with specialized expertise or resources relevant to the project. These contributors could be legal advisors, financial analysts, industry experts, or other professionals who provide valuable insights and support to the syndicate. Often those may be different contributors/advisers depending on the type and industry of the deal.

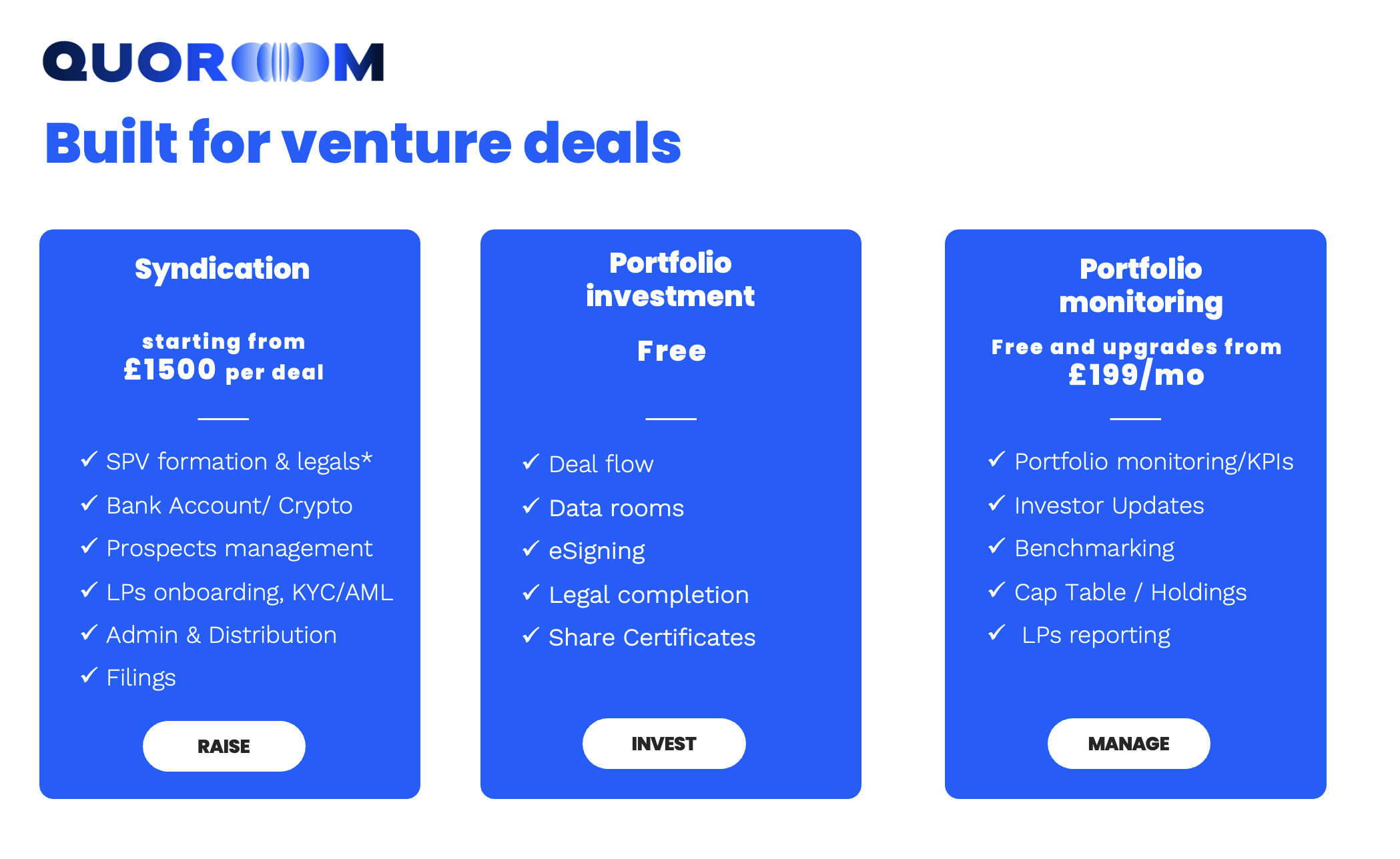

4. Service Providers: Syndicates may also engage external service providers such as legal firms, accounting firms, or consulting agencies to assist with various aspects of the syndicate’s operations, including legal compliance, financial reporting, due diligence, and other administrative tasks. But most often, syndicates use a legaltech software provider such as Quoroom that covers all the legal and compliance aspects of onboarding and signing syndicate members into the deal.

Clear delineation of roles and responsibilities is essential for avoiding conflicts of interest, maintaining transparency, and ensuring accountability within the syndicate. Effective communication and collaboration among members are also critical for maximizing the syndicate’s success and achieving the desired outcomes for all participants.

Why to invest in a syndicate?

Investing in syndicates has become an increasingly popular option for individuals looking to diversify their portfolios and gain access to exclusive investment opportunities. Syndicates composed of multiple investors pooling their resources, offer several potential benefits as well as drawbacks. Understanding the pros and cons of investing via syndicates versus funds is essential for investors considering this avenue for wealth accumulation. Let’s explore both sides options to provide a comprehensive overview of syndicate investing cooperatively to investing via funds.

Pros of investing via syndicate:

1. Diversification: Syndicates offer investors the opportunity to diversify their investment portfolios by gaining exposure to a broader range of assets or ventures than they could access individually. By spreading their investment risk across multiple projects or assets, investors can reduce their exposure to the potential downside of any single investment, enhancing overall risk management.

2. Access to Opportunities: Investors gain access to exclusive or high-quality investment opportunities that may not be available to individual investors, thanks to the extensive networks and expertise of lead syndicators.

3. Risk Mitigation and Impact: Unlike investing via funds, investors have the ability to select projects they are investing in. In addition to a better-diversified portfolio, it also offers the opportunity to control what projects investors want to contribute in from the industry perspective. For example, investing in impact businesses and not investing in businesses which cause negative externalities to the environment or society.

4. Expertise and Due Diligence: Syndicates are often managed by experienced professionals or entities with specialized knowledge, conducting thorough due diligence and making pre-selection of projects on behalf of the syndicate.

5. Scale and Efficiency: Syndicates enable investors to leverage collective resources and negotiating power to access larger investment opportunities or negotiate favourable terms, achieving economies of scale and improving investment efficiency.

6. Potential for Higher Returns: Syndicates may offer the potential for higher returns, especially in early-stage startups, emerging markets, or niche sectors with significant growth potential. Strategies such as leverage, or active management can further enhance returns.

7. Network and Collaboration: Participating in a syndicate provides investors with networking opportunities and collaboration with like-minded individuals, institutions, and professionals, leading to valuable connections, knowledge sharing, and potential future investment opportunities.

Cons of investing via fund:

1. Limited Control: Investors in a fund have limited control over investment decisions, as these are made by fund managers. This lack of control may not suit investors who prefer to have a more hands-on approach to their investments. When investing via a syndicate, investors are in control of their investments.

2. Dependency on General Partners: The success of investments in a Fund often relies heavily on the expertise and decision-making abilities of the General Managers If the general manager makes poor investment choices or lacks experience, it could negatively impact the fund’s overall performance. When investing via syndicate investors are making their own decisions based on a variety of factors and industry expert opinions available through the syndicate community.

3. Fee Structure: Funds charge annual management fees, typically 2% and carry fees 20%, which can reduce investors’ overall returns significantly over the years (typical life of the fund is 10 years). Also, some fund managers who use American style waterfall may get their carry before the hurdle and principal investment is repaid. It’s essential for investors to carefully consider the fee structure and potential impact on their investment performance. When investing via syndicates, syndicate leads typical charge a one-off entry fee on each investment up to 10%, which covers the entire lifetime of the investment and 20% carry-on exit proceeds which is only paid upon payment of principal and hurdle, the hurdle rate is typically 8-10% annually.

4. Illiquidity: Investments via private funds or syndicates are typically illiquid, meaning investors may not be able to easily sell their shares or withdraw their funds before the investment horizon or exit event. This lack of liquidity can limit investors’ flexibility and access to capital when needed. Nevertheless there may be more flexibility for secondary transactions when the investor is selling ownership rights in SPV dedicated to a specific company rather than the whole portfolio of the fund.

Operating a syndicate

Managing a syndicate involves several key steps and responsibilities to ensure its smooth operation and successful execution of investment strategies. Here’s a general outline of how to manage a syndicate:

1. Establish Clear Objectives: Define the goals and investment objectives of the syndicate, including target sectors, asset classes, risk tolerance, and expected returns. Ensure alignment among syndicate members regarding these objectives.

2. Structure and Legal Setup: Determine the legal structure of the syndicate, whether it’s a Trust or LLP/LTD created for each deal.. Consult with legal and financial advisors to draft the necessary legal documents or engage the legaltech software provider.

3. Recruit Syndicate Members: Identify and recruit potential syndicate members who align with the investment objectives and contribute complementary skills, expertise, and resources. Develop a clear process for onboarding new members and establishing their roles and responsibilities within the syndicate. Most often syndicate communications are managed via Whatsapp groups and emails, while legal onboarding is facilitated via the dedicated software.

4. Due Diligence and Deal Sourcing: Conduct thorough due diligence on potential investment opportunities, including financial analysis, market research, and risk assessment. Develop a robust deal-sourcing strategy to identify and evaluate investment opportunities that align with the syndicate’s objectives.

Most of the deal flow is sourced via the syndicate leads and members’ connections. Opportunities have to meet a certein minimum criteria set by syndicate members, therefore data-driven solutions for dealflow matching are used often.

5. Investment Decision-Making: Establish a transparent and collaborative decision-making process for evaluating and approving investment opportunities. Define criteria for assessing investment viability, risk-return profiles, and alignment with syndicate objectives.

6. Risk Management: Develop a risk management framework to identify, assess, and mitigate risks associated with investment opportunities. Monitor portfolio performance regularly and adjust investment criteria as needed to manage risk effectively.

7. Portfolio Management: Manage the syndicate’s investment portfolio actively, including monitoring performance, conducting periodic reviews, and making adjustments to optimize portfolio composition and performance. Implement diversification strategies to spread risk across multiple investments and asset classes. The most common ways of monitoring portfolio is via the dedicated software. Ideally when you syndication software include the ability to access your portfolio cap table, financial metrics and KPIs.

8. Communication and Reporting: Establish regular communication channels and reporting mechanisms to keep syndicate members informed about investment activities, portfolio performance, and other relevant updates. Provide timely and transparent reporting on investment outcomes, financial results, and key performance indicators. The most advanced syndication software should provide you with the opportunity to share reporting with the Syndicate Members/LPs.

9. Compliance and Governance: Ensure compliance with regulatory requirements and legal obligations governing syndicate operations and investment activities. Establish governance structures, including roles and responsibilities of syndicate members, decision-making processes, and conflict resolution mechanisms. Look for syndication software provided whoch offers legal and regulatory solution included.

10. Exit Planning: Develop exit strategies for investments to realize returns and distribute proceeds to syndicate members. Consider factors such as investment timelines, liquidity requirements, market conditions, and exit options (e.g., IPO, acquisition, secondary sale) to optimize investment outcomes.

11. Continuous Improvement: Continuously evaluate and improve syndicate management processes, investment strategies, and operational efficiency. Solicit feedback from syndicate members and stakeholders to identify areas for improvement and implement best practices to enhance syndicate performance.

By following these steps and adopting best practices in syndicate management, syndicate organizers and managers can effectively navigate the complexities of syndicate investing and maximize value for syndicate members.

In summary, managing a syndicate demands meticulous planning, diligent execution, and harmonious collaboration among its members. Following the outlined steps and embracing best practices in syndicate management can lead to successful navigation of the complexities inherent in syndicate investing. Clear objectives, robust legal and governance frameworks, thorough due diligence, active risk mitigation, and transparent communication are crucial components that pave the way for syndicate success. Continuous adaptation to market dynamics and a commitment to ongoing improvement are vital for sustaining long-term prosperity in syndicate ventures. Leveraging Quoroom‘s syndicate solution can streamline investor onboarding and legal documentation processes, automate reporting and exit distributions, and provide additional features such as Investor CRM (IRM) and a secure data room. Incorporating such technological solutions can enhance operational efficiency and optimize outcomes for syndicate participants.

Important notice: This content is for informational purposes only. Quoroom does not provide investment advice. You should not construe any information or other material provided as legal, tax, investment, financial, or other advice. If you are unsure about anything, you should seek financial advice from an authorised advisor. Past performance is not a reliable guide to future returns. Don’t invest unless you’re prepared to lose all the money you invest. Private equity is a high-risk investment, and you are unlikely to be protected if something goes wrong.