SEIS/EIS Funding: How UK Startups Attract Investors with Tax Relief

Raising funds is one of the biggest challenges for startups. In the UK, the Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) offer a solution by making investments more attractive through significant tax reliefs. These government-backed initiatives reduce the risks for investors, helping startups secure the capital they need to grow.

This guide covers:

- SEIS and EIS benefits for startups and investors

- Eligibility criteria and the application process

- Compliance requirements to maintain SEIS/EIS status

Whether you’re launching your startup or looking to scale, understanding SEIS/EIS funding can give you a competitive edge in attracting investors.

Understanding SEIS and EIS

The Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) are government-backed initiatives designed to encourage investment in UK startups. They do this by offering generous tax reliefs to individual investors, making it less risky to invest in early-stage and scaling companies.

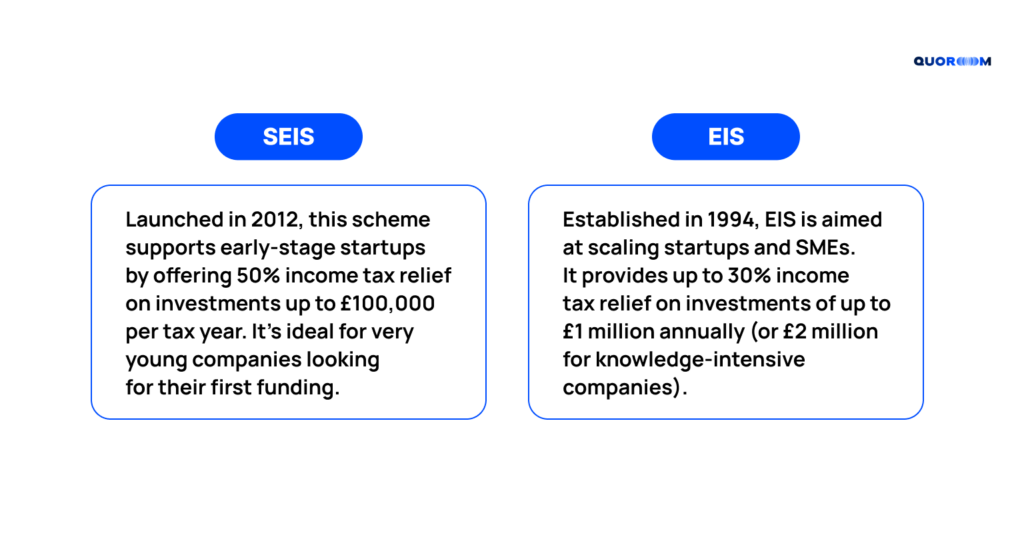

What Are SEIS and EIS?

The key difference lies in the stage of business they target: SEIS is tailored for startups just beginning their journey, while EIS focuses on companies ready to scale.

Key Benefits for Startups and Investors

For Startups:

- Easier access to capital by reducing the perceived risk for investors.

- A competitive edge in attracting funding compared to non-SEIS/EIS-eligible companies.

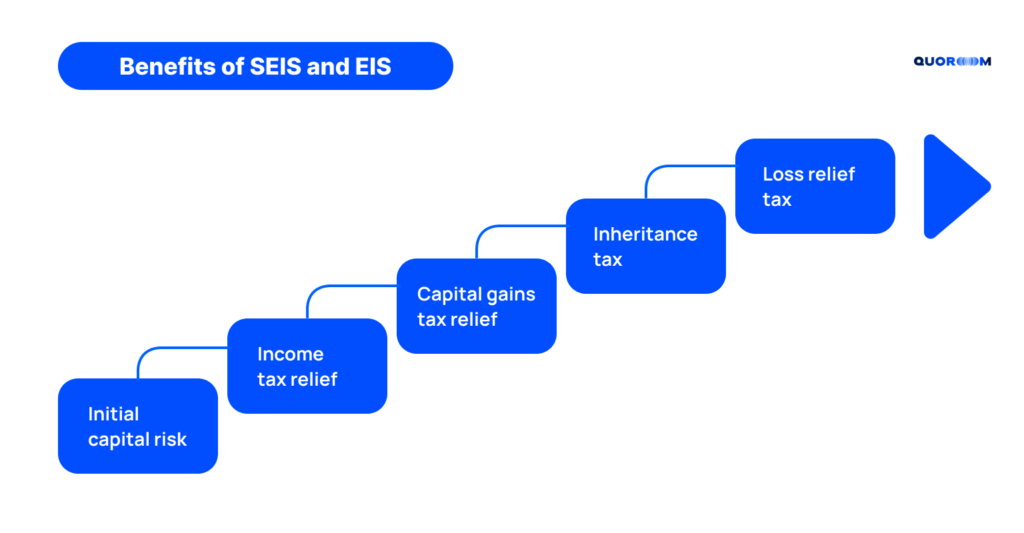

For Investors:

- Tax Relief: Reduced income tax liability and exemptions from Capital Gains Tax (CGT).

- Risk Mitigation: Loss relief allows investors to offset losses against other income or CGT.

- Inheritance Tax Benefits: EIS shares can qualify for Inheritance Tax exemption after two years.

These schemes make SEIS/EIS a win-win for both startups and their investors, providing a strong foundation for early growth and scalability.

Eligibility Criteria

To qualify for SEIS or EIS, both startups and investors must meet specific criteria set by HMRC. These requirements ensure that the schemes support the intended businesses and provide tax benefits to eligible investors.

Eligibility for Startups

SEIS Requirements

- Age of the Company: Must be less than two years old.

- Gross Assets: Total gross assets must not exceed £350,000 before the investment.

- Employees: Limited to 25 employees or fewer.

- Funds Raised: Can raise up to £250,000 through SEIS.

- Qualifying Trade: The business must carry out a qualifying trade (e.g., no property development or financial services).

EIS Requirements

- Age of the Company: Must be less than seven years old (or 10 years for knowledge-intensive companies).

- Gross Assets: Cannot exceed £15 million before investment or £16 million after.

- Employees: Limited to 250 employees or fewer (500 for knowledge-intensive companies).

- Funds Raised: Up to £5 million annually, with a lifetime cap of £12 million.

- Qualifying Trade: Similar to SEIS, the trade must meet HMRC’s requirements.

Eligibility for Investors

Residency: Investors must pay UK income tax.

Investment Limits:

- SEIS: Up to £100,000 annually.

- EIS: Up to £1 million annually (or £2 million for knowledge-intensive companies).

Shareholding: Investors cannot hold more than 30% of the company’s shares, including those owned by family members.

Type of Shares: Investments must be in newly issued ordinary shares with no preferential rights.

By meeting these criteria, startups can access funding through SEIS/EIS, while investors enjoy tax benefits that reduce their financial risk.

Applying for SEIS/EIS Funding

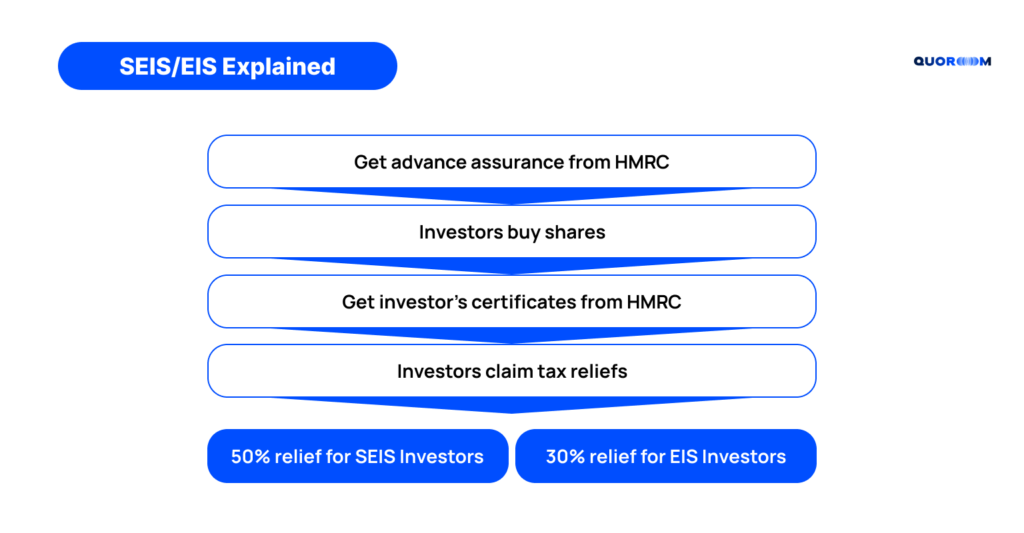

Securing funding through SEIS or EIS involves multiple steps, starting with advance assurance and ending with compliance reporting. Here’s how the process works:

The Role of Advance Assurance

Advance assurance is a critical first step. It’s a pre-approval from HMRC confirming that your company will likely qualify for SEIS or EIS tax reliefs.

Why It Matters:

- It reassures investors that their tax benefits are secure.

- It streamlines the fundraising process by reducing uncertainty.

How to Apply:

- Prepare supporting documents, including:

- A business plan and financial forecasts.

- Details of your company’s trade and how funds will be used.

- Copies of your articles of association and any fundraising materials.

- Submit the advance assurance application to HMRC well before raising funds.

Once approved, you’ll receive an advance assurance letter, which you can share with potential investors.

Issuing Shares and Submitting Compliance Statements

After securing funding, your company must follow these steps to finalize SEIS/EIS eligibility:

- Issue Shares

Shares must be issued within the terms of your advance assurance. Ensure they meet HMRC’s requirements for newly issued ordinary shares.

- Submit SEIS1/EIS1 Compliance Statement

File a compliance statement with HMRC to confirm the use of funds and issue tax relief certificates to investors. This must be done within four months of issuing shares.

- Distribute SEIS3/EIS3 Certificates

Once approved by HMRC, send SEIS3/EIS3 certificates to investors, enabling them to claim their tax reliefs.

Following these steps ensures that your investors receive the benefits they were promised and that your company remains compliant with HMRC regulations.

Fundraising can be a complex process, but platforms like Quoroom simplify it by helping startups manage documentation, investor communication, and deal tracking.

Discover how our deal management tools can streamline your funding journey.

Maintaining SEIS/EIS Compliance

Qualifying for SEIS/EIS funding is only the first step. To retain your status and ensure investors keep their tax benefits, your company must meet specific compliance requirements throughout the three-year compliance period.

Key Compliance Rules

Qualifying Activities

- Your business must continue to carry out a qualifying trade.

- Non-qualifying activities, like property development or financial services, could disqualify your SEIS/EIS status.

Proper Use of Funds

- SEIS/EIS funds must be spent on qualifying business activities, such as R&D, product development, or expansion.

- Funds cannot be used for repaying debts or acquiring another company.

No Return of Investment to Investors

- Investors must hold their shares for at least three years.

- Share buybacks or other arrangements that reduce risk for investors are prohibited.

Common Pitfalls to Avoid

Many companies lose their SEIS/EIS status due to avoidable mistakes. Here are the most common pitfalls and how to avoid them:

- Failing to Report Changes:

Notify HMRC within 60 days of any changes to your trade, ownership, or use of funds. Set up a system to track and report these changes promptly.

- Misusing Funds:

Keep detailed records of how SEIS/EIS funds are allocated to ensure they meet qualifying criteria.

- Missing Deadlines:

Submit compliance statements and required documentation on time to avoid delays or penalties.

Importance of Record-Keeping

Accurate record-keeping is essential for maintaining SEIS/EIS compliance. Your company must document:

- How funds were used to support qualifying activities.

- Annual updates on trade activities and employee numbers.

- Any changes to company structure or shareholder agreements.

By following these rules and maintaining clear communication with HMRC, your company can protect its SEIS/EIS status and continue to benefit from the schemes.

Managing equity schemes, share issuance, and compliance over time can be complex.

Platforms like Quoroom provide tools for employee equity scheme management, making it easier to track share grants, option allocations, and compliance with SEIS/EIS rules.

How to Support Investors with Tax Reliefs

Once your company secures SEIS/EIS funding, your investors will need support to claim their tax benefits. This involves issuing the correct certificates and guiding them through the process.

Issuing SEIS/EIS Certificates

To enable investors to claim their tax reliefs, you must complete and distribute SEIS3 or EIS3 certificates:

- File a Compliance Statement (SEIS1/EIS1)

This confirms that your company has issued shares and complied with SEIS/EIS rules. Submit it to HMRC within four months of issuing shares.

- Receive Approval from HMRC

HMRC will review your compliance statement and, if approved, authorize you to issue SEIS3/EIS3 certificates.

- Distribute Certificates

Provide each investor with their certificate, including all required details for claiming tax relief.

Assisting Investors with Claims

Investors may need guidance on how to claim their SEIS/EIS tax reliefs. Here’s how you can help:

- Income Tax Relief:

Direct investors to complete the relevant section of their self-assessment tax return, using information from their SEIS3/EIS3 certificate.

- Capital Gains Tax (CGT) Relief:

Explain how to defer gains by reinvesting them into SEIS/EIS shares. Provide clear instructions for completing CGT deferral claims.

- Loss Relief:

Inform investors about how to claim loss relief if their investment doesn’t succeed.

By proactively supporting investors, you can build trust and strengthen relationships, increasing the likelihood of future funding opportunities.

Final Thoughts

SEIS/EIS funding offers a powerful opportunity for UK startups to attract investment by reducing risks for investors through generous tax reliefs. These schemes not only make it easier to secure funding but also help businesses grow and scale effectively.

To recap:

- For Startups: SEIS/EIS funding provides easier access to capital, making your business more appealing to investors.

- For Investors: Significant tax benefits, including income tax relief, CGT exemptions, and loss relief, make investing in startups less risky.

- For Long-Term Success: Maintaining compliance and supporting your investors ensures your company retains SEIS/EIS status while fostering strong relationships with backers.

Starting early and staying organized is key to navigating the application and compliance process. With proper preparation, your startup can leverage SEIS/EIS funding to fuel its growth and achieve its business goals.

Simplify SEIS/EIS Documentation with Quoroom! Our platform helps startups efficiently manage investor relations and helps organize SEIS/EIS advance assurance and compliance.

Book a demo today to see how we can streamline your investment processes.

FAQs

What is SEIS/EIS funding?

SEIS/EIS funding helps UK startups attract investors by offering tax relief. SEIS is for early-stage startups, while EIS supports scaling companies.

Do I need advance assurance to raise SEIS/EIS funds?

Advance assurance is not mandatory but highly recommended. It reassures investors that their tax reliefs are secure and streamlines the fundraising process.

How long does the SEIS/EIS application process take?

Advance assurance typically takes 4–6 weeks. After raising funds, submitting compliance statements and issuing SEIS3/EIS3 certificates can take another few weeks, depending on HMRC processing times.

What are the main eligibility criteria for SEIS/EIS?

- SEIS: Companies less than two years old, with fewer than 25 employees and gross assets below £350,000.

- EIS: Companies less than seven years old (10 years for knowledge-intensive businesses), with fewer than 250 employees and gross assets below £15 million.

How do investors claim their SEIS/EIS tax reliefs?

Investors claim relief by including details from their SEIS3/EIS3 certificate in their self-assessment tax return.

What happens if my company no longer meets SEIS/EIS compliance?

If your company breaches compliance rules (e.g., misuse of funds, disqualifying trades), investors may lose their tax benefits. Reporting changes to HMRC within 60 days can help avoid penalties.