How to Apply for SEIS/EIS Advance Assurance: A Complete Guide

Securing funding is a critical challenge for startups. In the UK, the Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) are powerful tools that make your company more appealing to investors by offering tax incentives.

Yet, before investors can benefit from these incentives, your company needs to apply for SEIS/EIS advance assurance from HMRC. This advance assurance not only confirms your eligibility but also builds trust with potential investors, helping you secure funding faster.

This guide will take you through:

- What SEIS and EIS are and why they’re popular

- How advance assurance works

- Steps to apply and stay compliant

Keep reading to understand how SEIS/EIS advance assurance can support your startup’s fundraising efforts.

What Are SEIS and EIS?

SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) are two UK government initiatives designed to encourage investment in early-stage and growing companies. By offering tax relief, these schemes reduce the risk for investors and make it easier for businesses to raise capital.

SEIS: Supporting Early-Stage Startups

SEIS is tailored for very young companies in their early stages of growth.

Key Benefits for Investors:

- 50% income tax relief on investments up to £200,000 annually.

- Capital Gains Tax (CGT) exemption if shares are held for at least three years.

- Loss relief to offset losses against income tax or CGT.

Eligibility for Companies:

- Must be less than two years old.

- Limited to raising £250,000 under SEIS.

EIS: Fueling Growth for Scaling Companies

EIS is designed for slightly larger companies ready to scale their operations.

Key Benefits for Investors:

- 30% income tax relief on investments up to £1 million per year (or £2 million for knowledge-intensive companies).

- CGT deferral on gains reinvested into EIS shares.

- Inheritance Tax (IHT) exemption after holding shares for two years.

Eligibility for Companies:

- Can raise up to £5 million per year, with a lifetime cap of £12 million.

Why Are SEIS and EIS Popular?

These schemes are a win-win for businesses and investors:

By understanding the benefits and eligibility of these schemes, your company can better prepare to leverage SEIS/EIS to attract funding.

Why Advance Assurance Matters for Startups and Investors

Before investors can claim the tax benefits of SEIS or EIS, your company must apply for advance assurance from HMRC. This process confirms that your business will likely qualify for SEIS/EIS reliefs, giving investors confidence to proceed.

What Is SEIS/EIS Advance Assurance?

Advance assurance is a pre-approval from HMRC indicating that your company meets the eligibility criteria for SEIS or EIS. While it’s not a guarantee, it acts as a green light for investors, assuring them that their tax benefits are secure when they invest in your company.

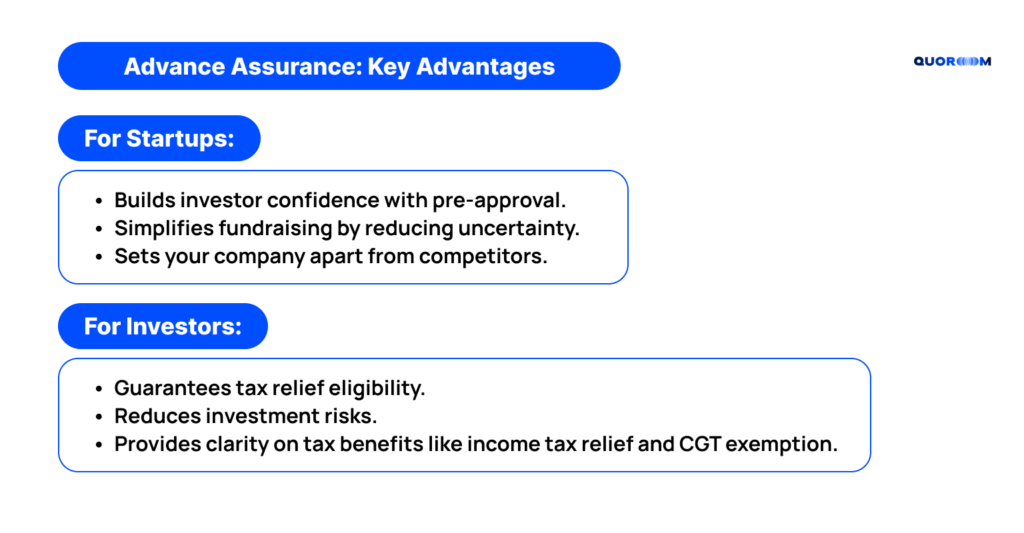

The Benefits of Advance Assurance

Builds Investor Confidence:

- Investors can focus on the opportunity without worrying about losing tax benefits.

- It’s often seen as a sign of transparency and preparation.

Improves Fundraising Efficiency:

- Companies with advance assurance are more likely to secure funding quickly.

- It sets you apart from other businesses competing for investor attention.

Streamlines Compliance:

- By addressing eligibility early, you reduce the risk of issues during the formal SEIS/EIS application.

How It Fits Into the Fundraising Process

Advance assurance is an essential step before issuing shares or starting your formal SEIS/EIS application. Once you have this pre-approval, you can confidently share it with potential investors, using it as a tool to attract and secure commitments.

Advance assurance reassures investors while simplifying your fundraising process. A platform like Quoroom can help you organize key documents, streamline communication, and track progress—all in one place.

Learn more about our fundraising management tools.

SEIS/EIS Compliance Requirements for Startups

To maintain SEIS or EIS status, your company must meet specific requirements set by HMRC. These rules apply not only when you apply for advance assurance but also throughout the 3-year compliance period.

Initial Compliance Requirements

At the time of your application, your company must meet the following criteria:

Qualifying Trade:

- The investment must be used for a trade that aligns with HMRC guidelines.

- Trades like coal production, property development, and financial services are excluded.

- A full list of non-qualifying trades can be found in HMRC’s Venture Capital Schemes Manual.

Age of the Company:

- SEIS: Less than two years old.

- EIS: Less than seven years old, or 10 years for knowledge-intensive companies.

Gross Assets:

- SEIS: Must not exceed £350,000 before the share issue.

- EIS: Must not exceed £15 million before shares are issued or £16 million after.

Employee Numbers:

- SEIS: No more than 25 employees.

- EIS: Up to 250 employees (500 for knowledge-intensive companies).

Permanent Establishment:

- Your company must have a physical presence in the UK, such as an office or operational site.

Private Status:

- The company must not be publicly traded or planning to list on a recognised stock exchange.

How Funds Must Be Used

The funds raised under SEIS/EIS must support a qualifying business activity within two years of the share issue. Acceptable uses include business expansion, product development, or research and development.

Restrictions include:

- No Debt Repayment: SEIS/EIS funds cannot be used to pay off existing debts.

- No Acquisitions: Funds must not be used to acquire another business.

Maintaining Compliance Over Time

For 3 years after the share issue, your company must continue to meet SEIS/EIS requirements.

- Qualifying Trade: Your business must stick to its qualifying activities. Any changes in trade must be reported to HMRC immediately.

- No Risk Reduction for Investors: Arrangements that reduce investment risks, such as guarantees or buy-back options, can disqualify the relief.

- No Repayment of Investment: You cannot buy back shares or return funds to investors within this period.

Record-Keeping and Reporting

Accurate records and regular reporting to HMRC are essential.

- Annual Returns: Submit detailed reports on how the funds were used and any changes to company activities.

- Notifications: Inform HMRC within 60 days if your company’s circumstances change, such as new business activities or ownership adjustments.

By adhering to these compliance rules, you protect your SEIS/EIS status and ensure your investors retain their tax benefits.

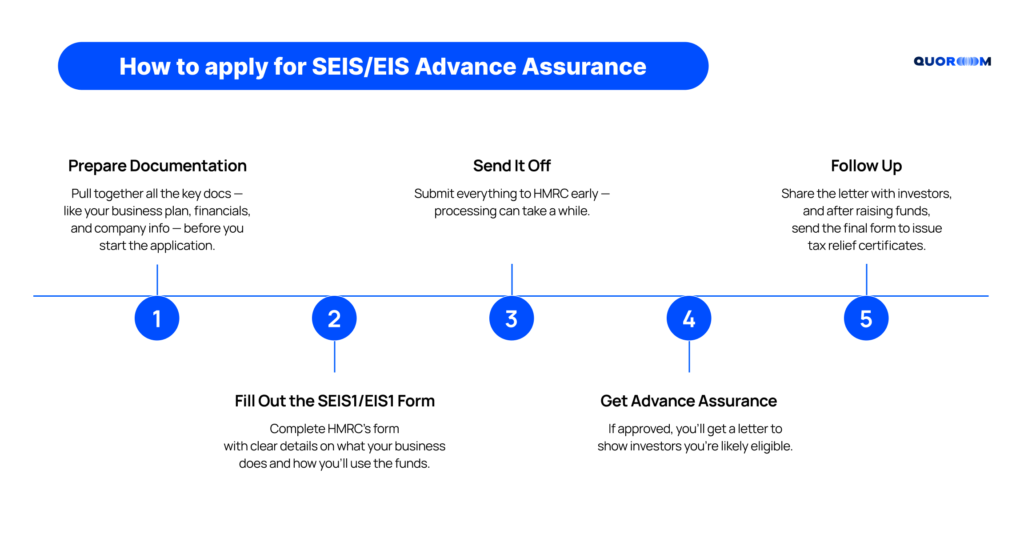

Step-by-Step Guide to Applying for Advance Assurance

Applying for SEIS/EIS advance assurance can seem complex, but breaking it into clear steps can simplify the process. Here’s how to do it:

1. Prepare Your Documentation

Before starting the application, gather the necessary documents to demonstrate your eligibility:

- A detailed business plan and financial forecasts.

- The latest company accounts.

- An explanation of how you meet the “risk to capital” condition.

- A list of your company’s trading activities and how funds will be allocated.

- An updated copy of your memorandum and articles of association.

- Fundraising documents, such as an investor pitch deck or prospectus.

- Details of previous investments received under SEIS/EIS or other venture capital schemes.

2. Complete the SEIS1/EIS1 Compliance Statement

HMRC provides specific forms for SEIS and EIS applications. These forms require detailed information about your company, including:

- The nature of your business activities.

- How the funds will be used for growth and development.

- The timeline for when the funds will be deployed.

Accuracy is key—errors or omissions can delay your application.

3. Submit the Application

Once your forms and supporting documents are ready, submit the application to HMRC.

- Be proactive: Submit the application well before you plan to raise funds. Processing can take several weeks or longer if revisions are needed.

4. Receive Advance Assurance

If HMRC approves your application, you’ll receive an Advance Assurance letter. This letter is not a guarantee of SEIS/EIS status but provides a strong indication that your company qualifies. Use this letter to reassure potential investors during fundraising discussions.

Post-Application Considerations

After receiving advance assurance, keep these points in mind:

- Communicate with Investors: Share the Advance Assurance letter to build trust and encourage investment.

- Submit Final SEIS/EIS Application: After raising funds, you must formally apply to issue SEIS3/EIS3 tax relief certificates to investors. This must be done within four months of the share issue.

By following these steps, you can complete the advance assurance process efficiently, improving your chances of securing investment.

Common Pitfalls and How to Avoid Them

The SEIS/EIS advance assurance process can be challenging, and many companies encounter setbacks. Here are the most common pitfalls and how to navigate them effectively:

Incomplete or Incorrect Applications

Missing documents, inaccurate information, or incomplete forms are the top reasons for delays or rejections.

How to Avoid:

- Double-check your application for errors.

- Use HMRC’s guidance to ensure you include all required documents.

- Consider professional advice to ensure everything is in order before submission.

Non-Qualifying Activities

Certain business activities, like financial services or property development, do not qualify for SEIS/EIS.

How to Avoid:

- Review HMRC’s list of excluded activities before applying.

- Clearly document how your business activities meet the qualifying trade criteria.

Misuse of Funds

Using SEIS/EIS funds for non-qualifying purposes, such as debt repayment or acquisitions, can lead to disqualification.

How to Avoid:

- Create a detailed plan for how the funds will be used and stick to it.

- Allocate resources toward growth activities like R&D or business expansion.

Failing to Notify HMRC of Changes

Changes in business activities, ownership, or use of funds can affect your eligibility. Failure to report these changes risks losing SEIS/EIS status.

How to Avoid:

- Set up a system to track and report changes to HMRC within 60 days.

- Train your team to identify and flag any potential compliance issues.

Underestimating the Time Required

The SEIS/EIS application process, from advance assurance to issuing tax certificates, can take months. Companies often underestimate the time needed.

How to Avoid:

- Start the application process early to accommodate potential delays.

- Build buffer time into your fundraising schedule to handle queries from HMRC.

Neglecting Professional Advice

SEIS/EIS rules can be complex, and small mistakes can lead to significant delays or rejections.

How to Avoid:

- Work with legal or financial advisors experienced in SEIS/EIS applications.

- Professional guidance can streamline the process and help you avoid costly errors.

By understanding these pitfalls and taking proactive steps, you can navigate the SEIS/EIS advance assurance process smoothly and focus on attracting the right investors.

Conclusion

SEIS/EIS advance assurance is a valuable step for startups seeking to secure investment. By obtaining pre-approval from HMRC, you not only demonstrate your eligibility for these schemes but also build trust with potential investors, making your fundraising efforts more efficient.

To recap:

- SEIS/EIS Benefits: These schemes offer significant tax reliefs, reducing the risk for investors and making your company more attractive.

- Advance Assurance Importance: It reassures investors, accelerates funding, and simplifies compliance.

- Avoid Common Pitfalls: Focus on thorough preparation, accurate documentation, and ongoing compliance to avoid delays or disqualifications.

Taking the time to navigate this process properly can make a significant difference in your ability to attract the right investors and fuel your company’s growth.

__________________________________________________________

Simplify SEIS/EIS Applications with Quoroom! Our platform helps you organize documents, track investments, and manage investor communications effortlessly.

Book a demo today to see how we can streamline your SEIS/EIS process.

__________________________________________________________

FAQs

What is SEIS/EIS advance assurance?

Advance assurance is a pre-approval from HMRC confirming that your company will likely qualify for SEIS/EIS tax reliefs. It gives investors confidence that they’ll receive the tax benefits when they invest.

Do I need advance assurance to raise funds?

While not mandatory, advance assurance significantly improves your chances of securing investment. Many investors prefer to see this approval before committing funds.

How long does the advance assurance process take?

HMRC typically processes applications within 4-6 weeks, but delays can occur if the application is incomplete or additional information is requested. Start early to avoid disruptions to your fundraising timeline.

What documents do I need for advance assurance?

Key documents include:

- A business plan and financial forecasts.

- Details of your trading activities and use of funds.

- Updated articles of association and pitch materials.

Can my company lose SEIS/EIS eligibility after receiving assurance?

Yes. If your company changes its trade, misuses funds, or fails to meet compliance requirements, you could lose eligibility. Keeping HMRC informed of any changes is essential.

What happens after raising funds under SEIS/EIS?

You’ll need to file a formal SEIS/EIS application with HMRC to issue tax relief certificates (SEIS3/EIS3) to investors. This must be completed within four months of issuing shares.