Capital fundraises typically take an average of 8 to 12 months to close. That is far too long to spend during the critical initial years of a business.

If you are a first-time founder, you usually learn as you go and then turn around in a few years reflecting on everything you would and should have done differently.

In fact, there are general aspects of the fundraising journey which if understood now would result in you not wondering about the time you could have saved later.

4 critical time-saving tips for your fundraising:

1. Reach out to the right investor at the right business stage

Firstly, do not neglect the basic parameters of matching with the investor who invests in your industry (Digital Economy or Real Economy business), invests in your sector (Fintech, Cybersecurity, AgroTech or simply agriculture), and focuses on businesses within your business model type (B2B, B2C, Marketplaces etc), invest in your country and region and invests in companies that align with the business stage you are currently. All of that should lead you to understand the type of investor you need (Angel, Pre-Seed VC, Early Stage VC, Late Stage VC, Bank etc). By actually doing this you will save a significant amount of time for yourself and your potential investors.

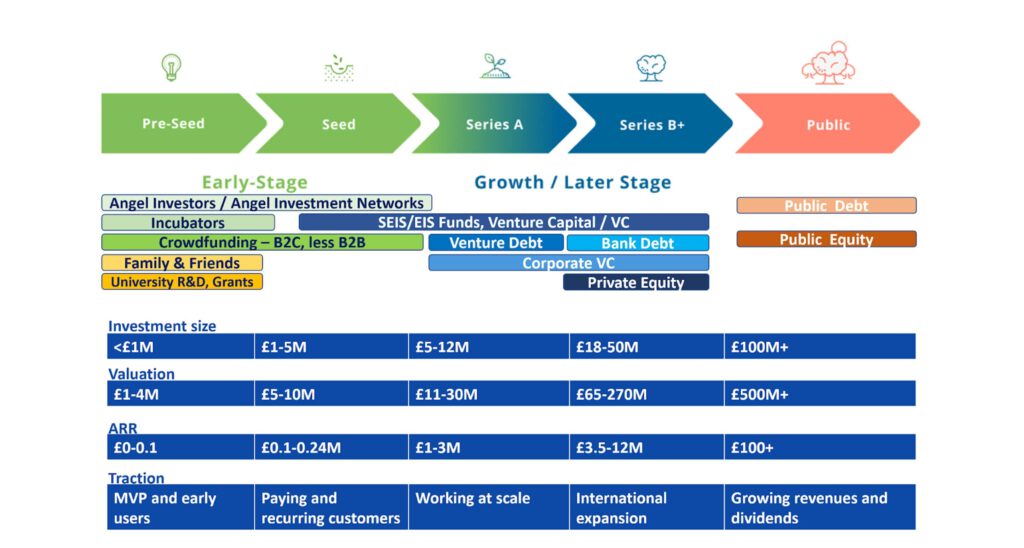

The graph below reflects the stages of raising capital for a digital economy business and the type of investors who invest at these stages.

Idea Stage. To build your product you would need to commit your own savings, preferably have a tech co-founder and most likely contributions from family and friends.

Pre-Seed Stage. Once you have MVP and early users you can start your external funding journey to raise from £200k to £1M and use this to lead the company to a revenue-generating stage. At the Pre-Seed stage, you should approach angel investors who have professional experience and personal interest in your industry and specific sector. At this stage, you also can apply for grants or choose to crowdfund. But raising money from retail investors through crowdfunding works significantly better for B2C (Business to Customers) products, as such businesses are much easier for non-professional investors to understand.

Seed Stage. To raise a Seed stage investment from £1 to 5 million you need to have already about £10-20K MRR (monthly revenue) and your product-market fit has to be confirmed by paying customers with positive reviews at Trustpilot, Capterra etc. Now you can approach VCs and engage with them utilising the traction your business has established. If you get to and close a Seed funding, you are a super lucky and hardworking entrepreneur that’s for sure.

Growth Stage. Series A is a first growth round of investments which might be your first round for an expansion to your closest markets. If you are raising Series B or a later round this means you are working at scale and raising money to internationalise your business. For that, you most likely will require a local VC or PE fund leading or co-investing in your funding round.

Key takeaways for early-stage startups:

- Investor types for pre-product companies (Idea stage): Friends & Family; Co-founding who are contributing with money; Grant money.

- Investor types for pre-revenue companies (Pre-Seed Stage): Angel Investors (target experts in your industry), local Angel Investor Networks, Pre-Seed VCs (usually accelerators Y Combinator, Techstars, Seedcamp).

- Investor types for early-stage post-revenue companies (Seed Stage): local and international Angel Investor Networks, SEIS/EIS Funds (UK), Seed VCs.

2. Be prepared and flexible to issue different types of securities

The better and more innovative product (of course revenue-generating) you have, the more investors would have interest to invest. Only if you have few interested investors are you able to offer and negotiate your type of securities and conditions. But if not and you don’t have other capital sources to grow your business, you will have to take what is offered by your investor.

During the life of your company, you will issue different types of securities. Usually, companies issue different types of ordinary shares at different funding rounds – Ordinary A, Ordinary B, Ordinary C or convertible notes at a really early stage of business. Some VCs may ask you for preferred shares, which would provide them with liquidation preference and what is better to avoid, the participation rights. Preferred Shares with 2x multiple liquidation preferences are a kind of double debt for your company and participation rights give your investor a right to receive at acquisition or IPO event the principal amount back (at X multiple) and then participate in the distribution of the rest of the proceeds on a pro-rata basis. If you happen to end up with a VC holding preferred shares it is almost always a result of a funding round closed at a valuation which is too high for your stage.

Most reasonable Early Stage deals with VCs are closed with the issuance of preferred convertible shares at 1x (or 1.5x) liquidation preference without participation. Early Stage VC would target 15-30% ownership in your company at valuation and consequently the level of dilution of founders which is reasonable enough to keep the team of founders motivated. Deal terms in the majority of cases would include reverse vesting of founders shares with a good leaver and bad leaver conditions and board or observer seats with protective provisions basically giving the VC investor veto rights on major decisions in the company. Protective provisions exist to protect investors from fraud and misconduct of founders, but in all good investment cases, they are never used as investors have the interest to act in the best interest of the company. You should trust a VC as they trust you by investing in you, but it’s essential homework to do research on the VC you are signing a deal with.

Debt is usually issued by more traditional real economy businesses or at the later stages of business development.

Equity Options is a useful tool to motivate your employees or advisors by granting them the option to buy your company shares at an IPO event at a grant price, a price set at valuation as of today.

At the IPO event different shares, options and convertible debt of the company will be converted into ordinary shares in order to unify the price of share within the secondary market.

3. Automate the investor pipeline

Once you clearly evaluate your business stage and what investor type is the right fit, the fun begins as you start to manage your investor pipeline. Usually, companies do it on spreadsheets or customise their CRM, but as the digitization era is taking over, more companies choose specialized software such as Quoroom to create and manage a list of potential investors and distribute the investor proposal. Unless you have insane traction and you are a serial entrepreneur who has sold and taken at least one company public, you’d need to talk to a significant number of investors and after a series of meetings, finally, find your match and proceed to the completion process.

The earlier within the process you are, the more rejections you will get, but you should just keep searching for prospects and where possible introductions to the investors who are the right fit for the stage of your business. Thus, the first step is to build a list of 150 to 200 names for an angel round and about 15-50 names for your VC round. You don’t want to waste your time talking to the incorrect investors so review your list to make sure you have relevant investors. Delete anyone who is not investing in your sector, your revenue stage — or worse, they have invested in your competitor or they’re not currently doing new deals. Angel investors, VC and PE funds who invested in your competitors will not invest due to potential conflict of interest but will definitely share your website with your competitor which is in their portfolio.

Quoroom has built an investor matchmaking engine to match your business with the investor profiles all over the web and if there are matches by type of securities, industry, size of investment and type of investor then the engine gives you a choice to select a degree of match and add contacts of such investors to your prospect list.

Start your outreach with a search for introductions via a mutual connection (for example your advisor, their portfolio company or even a client who additionally can add their personal opinion and overview of your product). You can even cold-email one or two of the founders in the investor’s portfolio, ask about their fundraising journey, and the quality of the investor and then ask for an intro.

As the next step you can distribute cold emails to general contacts of those selected institutional investors, such as pitch@…, deck@…, very often you will end up on the same road as after the introduction to a partner you will be referred to the analyst or associate who will review your pitch deck for a basic match with the investor’s investment thesis and criteria.

As the last resort, you can email angel investors or partners of a fund directly and it may work well however only if you personalize your email referring for example to a very specific fit of your company to the investor thesis, referring to the specific activities of the investor, for example, a blog article written by the investor, maybe some existing relationship of your company to their portfolio company etc.

If you have a feasible innovative business it’s not that complicated to get on a call with the VC associate or sometimes even a partner. What is more complicated is to convince them that you have a strong competitive advantage, which is not easy to copy, that you have a solid product-market fit, qualitative and fast go-to-market strategy (including scalable business model and sale channels) and of course, you have the right team to facilitate the business to grow exponentially.

It’s important to reflect on the feedback provided by investors. Firstly, because it may give you a new understanding of your product-market fit, leading to a pivot (audience, technology, product zoom in/out pivot ect) and secondly, you may realise that you have defined wrong your business stage and its fit to a specific type of investor. If the latter happens so you either need to work on your investment readiness or approach a different type of investor.

We have good news for revenue-generating businesses at the Seed stage – if you have a reasonable valuation of less than £5m it absolutely makes sense for you to include in your outreach both angel investors and VC, because if you can convince them both you will close a bigger round of investment. However, if you have mistaken your readiness for a VC round, the experience and effort can be beneficial. You will have a better understanding of the VCs and their requirements and most likely you will get angels supporting your further growth to help meet the VC requirement at the next round – Late Seed or Series A.

Angel rounds or private placement among a significant number of investors are not that complicated to manage if you have a Quoroom platform to automate the investor pipeline management and deal completion process, which will include legal workflow, due diligence and issuance of securities.

4. Be prepared to disclose your cap table and financials

When you get to the due-diligence stage with the interested investor, you will be asked to share your capital structure (shares, debt and options issued by the company) and financials (bank statements, balance sheet etc), which you can do automatically through the deal room on Quoroom platform.

Key documentation to disclose during the due-diligence process will include: board resolutions and reports, shareholder minutes, Confidentiality and Invention Assignment Agreements signed by employees and founders, corporate approvals, shareholder ‘ and subscription agreements (if any previous agreements were signed), disclosure letter, articles of association, service agreements, directors appointment letters, company registry filings etc

In addition to professional cap table management, Quoroom automates the whole process of fundraising from investor pipeline manager and orderbook to investment deal room with legal templates, e-signing of documents, direct issuance of securities to the cap table, distribution of share/debt certificates, issuer and investor portals to support your ongoing investor relations and compliance.

With Quoroom investor management software, you are in full control of communication with potential investors. You are the one to impress them with your traction, growth opportunities and transparency provided through your digitized deal room at Quoroom.

Visit Quoroom to explore a number of our free and paid tools for growing companies at different stages in their development journey.