Negotiating Startup Terms with Angel Investors: A Simple Guide

Angel groups are often the first investors in early-stage startups. They provide the funds to help you grow. But before you accept their investment, you need to negotiate the terms. This can feel overwhelming, especially if it’s your first time.

In this article, we’ll walk you through the key terms you need to know. We’ll also share practical tips for negotiating and managing your relationship with angel investors. Whether you’re just starting or looking to sharpen your skills, this guide will help you get the best deal for your startup.

Key Terms Every Startup Founder Should Know

When negotiating with angel groups, it’s important to understand the key terms shaping the deal. These terms affect how much control you keep, what happens in case of an exit, and how future investments will impact your equity.

Convertible Notes and SAFEs

These are two common ways to raise early-stage funding without setting a valuation right away. For example, in 2023, the median valuation of a startup receiving angel investment is €1.9 million. These instruments can help founders secure funding without locking in a potentially lower early-stage valuation.

Founders must prioritize negotiating a “pre-money” valuation cap instead of a “post-money” cap, which can significantly reduce dilution in subsequent funding rounds. Additionally, founders should strive to negotiate a discount on future “priced” funding rounds, rather than relying solely on a valuation cap.

While many convertible instruments typically include a valuation cap, investors are often more willing to accept a higher cap when they recognize that they will still receive better terms than later investors. This strategic approach enhances the overall funding process. It aligns the interests of both founders and investors, allowing startups to focus on growth and operational milestones without the pressure of immediate valuation decisions.

Y Combinator offers the most widely recognized version of the US SAFE (Simple Agreement for Future Equity). However, this model is not suitable for non-US companies. To address this gap, Quoroom provides founders with automated solutions for various agreements, including the US SAFE, the UK Advance Subscription Agreement (ASA), the Singapore SAFE, and other localized alternatives.

UK Advance Subscription Agreement (ASA)

The UK ASA, also known in the UK as SeedFAST, features a longstop date, which is the maximum period by which shares must be issued, typically set at six months from the agreement date.

This provision ensures that investors can secure their investments under the Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS) tax reliefs. The ASA also includes a pre-agreed longstop valuation, allowing investors to qualify their investments for these tax benefits while avoiding potential pitfalls associated with fluctuating valuations in early-stage funding rounds.

Key Features of ASAs

| Features | Details |

| Conversion Triggers | – Shares issued upon: • Qualifying funding round • Longstop date reached • Company sale or insolvency |

| Discount Rates | – 10-30% discount on shares compared to future valuations in funding rounds |

| Investor Protections | – Agreement requires mutual consent for changes – No interest on subscription amounts (maintains equity nature) |

| HMRC Compliance | – SEIS/EIS relief eligibility requires: • Longstop date ≤ 6 months • Issuance of ordinary shares (no preferential rights) |

By leveraging these features, Quoroom facilitates a streamlined investment process that aligns with local regulations and investor expectations, ultimately enhancing the fundraising capabilities of startups across different jurisdictions.

Equity Dilution

Dilution happens when you issue new shares in exchange for investment. This reduces your ownership percentage. Founders need to understand how much equity they’re giving up and how it will affect control over the company.

We recommend utilizing Quoroom’s scenario modeling functionality to effectively simulate the conversion of your convertible instruments and their potential impacts on your cap table.

One of the most common pitfalls for founders is issuing convertible notes or SAFEs without fully understanding how these instruments will affect ownership distribution and dilution within the cap table. By leveraging Quoroom’s tools, you can gain valuable insights into various scenarios, helping you make informed decisions that align with your fundraising strategy.

Preferred vs. Common Shares

Angel investors are typically issued standard (ordinary) shares, primarily because this structure allows them to qualify for tax relief programs, available only when investors assume the entire risk with their investments. This is a crucial factor for angel investors, as it encourages them to support early-stage companies.

In contrast, venture capital (VC) funds often request preferred shares. These shares provide VCs with certain advantages, such as priority over common shareholders in the event of a company sale or liquidation. Preferred shares often come with additional rights, such as dividend preferences and anti-dilution provisions, which can significantly impact the overall equity structure of the company.

Given these differences, founders must understand the implications of the share types they offer. We strongly advise against issuing preferred shares to angel investors. Doing so can complicate the capital structure and may deter future investment rounds, as it could create conflicts between different classes of shareholders. Instead, maintaining a straightforward equity structure with common shares for angel investors can help preserve alignment and simplify future fundraising efforts.

Liquidation Preferences

As mentioned earlier, we advise against issuing preferred shares to angel investors. However, if you find yourself in a position where you must agree to these shares, it is crucial to understand the liquidation preferences associated with them entirely.

Liquidation preferences dictate how investors are compensated in the event of a company sale or liquidation. For instance, a 1x liquidation preference ensures that the investor recoups their initial investment before any profits are distributed to common shareholders. This can significantly impact the financial returns available to founders and other common shareholders.

Moreover, some liquidation preferences may include a participation clause, which allows investors to receive their 1x+ investment back and then participate in any remaining distribution on a pro-rata basis according to their shareholding. This arrangement can drastically reduce the amount left for common shareholders, potentially leaving founders with little to no payout.

Given these complexities, we strongly recommend against agreeing to participation rights in liquidation preferences, as they can severely diminish the financial rewards for founders and early employees. Always consult with legal and financial advisors to ensure you fully grasp the implications of any terms before finalizing agreements with investors.

Understanding these terms is essential to negotiating a fair deal. They will help you protect your interests while securing the funds you need.

Looking to streamline your fundraising process and startup legals?

Book a demo and see how Quoroom supports founders with tools for seamless fundraising, deal execution, investor onboarding, cap table management, and investor reporting.

How to Prepare for Negotiation with Angel Groups

Early-stage funding has dropped by over 40% in 2023. This makes it more critical than ever to be prepared. You’ll need strong financial projections and a clean cap table to negotiate effectively in this challenging market.

Research the Angel Investor, Angel Networks and Syndicates

Not all angel investors, groups, and syndicates are alike; each has its unique focus and preferences. Some specialize in specific industries or favor startups at particular stages of development. To better align your pitch with their interests, reviewing their previous investments is essential, as this will provide insight into their priorities and investment strategies.

When researching potential angel investors, consider targeting those who are affluent executives within your industry. Their familiarity with your sector will enable them to grasp your solution more effectively, increasing the likelihood of a successful partnership. Additionally, seek out angel groups that have made similar investments but are not direct competitors, as this can foster a collaborative environment.

Utilize platforms like LinkedIn and other tools to identify actively investing angels. If you’re interested in accessing a comprehensive resource, reach out to us for a discount on the Scribe platform, which offers a list of over 400,000 active angel investors in the UK along with their contact information. This can significantly streamline your search for potential investors who align with your vision and goals.

Know Your Non-Negotiables

Before entering negotiations, it’s crucial to identify the terms that are most important to you. For instance, you may want to retain control over key decisions or limit the percentage of equity you are willing to give up. Establishing clear boundaries will help you maintain focus during discussions and ensure that your priorities are addressed.

Additionally, be aware that significant dilution for founders can be a red flag for future funding rounds. This insight can serve as a valuable negotiating point when engaging with investors, as it highlights the long-term implications of equity distribution. By articulating your concerns about dilution, you can advocate for terms that protect your interests while fostering a constructive dialogue with potential investors.

Prepare Financial Projections

Investors are primarily interested in understanding how their capital will generate growth. Presenting a realistic and compelling path to revenue and profitability is essential. Strong financial projections justify a higher valuation and provide you with leverage during negotiations.

Fortunately, angel investors and groups tend to have more flexible criteria than venture capital (VC) funds. While they still consider factors such as traction, team strength, market size, and innovation (competitiveness), angels often focus on startups that can make a significant local impact. In contrast, VCs prioritize companies with the potential for global scalability and unicorn status.

However, it’s important to note that angels are generally reluctant to invest in early-stage solutions that lack an impact component. As a result, top angel investments are frequently found in sectors such as cleantech, climate tech, healthcare, and deep tech—areas that promise substantial societal benefits. By aligning your startup’s mission with these values, you can attract the interest of angel investors who are committed to making a positive difference while also seeking financial returns.

Clean Cap Table

Make sure your cap table (a record of ownership) is organized and up-to-date. A messy cap table raises red flags for investors. Platforms like Quoroom help founders manage their cap tables efficiently, giving investors confidence in the company’s structure.

Being well-prepared allows you to negotiate from a position of strength, ensuring you get the best possible terms.

“You’ll need strong financial projections and a clean cap table to negotiate effectively in this challenging market. Being well-prepared allows you to negotiate from a position of strength, ensuring you get the best possible terms.”

Ulyana Shtybel

Co-founder and CEO at Quoroom

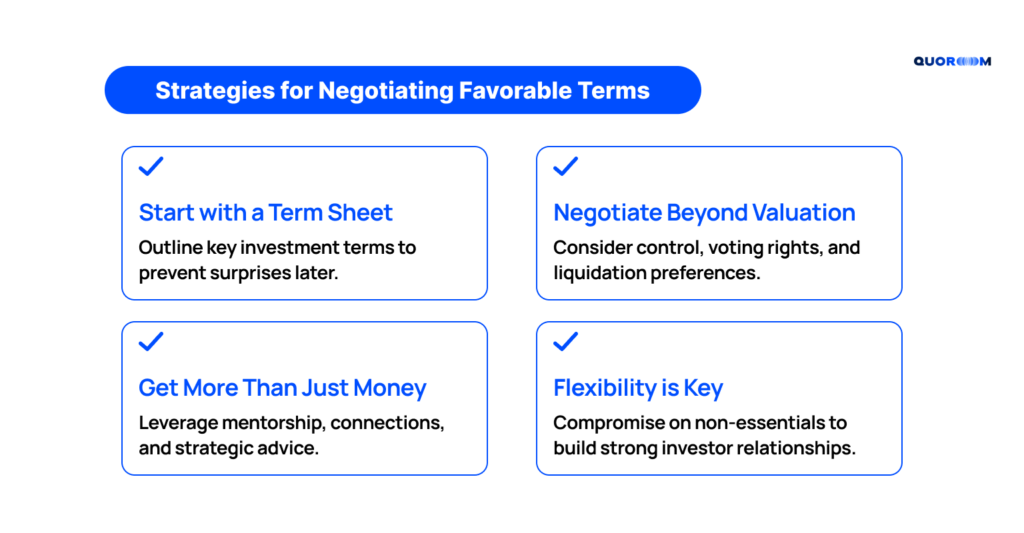

Top Strategies for Negotiating Favorable Terms

Once you’re at the negotiation table, it’s important to stay focused on more than just valuation. Here are some strategies to help you secure a well-rounded deal:

#1 Start with a Term Sheet

A term sheet is the first step in any negotiation. It outlines the basic terms of the investment, such as the amount being raised and the equity being offered. Make sure the term sheet is clear and covers all key points before moving forward. It can save you from surprises later in the process.

#2 Negotiate Beyond Valuation

Many founders focus solely on valuation, but other terms can have a bigger impact in the long run. Look at things like board control, voting rights, and liquidation preferences. These terms influence your level of control and what happens in different exit scenarios.

#3 Get More Than Just Money

Angel investors often bring more to the table than just cash. They can offer mentorship, industry connections, and strategic advice. Make sure to include these non-monetary benefits in your discussions.

#4 Flexibility is Key

Be ready to make compromises. While sticking to your non-negotiables is important, being flexible on less critical points can help build a stronger relationship with your investors. This can also lead to better terms down the line.

How to Close Deal with Angel Investors

Closing deals with angel investors can be challenging for founders. Often, extensive discussions occur without resulting in actual investments. This issue primarily stems from the inherent uncertainties in angel investing, particularly at early stages when startups may lack traction.

Utilizing Soft Commitment Forms

To streamline the decision-making process, founders should leverage Quoroom’s soft commitment forms and pitch events. Instead of scheduling individual calls with each investor, consider organizing a group pitch or Q&A event. This approach allows you to invite investors who have yet to engage deeply or those whose interest has stalled.

Benefits of Group Events

| Benefit | Description |

| Opportunity for Questions | Investors ask relevant questions and benefit from answers addressing others’ concerns. |

| Demonstrating Interest | Group events showcase interest, fostering urgency or FOMO among attendees. |

| Soft Commitment Link | Share a link to the form during the event, prompting investors to secure allocation by a deadline. |

A soft commitment is non-binding and contingent upon reaching a funding target, such as $300,000. This mechanism allows investors to mitigate risk since they will only proceed if sufficient interest exists, which fosters comfort and encourages a collaborative dynamic among potential investors.

Pitching the Angel Groups and Syndicates

When discussing opportunities with an angel group or syndicate, invite them to participate in your group pitch event as well. If interested, they will request allocation and invite you to their own pitch events with syndicate members. Then, a syndicate lead will distribute their own soft commitment forms among their members, facilitating collective investment through a Special Purpose Vehicle (SPV).

Legal Completion Process

Once you have collected soft commitments and recorded them on the Quoroom platform, you can efficiently invite investors to sign legal documents. Quoroom provides the necessary legal documentation for both individual investors and for grouping them into a Founders Special Purpose Vehicle (SPV).

Utilizing a Founders SPV offers several advantages: it simplifies the investment process by consolidating multiple investors into a single entity, thereby reducing administrative burdens and legal complexities. Additionally, it enhances compliance with regulations while allowing for streamlined capital management. By using Quoroom’s integrated tools, founders can ensure that all legal requirements are met, facilitating a smoother transition from commitment to actual investment.

This comprehensive approach accelerates the closing process and fosters stronger relationships among investors, ultimately contributing to a more robust funding environment.

By adopting these strategies, founders can enhance their chances of closing deals with angel investors, fostering a more engaging and collaborative investment environment.

Looking to create a Founder SPV to group angels under one entity?

Book a consultation with one of our experts to discuss your fundraising strategy and fundraising options.

Post-Negotiation: How to Manage the Investor Relationship

Securing the deal is just the beginning. Managing the relationship is key to long-term success once you’ve brought angel investors on board.

Ongoing Communication

Keep your investors informed. Regular updates on progress, challenges, and milestones help maintain trust. This can also open the door to additional funding or support when needed. Transparency is essential for building strong investor relations.

Portfolio Monitoring

Investors want to see how their investment is performing. Use tools that provide visibility into your company’s metrics. Platforms like Quoroom offer portfolio monitoring and investor reporting capabilities, helping you keep everyone aligned without adding extra workload.

Cap Table Management

As your company grows, managing your cap table becomes more complex. A clean cap table is crucial when you’re raising future rounds or planning exit strategies. By keeping it well-organized from the start, you avoid headaches down the road and ensure future investors have a clear view of ownership and equity splits.

By managing investor relationships effectively, you ensure that your current investors remain supportive and engaged, paving the way for future rounds of funding.

Need a simpler way to manage your cap table and investor reporting?

Explore how Quoroom helps founders and syndicate leads maintain clean cap tables and deliver real-time updates to investors.

Common Pitfalls to Avoid in Negotiations: Tips from the Quoroom Team

Even the best-prepared founders can make mistakes during negotiations. Here are some common pitfalls to watch out for:

Lack of Clarity in Terms

It’s easy to overlook minor details in the excitement of securing funding. However, unclear or missing terms can lead to conflicts later on. Always make sure the terms are well-defined and understood by both parties before signing anything.

Focusing Too Much on Valuation

While it’s tempting to push for a higher valuation, other terms like liquidation preferences or investor rights can have a bigger impact in the long term. Balance your focus to avoid giving up too much control or future profits.

Over-Promising

Be realistic with your financial projections and timelines. Investors appreciate honesty, and it’s better to under-promise and over-deliver than the other way around. Overestimating can lead to disappointment and strain the relationship with your investors.

By avoiding these mistakes, you’ll position yourself to secure fair and balanced terms that support the long-term growth of your startup.

Final Take

Negotiating with angel groups may seem daunting, but with the proper preparation and understanding of key terms, you can secure a deal that benefits both your startup and your investors.

Remember to focus on more than just valuation, build strong relationships, and use the right tools to manage your investors effectively. Doing this sets the stage for a successful partnership and gives your startup the best chance of scaling in the future.

Need a simpler way to manage your cap table and investor reporting?

Start free with Quoroom to maintain clean cap tables and deliver real-time updates to investors.

FAQs

What are the most important terms to focus on during negotiations with angel groups?

Founders often focus too much on valuation, but other terms like liquidation preferences and control rights can have a more significant impact in the long term. Understanding these terms ensures a balanced and fair deal for both parties.

How do I manage multiple investors and keep them informed after closing the deal?

Maintaining clear communication and providing regular updates are essential to keeping investors engaged. Tools like Quoroom can help founders track portfolio performance, manage cap tables, and send investor updates seamlessly.

What’s the difference between convertible notes and SAFEs, and which is better for my startup?

Both convertible notes and SAFEs delay valuation discussions until a future round of funding. However, a SAFE is simpler, as it does not involve a loan. The best option depends on your startup’s funding needs and the preferences of your investors.