Why Use a Founders SPV for Cap Table Management

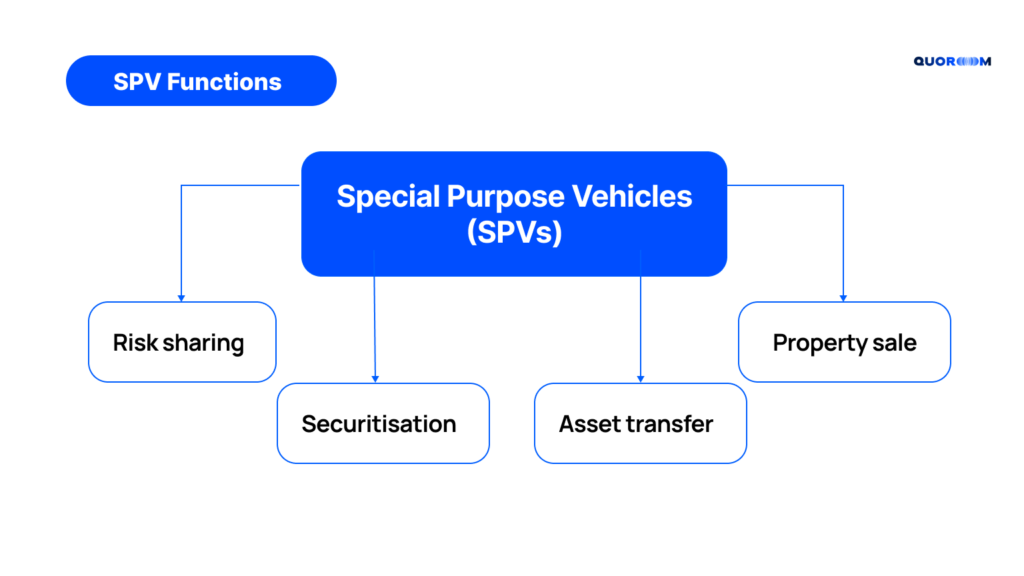

Managing a startup’s cap table can become increasingly complex as the number of investors grows. To streamline this process, many founders are turning to a Special Purpose Vehicle (SPV), particularly a Founders SPV, to roll up angel investors into a single entry on the cap table. By using a Founders SPV or known as Roll Up Vehicles, you can not only simplify cap table management but also ensure smoother growth and investor relations.

Key Benefits of Using Founders SPV for Founders

Founders SPVs, or Roll Up Vehicles (RUVs), have emerged as a powerful tool for startup founders, offering a range of benefits that can significantly enhance their fundraising efforts and operational efficiency. Below are the key advantages specifically tailored for founders who lead these SPVs.

Streamlined Cap Table Management

One of the most significant benefits for founders using an SPV is the simplification of the capitalization table. By consolidating multiple small investors into a single entity, founders can reduce the complexity associated with managing equity ownership. This streamlined cap table not only makes it easier to negotiate future funding rounds but also minimizes administrative burdens, allowing founders to focus more on their core business operations.

Enhanced Control Over Investor Relations

Leading an SPV allows founders to maintain greater control over their relationships with investors. Instead of dealing with numerous individual shareholders, founders can communicate and negotiate as a unified entity is investors are ready to select a single. This centralized approach helps ensure that the interests of all investors are aligned, making it easier for founders to manage expectations and foster positive relationships with their backers.

Cost Efficiency and Reduced Legal Obligations

Utilizing a Founders SPV can lead to substantial cost savings for founders. Instead of requiring separate legal agreements for each investor, a single legal agreement suffices for the entire SPV. This reduction in legal costs simplifies compliance processes and reduces the administrative workload, allowing founders to allocate resources more effectively toward growth and innovation.

Improved Valuation Potential

Founders often have the opportunity to command higher valuations when utilizing RUVs due to aligned conditions offered to all investors in the vehicles. By presenting a consolidated investment structure to investors, founders can encourage investors to join under the same conditions and also speed up the process by setting a deadline for investors to join the SPV.

Together with Quoroom’s soft commitment forms, Founder SPV is a powerful tool to close funding rounds faster.

Increased Flexibility in Secondary Transactions

Founders benefit from enhanced flexibility when negotiating secondary transactions and structuring deals with potential buyers. As angel investors may eventually push for exits to secure liquidity, founders often engage in secondary transactions with Private Equity and Secondary Funds. The process of selling an investor’s stake becomes significantly easier if the buyer is interested in acquiring the entire SPV stake, rather than dealing with individual shares.

Moreover, even smaller stakes or simple secondary transfers are much more manageable when conducted at the SPV sub-register level rather than directly on the company’s cap table. This structure allows founders to maintain a cleaner cap table while facilitating smoother transactions. By consolidating multiple investors into a single entity, founders can streamline negotiations and reduce the administrative burden associated with managing numerous individual shareholders.

Understanding the UK Bare Trust Structure for Founders SPVs

The UK Bare Trust structure is a highly effective model for rolling investors into a Founders SPV. In this setup, investors become beneficiaries of a simple, transparent trust, where the trustee holds the shares on their behalf. Founders and investors benefit from this structure because it is easy to set up and manage.

Key advantages of the UK Bare Trust Structure:

- Transparency. The trust is simple and easy to administer, with clear terms that investors can understand.

- Efficiency. It consolidates multiple investors into one entry on the cap table, reducing administrative burdens.

- Flexibility. The UK Bare Trust Structure is reusable and the same SPV (Trustee) entity can accommodate future fundraising rounds, which makes it perfect for growing companies.

Exit Distribution and Transaction Options for Founders SPVs

At some point, you may want to sell your business or explore various transaction options for your SPV. Whatever path you choose, it’s essential to understand the associated costs in advance.

Direct vs. Pooled Transactional Flows for SPV Investments

You have two options to collect funds from investors: through direct or pooled transactions. During the direct transaction, each investor’s funds are transacted directly into your bank account. This is a straightforward and cost-effective choice for many founders.

During the pooled transaction, all investor funds are collected into a single account of the service provider, often a regulated entity, and then transferred as one consolidated pool to your company. This approach is more convenient for handling multiple investors as the reconciliation of payment is done by the service provider such as Quoroom.

Choose the Best SPV Structure for Your Startup

Book a call to learn more!

Key Legal and Tax Considerations for US Investors in Foreign Founders SPVs

Founders SPV offers numerous investment opportunities and reduces personal liability. At the same time, it comes with specific legal and tax obligations. If you are a US investor willing to invest via foreign Founders SPV, consider the following points

Mandatory IRS Forms for US Investors in SPVs

There are two mandatory IRS Forms for US Investors in SPVs: Form 8621 and Form 8938.

- Form 8621 is necessary for reporting investments in passive foreign investment companies.

- Form 8938 is required if the investment exceeds $50,000 (or $100,000 for households).

You should submit the forms together with your annual tax filings. This is needed to specify your ownership in the Trust.

We are happy to answer any questions about best practices of syndicate management and legal aspects.

Here is a link to book a demo call with the CEO of Quoroom.

Impact of SPVs on QSBS and SEIS/EIS Tax Reliefs

To qualify for UK SEIS/EIS tax reliefs, the SPV used for investments must be structured as a UK bare trust. Within this trust, eligible shares are held by a Trustee (the trustee) on behalf of an individual. If a different structure, such as an LLP or LP, is used, HMRC would not consider the shares to be held directly by the individual investors, and therefore, the tax breaks would not apply.

For an investment to qualify as US Qualified Small Business Stock (QSBS), the stock must be issued by a domestic C corporation with gross assets not exceeding $50 million at the time of issuance. Additionally, the investor must acquire the stock directly from the issuing company and hold it for at least five years. If a trust is set up correctly and holds QSBS on behalf of the investor, the investor can still benefit from these tax exclusions, as long as the trust complies with IRS regulations regarding ownership and control of the stock.

We recommend consulting with tax advisors to understand how SPV can impact your tax benefits. Once you are clear about all the tax nuances, you can start making the investments via SPV.

Conclusion

Whether you are a founder or investor, you have a lot on your plate when it comes to investment management. One way to simplify this process is to use Founder SPV.

With Founder SPV, you can consolidate all investors into a single entry in your cap table. This will allow you to control your company’s equity structure and investment activities.

Founder SPV is straightforward. However, there are specific legal and tax nuances that you should be aware of to avoid bearing unnecessary costs.

At Quoroom, we provide various options for creating Founder SPV and guide you through the tax and legal hurdles while undertaking all the necessary paperwork.

Ready to optimize your investor management?

Book a consultation with one of our experts to discuss your fundraising strategy and if Founder SPV is right for you.

FAQs

What is the main advantage of using a Founders SPV for rolling up angel investors?

The main advantage of Founders SPV is that it simplifies the investment process by consolidating multiple angel investors into a single entity. Founders SPV enables founders to manage their funding easily and reduce administrative burdens.

What are the differences between using ‘Your Trustee Limited’ and ‘Quoroom Trustees Limited’ for my SPV?

The main difference lies in ownership and cost. Your Trustee Limited is an SPV entity that belongs to you. If you create your Trustee Limited, you pay a monthly maintenance fee of £160.

Can US investors use a Founders SPV, and what tax forms are required?

Yes, US investors can use a Founders SPV. The required tax forms are Form 8621 and Form 8938 if they invest in a foreign entity via an SPV.

How does using a Founders SPV impact QSBS and SEIS/EIS tax reliefs?

As long as Founders SPV is structured as a bare trust, it does not impact your right to get QSBS and SEIS/EIS tax reliefs.