Comparing UK EMI Options, Unapproved Options, and Growth Shares

Equity incentive schemes are a powerful way for UK companies to attract and retain top talent. Choosing the right scheme—whether EMI options, unapproved options, or growth shares—can have a significant impact on your business and its stakeholders.

In this guide, you’ll learn:

- The key differences between these equity schemes.

- How they affect taxes, dilution, and legal compliance.

- Practical use cases for each option.

Whether you’re a founder, an HR manager, or a financial advisor, this guide will help you make an informed decision tailored to your company’s needs.

What Are Equity Incentive Schemes?

Equity incentive schemes help businesses reward employees, founders, or advisors with a stake in the company. These schemes are designed to attract, retain, and motivate talent while aligning their interests with the company’s growth.

Why Companies Use Equity Incentives

Offering equity can:

- Improve employee loyalty and retention.

- Attract skilled personnel who value long-term benefits.

- Reduce upfront salary costs for cash-strapped startups.

The Three Key Schemes Explained

There are three widely used equity incentive schemes in the UK: EMI options, unapproved options, and growth shares. Each serves a specific purpose and caters to different needs.

EMI (Enterprise Management Incentive) Options

EMI options are designed for smaller UK companies to provide tax-efficient rewards to their employees. These options are ideal for startups or growth-stage businesses with fewer than 250 employees, allowing them to incentivize staff without triggering immediate tax liabilities.

Unapproved Options

Unapproved options offer a flexible alternative for individuals not qualifying for EMI options. These are typically used for part-time employees, non-UK workers, or advisors. While less tax-efficient than EMI options, they suit businesses needing a broader equity incentive plan.

Growth Shares

Growth shares reward future company growth while protecting current shareholders. They are issued with a “hurdle” value, meaning they only gain value if the company’s valuation exceeds this threshold. Growth shares are particularly effective for rewarding founders or employees in companies with a significant valuation.

Understanding these schemes is the first step in determining which aligns best with your business goals and team structure.

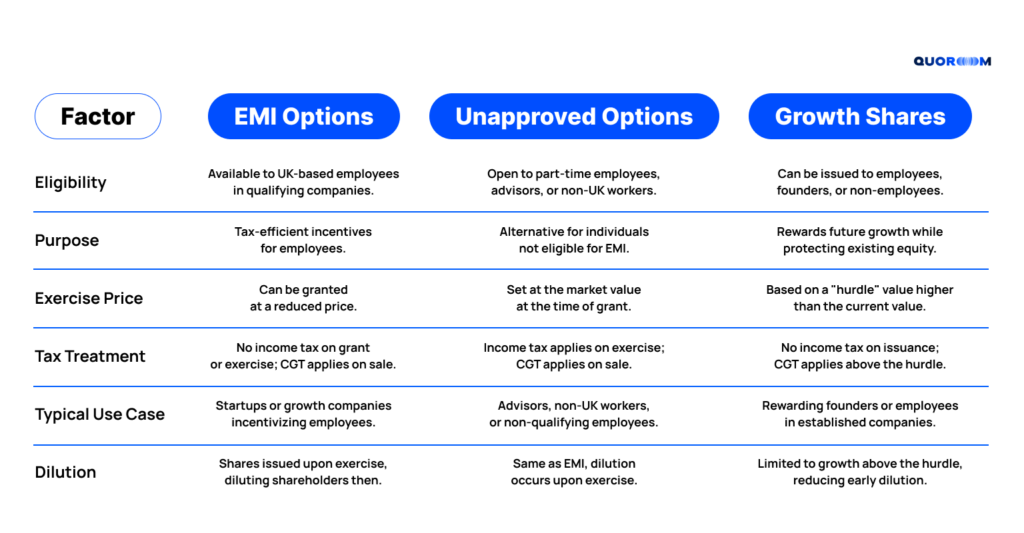

Breaking Down the Differences: EMI, Unapproved Options, and Growth Shares

Choosing the right equity scheme means understanding how each one works. This table highlights the key factors that set EMI options, unapproved options, and growth shares apart:

Detailed Analysis of Each Scheme

EMI Options

- Designed for UK-based companies with fewer than 250 employees and assets under £30 million.

- Provide significant tax advantages, including no income tax on grant or exercise.

- Best suited for startups looking to incentivize employees without creating immediate tax liabilities.

Unapproved Options

- Offer flexibility for individuals who don’t meet EMI criteria, such as part-time workers or non-UK employees.

- Tax implications include income tax and National Insurance Contributions (NIC) at exercise.

- Ideal for companies needing a broader reach in their equity schemes.

Growth Shares

- Allow employees or founders to benefit from future growth without diluting early-stage shareholders.

- Issued with a hurdle, making them valuable only if the company’s valuation exceeds this threshold.

- Useful for companies with established value that want to reward long-term contributions.

Tax Implications of EMI Options, Unapproved Options, and Growth Shares

Tax treatment is a critical factor when choosing an equity scheme. Here’s how taxes apply to each option:

EMI Options

- Income Tax: No income tax is due upon granting or exercising the option if the exercise price matches the market value at the grant date.

- Capital Gains Tax (CGT): Employees only pay CGT on the profit when they sell their shares. The rate is typically 10% if they qualify for Entrepreneurs’ Relief.

Example:

- Exercise Price: £1 per share for 1,000 shares.

- Sale Price: £10 per share.

- CGT Calculation: (£10,000 sale value – £1,000 exercise price) = £9,000 taxable gain at 10%.

Unapproved Options

- Income Tax: Applies on the difference between the market value at exercise and the strike price.

- National Insurance Contributions (NIC): May also apply upon exercise.

- CGT: Charged on the gain at sale, typically at 20%, or 10% with Entrepreneurs’ Relief.

Example:

- Strike Price: £1 per share for 1,000 shares.

- Market Value at Exercise: £10 per share.

- Income Tax: 20% of (£10 – £2) x 1,000 = £1,600.

- CGT Calculation: (£10,000 sale value – £1,000 strike price) = £9,000 taxable gain.

Growth Shares

- Income Tax: None at issuance since the shares have little value initially due to the “hurdle.”

- CGT: Charged on the increase in value above the hurdle upon sale, often benefiting from the 10% rate.

Example:

- Acquisition price: £0.001 per share

- Current market value: £1 per share

- Hurdle: £5 per share for 1,000 shares.

- Sale Price: £10 per share.

- CGT Calculation: (£10,000 sale value – £5,000 hurdle) = £5,000 taxable gain at 10%.

Let’s say your company’s shares are currently worth £1 each, and you issue growth shares with a £5 hurdle per share. The £4 gap — the so-called “hope value” — reflects the premium for future growth. Since these growth shares have no immediate value and must surpass the hurdle to gain worth, their current market value can be set much lower, often just £0.001 per share. That means new team members can buy shares at a minimal cost and still benefit if the company grows in value.

By understanding these tax implications, you can choose a scheme that balances employee incentives with tax efficiency.

Risks and Legal Considerations

Equity schemes come with unique risks and legal requirements. Here’s what you need to know about EMI options, unapproved options, and growth shares.

EMI Options

Risks

- Disqualification Risk: Losing eligibility due to changes in company size or employee working hours may void the tax benefits.

- Liquidity Risk: If options are only exercisable during liquidity events (e.g., company sale), employees may not realize their gains.

- Valuation Disputes: HMRC-approved valuations can be challenged, altering tax liabilities.

Legal Requirements

- Company Criteria: Must employ fewer than 250 people and have assets below £30 million.

- Employee Eligibility: Employees must work at least 25 hours weekly or 75% of their time for the company.

- Option Agreements: Must outline the grant terms, exercise price, and vesting schedule.

- HMRC Notification: EMI options must be reported to HMRC within 92 days of grant to retain tax benefits.

Unapproved Options

Risks

- Higher Tax Burden: Income tax and NIC on exercise can create significant liabilities.

- Timing Challenges: Employees may face tax payments before shares are sellable.

- Market Volatility: Share price drops after exercise can lead to financial losses.

Legal Requirements

- Flexibility: Can be issued to anyone but must comply with local tax laws if offered internationally.

- Option Agreements: Clear terms for strike price, vesting conditions, and shareholder rights are essential.

Growth Shares

Risks

- Demotivation: A high hurdle may discourage employees if growth seems unattainable.

- Valuation Complexity: Determining a fair hurdle value requires professional input.

- No Guaranteed Value: If the company’s valuation doesn’t exceed the hurdle, shares may become worthless.

- Tax Risks: Potential income tax charge on undervalued shares.

Legal Requirements

- Articles of Association: Must be updated to define the hurdle and shareholder rights.

- Hurdle Valuation: Requires a documented, accurate valuation to avoid disputes.

- Shareholder Agreements: Changes impacting existing investors must be formally approved.

Several key documents are required to implement growth shares with vesting conditions. First, update your Articles of Association to create a new class of shares and define its rights. Then, you’ll need a Shareholders’ Agreement that outlines share restrictions and exit terms. A Subscription Agreement details on the share purchase, hurdle rate, and vesting conditions.

Make sure the Employment or Consultancy Agreement ties the share ownership to ongoing service. Additionally, you’ll need Shareholder Resolutions to approve the changes and a Valuation Report to set a fair market value and hurdle.

How to Choose the Right Scheme

Selecting the best equity incentive scheme depends on your company’s goals, structure, and workforce. Here’s how to evaluate your options:

Assess Your Company’s Stage

- Early-Stage Startups: EMI options are ideal for smaller companies meeting the eligibility criteria. They provide tax benefits and incentivize employees without creating immediate financial strain.

- Growing Companies: Growth shares work well if your company already has a valuation and you want to reward long-term contributions while protecting early shareholders.

- Flexible Needs: Unapproved options offer versatility for companies with diverse workforces, including part-time or international employees.

Identify Your Employee Profiles

Your team composition plays a significant role in selecting an equity scheme. EMI options are the most tax-efficient for UK-based employees. For non-UK workers or advisors, unapproved options provide broader eligibility.

Growth shares are a better fit for founders and senior employees who drive long-term growth and performance, aligning their incentives with the company’s success.

Consider Tax Efficiency

Tax implications should be a key consideration. EMI options offer substantial tax benefits, with no income tax on grant or exercise, making them the most efficient choice.

Growth shares allow participants to avoid upfront taxes and focus on long-term gains, making them attractive to established companies. While unapproved options may result in higher immediate tax liabilities, they accommodate a broader range of participants and use cases.

Align with Business Goals

Think about your overarching business objectives. Equity schemes can help attract and retain top talent, motivate long-term performance, or reward key contributors.

At the same time, it’s essential to balance these incentives with protecting early shareholders and minimizing dilution risks. Choosing the right scheme will depend on how these goals align with your company’s stage and workforce needs.

By evaluating these factors, you can tailor your equity scheme to fit your business needs while motivating your team and preserving tax efficiency.

Wrapping Up

Equity incentive schemes are a powerful way to attract and retain talent, motivate long-term contributions, and align your team’s goals with the company’s success. EMI options, unapproved options, and growth shares each offer unique benefits tailored to different business needs.

- EMI Options: Best for UK-based startups looking to reward employees with significant tax advantages.

- Unapproved Options: A flexible choice for part-time or international workers, though with higher immediate tax implications.

- Growth Shares: Ideal for rewarding founders or senior team members in established companies, tying rewards to future growth.

By understanding their differences and evaluating factors like tax implications, workforce composition, and company stage, you can choose the right scheme to meet your goals.

__________________________________________________________

Ready to simplify equity management? Book a discovery call today to see how Quoroom can help streamline your incentive schemes.

__________________________________________________________

FAQ

What are EMI options?

EMI options are tax-efficient rewards for employees in UK startups with fewer than 250 employees and assets under £30 million.

Who should use unapproved options?

Unapproved options are ideal for part-time employees, advisors, or non-UK workers who don’t qualify for EMI options.

What are growth shares?

Growth shares reward employees or founders for future company growth while minimizing upfront tax liabilities and protecting existing shareholders.

How do EMI options differ from unapproved options?

EMI options offer significant tax advantages, while unapproved options are more flexible but come with higher immediate tax implications.

Which scheme is best for my company?

For startups, EMI options are most tax-efficient. Growth shares work for established companies, while unapproved options suit flexible, broad eligibility needs.