The private capital industry is at a crossroads, with unprecedented levels of capital available for investment but the low-risk appetites of investors. As we step into 2024, several trends are shaping the landscape, impacting entrepreneurs, investors, and companies alike. In this article, we explore the key developments and their implications.

1. Private Equity and Debt: The Powerhouses of Growth

Money Flows from Public to Private Markets

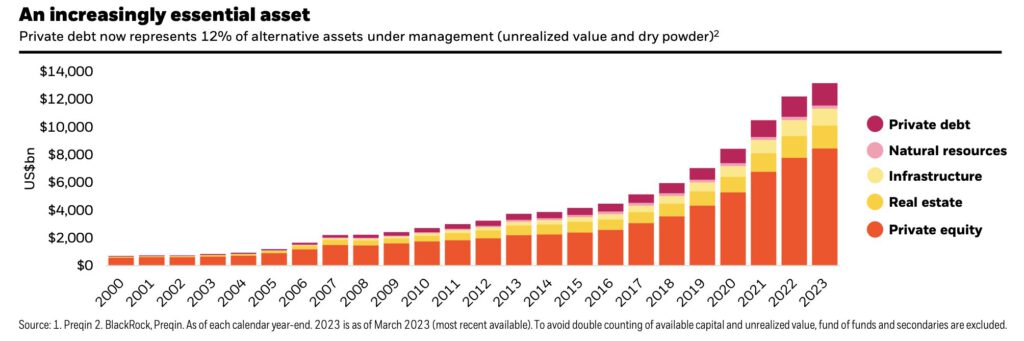

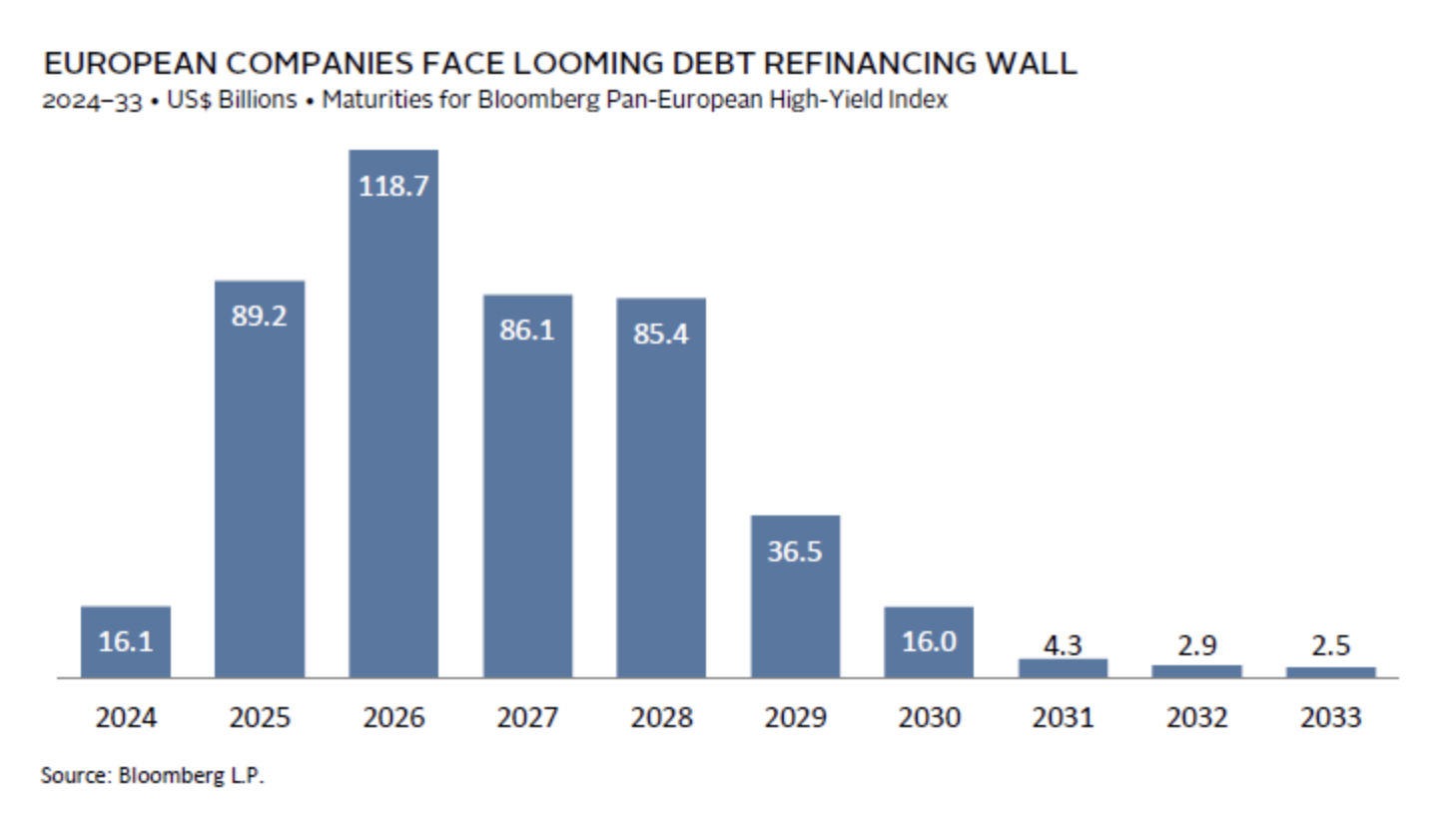

Private equity and debt remain the fastest-growing asset classes, attracting substantial capital as investors seek higher returns. In 2023, the total value of private equity and debt assets surged to an impressive $13 trillion. This shift from public to private markets reflects investors’ hunger for alternative investments that offer both yield and insulation from market volatility. As public markets face headwinds, private capital emerges as a beacon of opportunity.

The wealth landscape is undergoing a seismic shift, with $68 trillion poised to transfer from baby boomers to millennials by 2030. This massive wealth transfer not only decreases inequality between generations but also fuels a surge in venture capital (VC) and impact-focused investing. Gen Z and millennials, driven by purpose, seek to make a difference. Venture capitalists recognize their role as a force for good, investing in sustainable enterprises and technology-driven solutions. As young people enter the workforce armed with knowledge and financial security, the trend toward impact-focused investing is set to continue, benefiting both the world and business.

2. The Dry Powder Phenomenon: A $4 Trillion War Chest

A Bounty Awaits Deployment

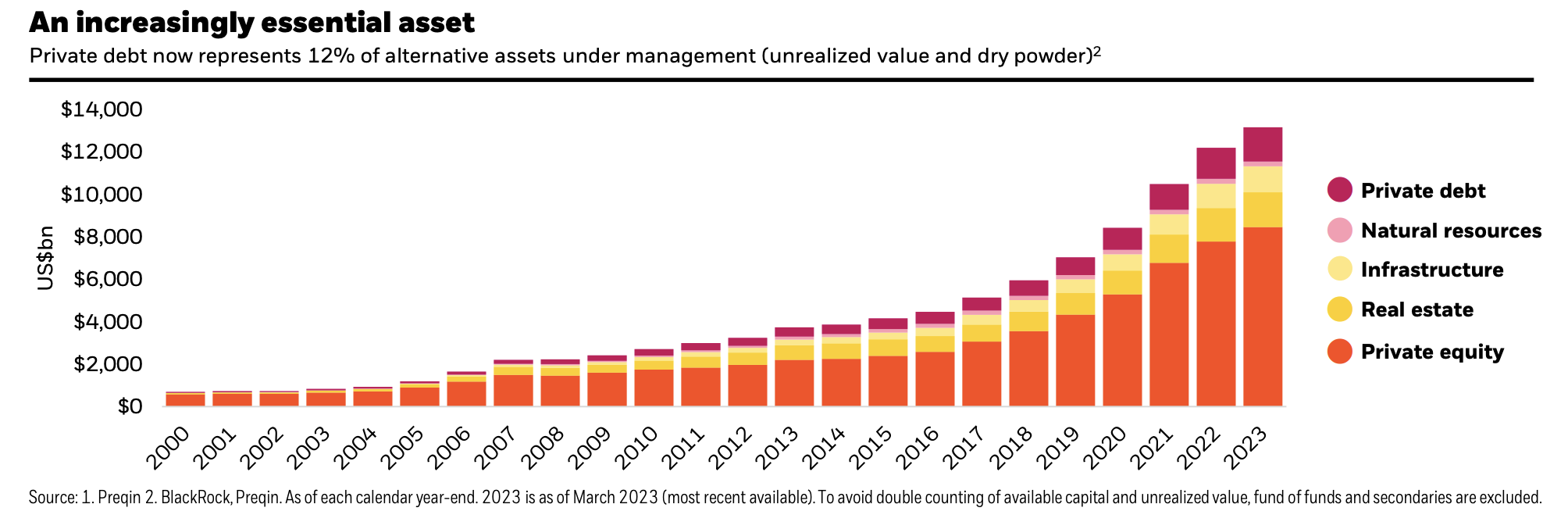

The private capital industry’s “dry powder” has reached an astonishing $4 trillion. Imagine having enough firepower to acquire Apple, with change left for Berkshire Hathaway or Tesla. This colossal sum could comfortably buy every listed company in the UK. But what does it mean? Investors see both promise and peril. On one hand, this liquidity can reinvigorate mergers and acquisitions, stimulate capital markets, and fuel the bull run. On the other hand, it raises concerns about reckless investments driven by desperate fund managers seeking fees or conservative managers being focused only on profitability rather than growth.

3. Navigating Debt Refinancing Challenges

Rising Rates and Complex Loan Approvals

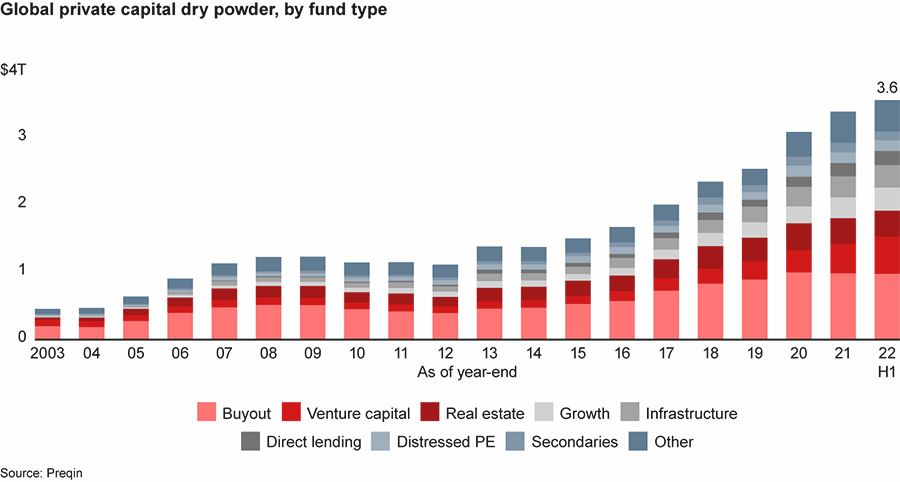

Global companies face a looming challenge: refinancing maturing debt. With interest rates on the rise, securing favorable terms becomes tougher. In 2024, nearly $8 billion of corporate debt matures. Companies must tread carefully, balancing the need for capital with the risk of default. While some have lengthened maturities during favorable financing conditions, others may find themselves on precarious ground. The path to financial sustainability lies in strategic debt management via equity financing.

4. Entrepreneurs Embrace Venture Capital Financing

Beyond Traditional Bank Loans

Entrepreneurs are pivoting away from traditional bank loans, opting for venture capital financing. Venture equity and debt, a lifeline for growth companies, offers non-dilutive financing. It bridges the gap between equity rounds, extends cash runways, and validates business models. Distressed equity and venture debt deals are on the rise, providing flexibility and resilience. Entrepreneurs recognize that profitability and growth go hand in hand, and venture capital fuels their journey.

5. Data-Driven Decisions Shape Investment Landscape

Investors Prioritize Profitability

Investors now eye “distressed” companies with lower valuations but solid fundamentals. Data analytics tools play a pivotal role, enabling funds to source companies and make informed decisions. Gartner predicts that by 2025, over 75% of funds will use data analytics tools to source companies and make decisions. Profitability takes center stage as investors seek sustainable returns. The era of gut feelings gives way to data-driven precision. Companies that embrace this shift will thrive in the evolving private capital ecosystem.

Quoroom is the first platform of its kind that offers founders the opportunity to leverage their data to get more term sheets and choose better terms.

6. The Private Secondary Market: A Quest for Insights

Data as the North Star

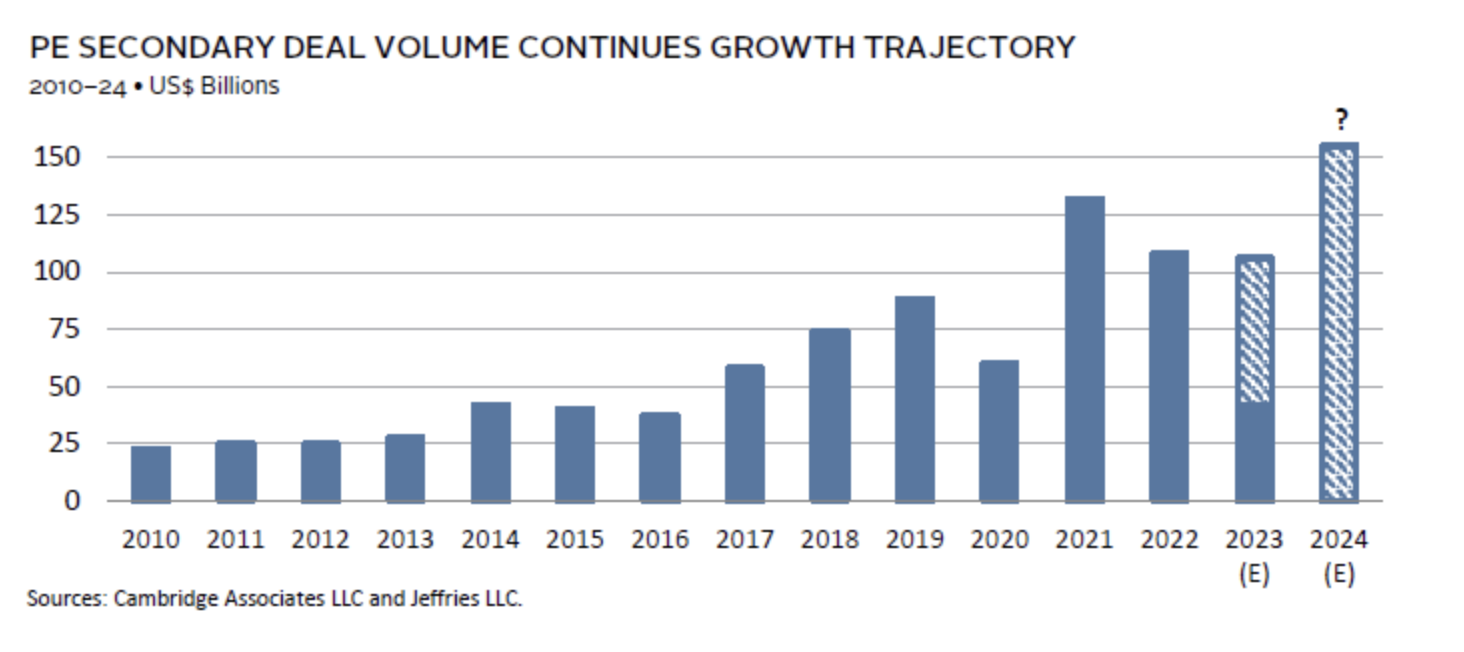

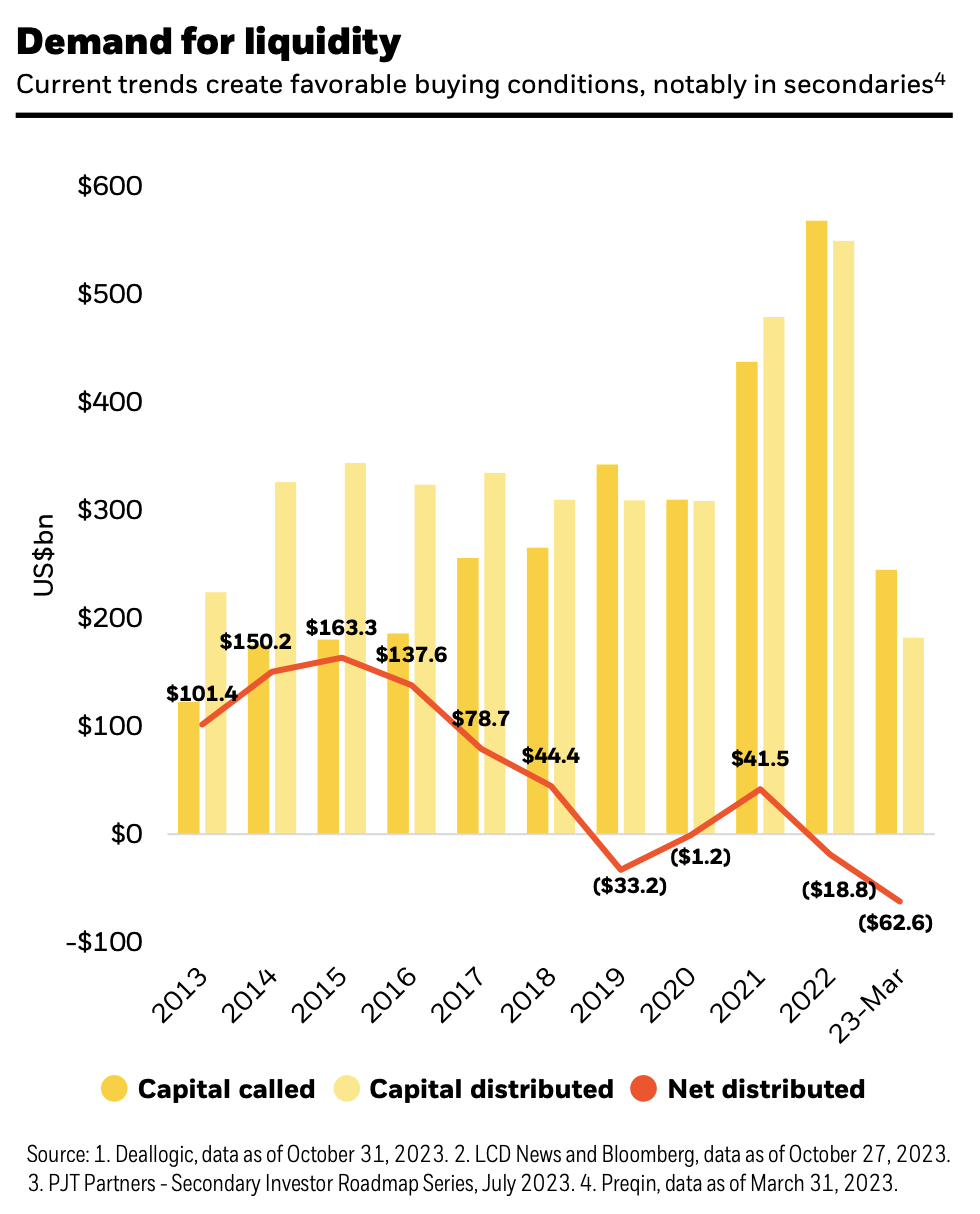

The private secondary market is expanding and the need for liquidity is light as the IPO market is on its low and private companies tend to stay private much longer.

However, decision-making requires more data. Investors seek deeper insights into portfolios, valuations, and risk profiles. By leveraging data analytics, they navigate uncertainty and uncover hidden opportunities. As the private capital landscape evolves, those armed with data will chart a course toward success.

Private Capital Market Outlook Summary

- Despite the VC decline in 2023, private equity and debt are still the fastest growing asset classes as money shifts from public to the private market ($13T in 2023). The private capital industry’s ‘dry powder’ has hit $4tn as investors remain selective.

- PwC predicts US$68 trillion transfer of wealth from baby boomers to millennials by 2030. Even more money will shift into VC and impact-focused investing.

- Global companies face looming debt refinancing wall in 2024-2026. With rising interest rates and complex loan approval processes, entrepreneurs are skipping bank loans and heading to equity financing opportunities.

- Private and venture debt is available to those companies that qualify and can afford high interest rates.

- Investors are eyeing “distressed” companies with lower valuations but solid financial fundamentals – decisions become more data-driven.

- The majority of fund managers will use data analytics tools to source companies and make decisions – companies have to be ready to share more data with investors in order to raise capital.

- The private secondary market is growing, but decision-making requires more data.

In summary, the private capital market is a dynamic arena where growth, profitability, and data converge. Investors and entrepreneurs must adapt, leveraging these trends to create value and resilience. Whether it’s deploying dry powder, embracing venture debt, or harnessing data, the future belongs to those who navigate wisely.

To get a free consultation on your fundraising strategy in 2024, book a demo with our senior team.