If you are an executive in a growing company, you probably know the challenge in hiring professionals and attracting talent to join your team. As a founder or executive in a startup or scaleup company, you understand the intrinsic value of motivated professionals and often would choose to reward your employees or advisers for their work by giving them the right to buy shares in your company in the future (the “option”) at a much lower price (the “exercise price”) than the fair market value of shares at the time of exercise (the “market price”). There are three reasons why you would decide to grant equity options:

- Hire a professional on a lower salary.

- Headhunt a professional to choose to work for your company.

- Gain loyalty and motivate an employee or adviser to stay with your company longer.

If this is the case and you decide to incentivise your team or advisers with Share Options (known as Stock Options in the US), the first step would be to choose and approve by Board Resolution the Option Pool and Share Scheme to exist within your company. Government-approved schemes with tax advantages can be granted to PAYE employees only, while unapproved schemes are for consultants, advisors, contractors etc.

There are a few types of share options schemes in use by UK startups and scaleups:

- An Enterprise Management Incentive (EMI) Share Scheme

EMI scheme is the most popular and commonly used by startups and SMEs in the UK with assets of £30 million or less. The company can grant to one employee, share options up to the value of £250,000 in a 3-year period. The aggregate value of shares over which EMI options are granted must not exceed £3 million.

- Company Share Option Plan (CSOP)

This scheme gives each employee the option to buy up to £30,000 worth of shares at a fixed price. CSOP options can be granted only over ordinary shares. An employee can exercise their option from 3 to 10 years after the date of the grant. Options are normally lost upon cessation of employment and lapse after 10 years.

- Save as You Earn (SAYE)

Each employee can save up to £500 a month under the scheme. At the end of your savings contract (3 or 5 years) these savings can be used to buy shares. One of the biggest benefits of this Scheme is that employees will not pay Capital Gains Tax if they transfer the shares to an Individual Savings Account (ISA) or to a pension scheme within 90 days of the scheme ending.

- Share Incentive Plans

Employers can give up to £3,600 of free shares in any tax year. There are also partnership shares and matching shares that can be provided under this scheme. Employees will not pay Capital Gains Tax on shares they sell if they keep them in the plan until you sell them.

- An Unapproved Options Scheme

Unapproved schemes offer flexibility but provide no tax advantages. Companies would tend to use unapproved share option schemes when the company is too big to qualify for EMI share options, and the £30,000 CSOP limit is too low or the company wishes to use shares or exercise rules that would not qualify for tax-advantaged share option schemes.

Tax Implications

Unlike the Unapproved Options Scheme, all Approved Share Schemes would allow your employees to benefit from tax advantages, such asnot paying Income Tax or National Insurance on the value of company shares. They will be able to buy the shares at the exercise price and sell them at the market price, benefitting from the price differential. Employees may still have to pay Capital Gains Tax however if they sell the shares. The “gain” is usually the difference between what the employee paid for your shares and what they sold them for. But because they acquired shares through certain approved Employee Share Schemes, the “gain” would be calculated as the difference between the market value of shares at the date of exercise and the sale proceeds received for the sale of the shares. Additionally, employees would not pay any tax up to their individual allowance limit. Capital Gains tax-free allowance from the taxable gain for the for the 2020 to 2021 tax year is £12,300.

A practical guide to grant an options

All schemes have similar legal registration and reporting requirements, however, the EMI Scheme additionally would require the agreement of a company valuation with HMRC. Unapproved schemes also do not require approval and filing of an annual return.

Steps to grant and manage share options:

- For an EMI scheme, the exercise price has to be calculated based on the valuation agreed with the HMRC. A share valuation can be applied for by filing in VAL231 form and emailing it to HMRC Shares and Assets Valuation (SAV). You also must request HMRC Shares and Assets Valuation (SAV) to approve the value of shares in a Share Incentive Plan (SIP) via emailing them VAL230 form and your valuation of a Company Share Option Plan or Save As You Earn scheme by emailing to SAV the valuation with the necessary supporting documents.

- Approve a Share Options Pool and Share Scheme with shareholders and the board of directors (issue a Board Resolution and/or Shareholder Resolution).

- You may need to update your Articles of Association to support options

- Sign the Share Option Agreement with each employee and make sure the employee is registered for PAYE online.

- Within 90 days of the valuation being approved, issue the options with a vesting schedule to your employees.

- Distribute option certificates to your employees.

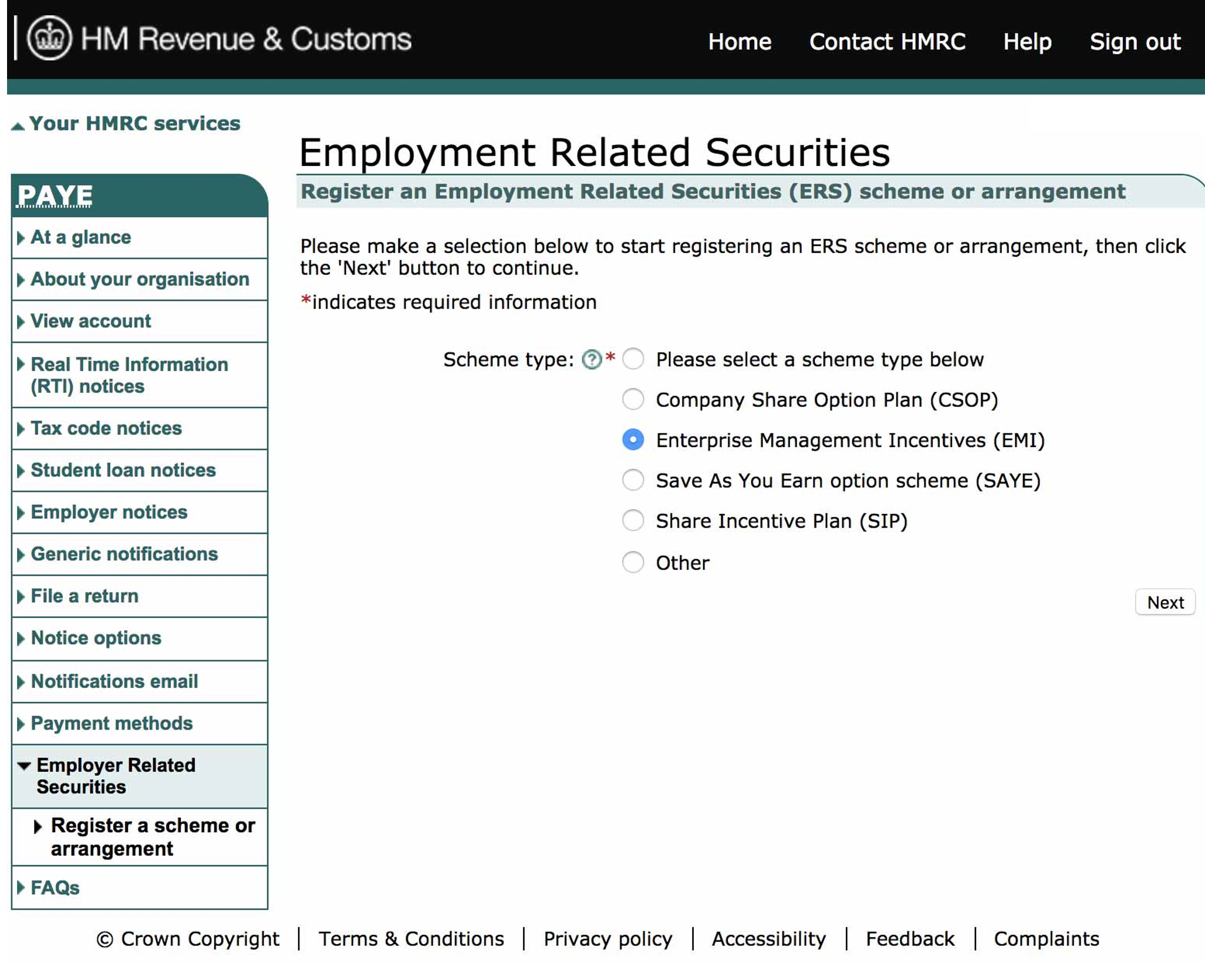

- Register all new tax-advantaged schemes by 6 July following the tax year it was established. You have to do this through your PAYE online account.You only need to register non-tax advantaged (Unapproved or Other in the PAYE system) schemes when assigning or releasing securities options.

- Within 7 days, you’ll be allocated a scheme reference number. You will need it to submit the EMI Notification to HMRC within 92 days of EMI option grant.

- Each year by 6 July every year complete and submit to HMRC a scheme-specific annual return form. This has to be done for each scheme even if there’s no reportable event.

- Manage vesting and exercise of options.

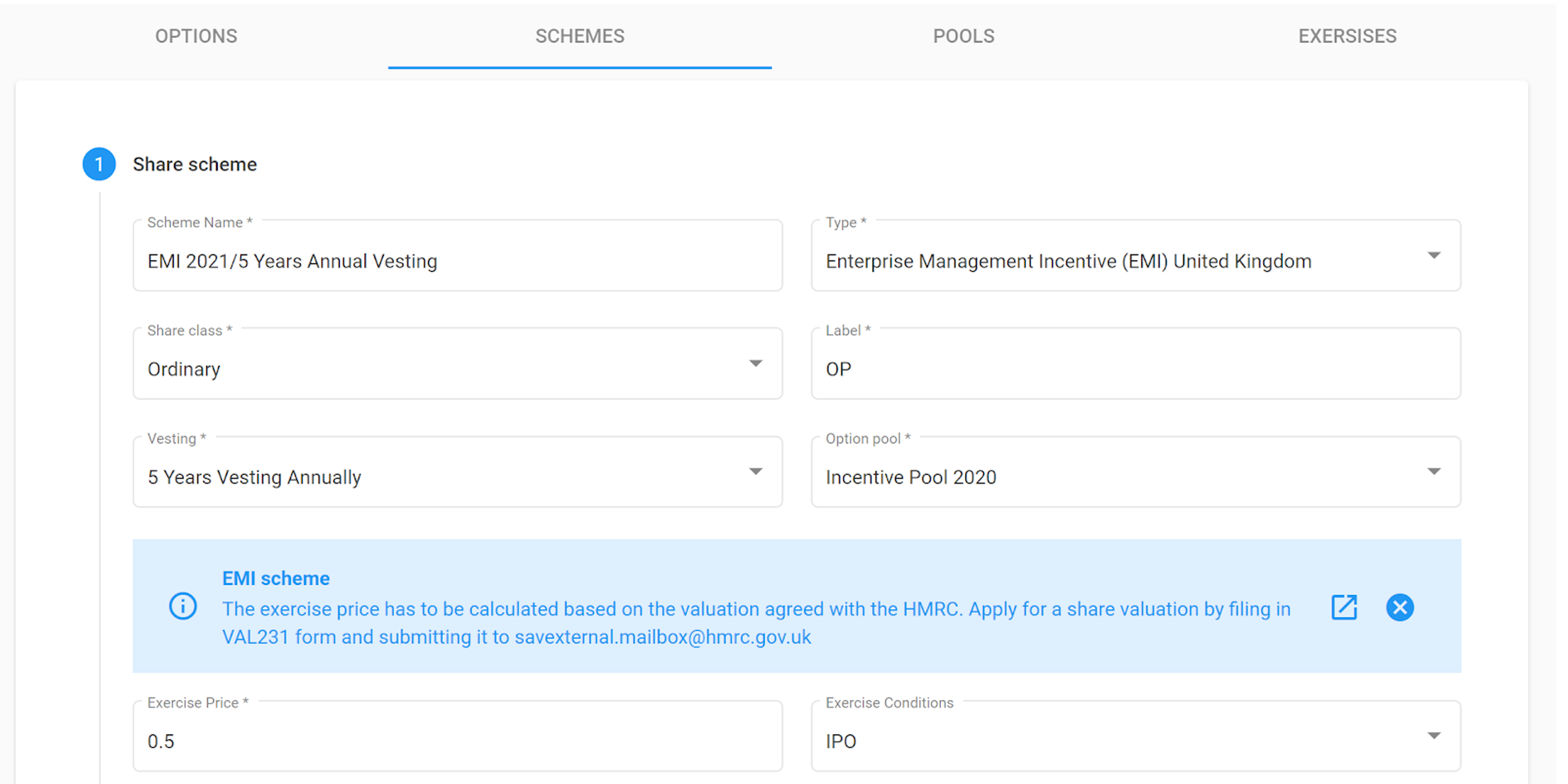

All of these steps can be done faster, cheaper and easier with the software solution in place. You can utilise Quoroom to set up any approved or unapproved schemes, and issue options with fully automated vesting schedules and event-based flow for your option holders to exercise their options.

Log in to your Quoroom account to get started or book a free demo with one of the team members.

Photo by Brett Jordan