Investor Update Templates for Startups

Welcome to the heartbeat of startup communication—the Investor Update.

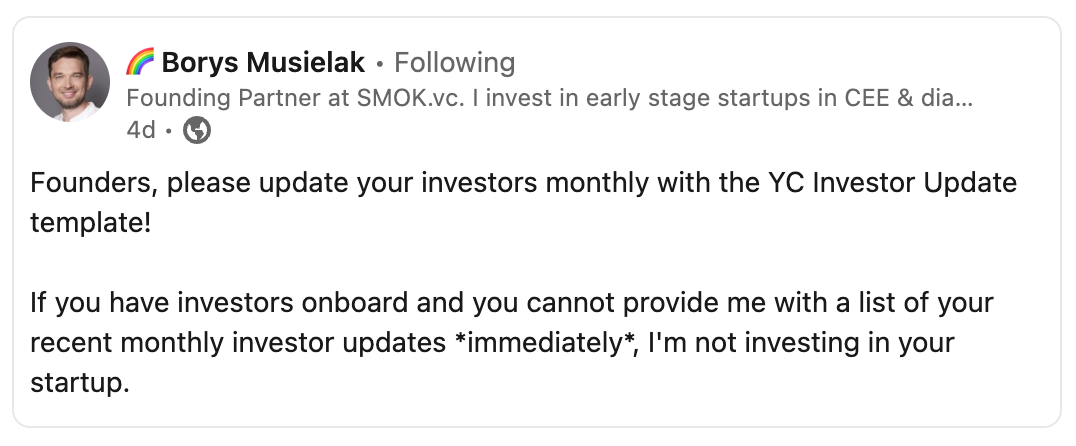

The most successful companies use Investor Update as a tool to build a relationship with investors, stand out of the crowd and raise new capital faster.

So investors even require to see updates you send to your existing investors before they will invest in your company.

Let’s delve into the anatomy of Investor Updates, deciphering the significance they hold in the dance of capital and innovation.

In essence, an Investor Update is a strategic communication tool, a periodic dispatch that illuminates the progress, challenges, and triumphs of a burgeoning company to its stakeholders. Startups and scaleups should send regular updates to their existing investors, usually on a monthly basis.

F1V Investor Update Template

Partners and friends,

This is Ulyana, co-founder at __. I’d like to share our news and growth updates with you. Let me know if you’d like to schedule a meeting to have a deep dive into the details.

Let’s begin!

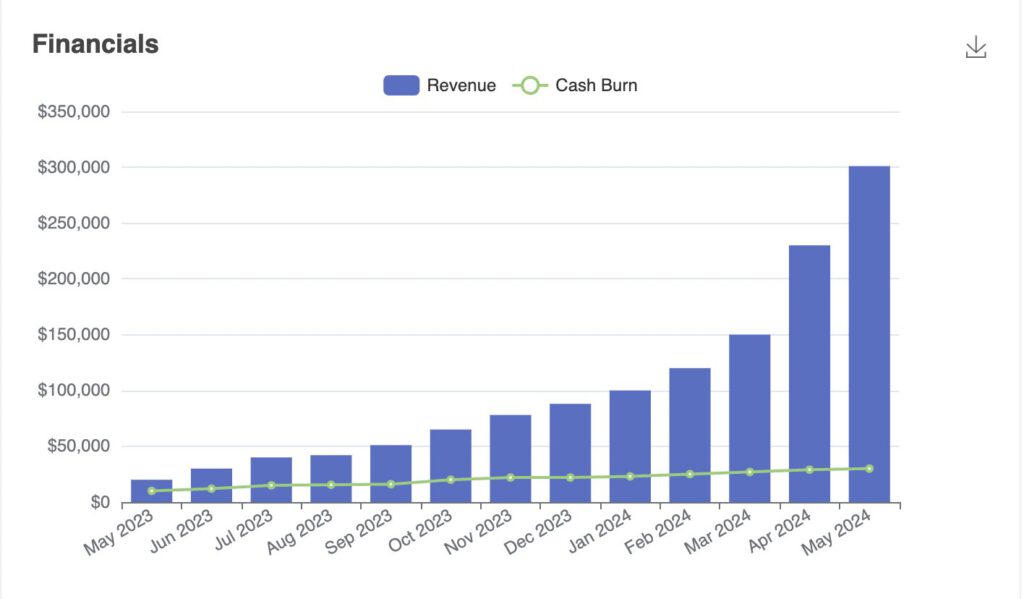

Financials

In this quarter (month), we generated revenue of $__, resulting in a __% YoY increase. Our goal for the next quarter is to achieve $__ in revenue, reaching __% growth YoY.

Current MRR: $__.

Balance: $__.

Runway: __ months.

Net Burn Rate: -$__.

We currently serve over ___ clients and aim to acquire and scale ___ more by the end of the year.

Performance

Marketing

Cost Per Click: $__.

CPA: $__

Return on Advertising Spend (ROAS): __.

Sales

Lead Conversion Rate: __%.

Lead-to-Opportunity Rate: __%

If your financial or operational performance has gotten worse, the report should briefly describe possible reasons and how your team is fixing it.

Product updates

Launched a new feature: __.

We have also figured out how to improve our customers’ user experience: __.

We redesigned __.

It’s important to specify the benefits these changes bring to your product: they might save time, increase customer retention, allow you to increase the average check, and so on.

New hires

Throughout Q1 we have focused on some top hires to lead our continuing growth in 2023:

-

-

We are welcoming (name) as our Global CFO bringing 20 years of experience in finance.

-

-

-

A few months ago, (name) joined our team, and we are excited to announce that she will now be leading our strategy and M&A efforts. She has over 12 years of experience in the VC world, product management and strategy.

-

Open vacancies

-

-

Jr. Customer Success Manager, NYC

-

-

-

Customer Success Manager, NYC

-

-

-

Customer Success Manager, Seoul

-

Asks

Additionally, you could use your investor update as a platform to share your plans and worries and ask VCs for help.

We have been experiencing problems with __ and are looking for additional expertise in __.

We are planning to raise a new round in __ month and we would greatly appreciate your assistance with __.

Best regards,

Ulyana

Coding VC Investor Update Template

Hi everyone!

Here are our updates for this month.

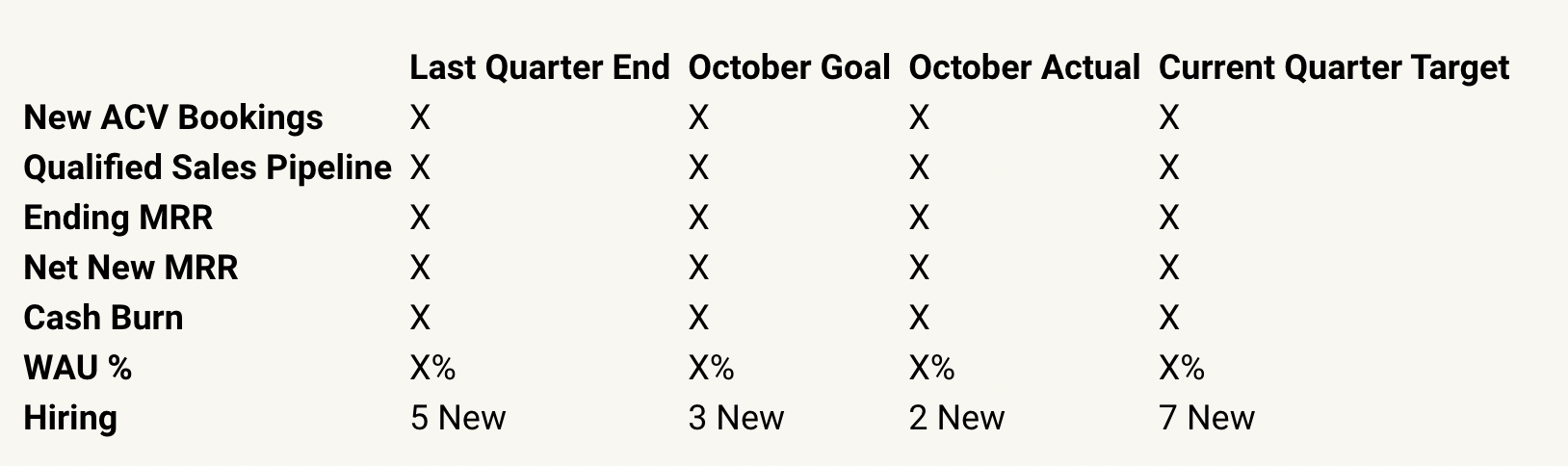

>>KPIs

-

- # of paying users: 40 (+25% compared to last month)

-

- # of logins/user/day: 1.73 (+38%)

-

- Users active after 60 days: 37.5% (-8%)

-

- Employees: 5

-

- Monthly burn: $42k

-

- Runway: 19 months

>>Notable Events

>Great

-

- We were featured in TechCrunch which led to 173 trial customers and 8 new users. [link to TechCrunch article]

-

- We hired Joe Smith as our first VP of Sales. Joe was a Sr. Director at Salesforce for the last 6 years and graduated from Yale.

>Good

-

- We are still looking for junior front-end engineer. We went to three college career fairs last month and now have 84 potential candidates in our hiring pipeline.

>Bad

-

- Our main web server crashed on Feb 23rd and we have three and a half hours of downtime. Several customers called to complain, and we offered them a 50% discount for the month. We will be working this month on improving the fault tolerance of our system.

-

- We are still looking for a DevOps engineers and don’t have many good leads.

>Ugly

-

- We’ve been trying to close a deal with XYZ corp for 4 months, and they decided to go with RelateIQ instead of us. This would’ve been a landmark deal for the company. We’ve followed up with XYZ to learn what we could have done better and will be incorporating their feedback in March and April.

>>Thanks!

-

- Thanks to John E. for referring 3 potential front-end engineers.

-

- Thanks for Lucy K. for helping us think through our PR strategy.

-

- Thanks for Joe D. and Kathy R. for introducing us to over a dozen potential customers.

>>How you can help

-

- We are looking for a good DevOps engineer. If you know someone who might be a good fit, please let us know.

-

- We love getting intros to potential customers. Our ideal customers right now are startups with $1m-$10 in revenue and 3-10 salespeople.

-

- If you have a few minutes, we’d love to get feedback on our newly redesigned Contacts page: [link to Contacts page].

Cheers,

Joe Founder

Underscore VC Investor Tempates

Seed Investor Update Template (Option 1)

Dear Friends of [Company],

Hope you are doing well! Here is a quick update from the last X weeks/month/quarter at the company.

Main Updates

[Reminder: Underscore’s SaaS Metrics overview is here.]

-

-

Traction: We finished the last quarter at $XX ARR. Currently tracking at $XX and with the [Customer] season picking up again this quarter, we’re targeting higher growth for the rest of Q.

-

-

-

New Customers: Added some great enterprise software logos: [X Customer], [Y Customer], [Z Customer]: and crossed X paying customers.

-

-

-

Customer Love: Keeps on growing! New case studies and quotes on [URL to Page]. We are also on [Rating Site] now, trending strong at X/5.

-

-

-

Burn & Runway: Still projecting cash runway until [Month/Year] assuming base case revenue growth.

-

-

-

Team: We are now XX+ members strong. Really excited to have [Name] join as [Title] to help us [Job Goals]!

-

-

-

Customer Advisory Board: We are forming a customer advisory board of thought leaders and influencers in [Industry] – already 10 members strong.

-

Q3 Priorities

-

-

Pipeline building remains the biggest GTM priority. We are actively working towards a free trial flow, and investing in ads and other salestech accelerants.

-

-

-

Partnerships as a GTM channel is also something we are keen to experiment with this year. The [Industry] ecosystem is ripe for this – any suggestions here would be welcome.

-

-

-

Our CS function is evolving to help us hit market leading NPS and NRR next year. We are now X member-strong and are building out motions for onboarding, success, and support to streamline customer ops.

-

-

-

[Customer Use Case] is top of mind on the product side. We are working on some exciting products which will make doing [Customer Use Case] truly simple. More on this next month!

-

-

-

Working towards doing a mini customer event in [Month] and a customer conference in [Month].

-

Best ways to help are

-

-

Hiring recommendations for the [Title w/ Link to Job Description] role. Very important to close this.

-

-

-

Community Suggestions: We are looking to work with communities such as X, Y, and Z, where [Customers] hang out. Warm intros to any such community you know of would be helpful.

-

-

-

Advice on growth: Always looking for tactical advice on growth and partnership recommendations.

-

-

-

Warm intros: Can never get enough of ‘em. Anything especially at [List of Companies] would be great.

-

-

-

Customer Advisory Board: If you know any great [Customer Role] leaders who you think highly of, we would love to speak with them.

-

-

-

Use us: Many of our investors are using us for [Use Case]. It is a great way to know the product better and spread the word!

-

Thanks,

Co-Founders

PS: ICYF “What does [Company] do exactly?” “We are a [Boilerplate Description].”

Seed Investor Update Template (Option 2)

Hi everyone,

Hope you’re having a great summer so far. Here’s our monthly investor update.

But first, how you can help:

Does anyone know a good PR consultant? The holidays will be an awesome opportunity to get our message out to the media and other outlets that will be covering this.

July Summary

Highlights

-

-

Closed our first 4-figure MRR / $35k ARR customer.

-

-

-

We hired our first full-time Marketing Manager. [Name] comes to us from [Company] and starts this month.

-

-

-

We’re now winning deals against major competitors (including [Competitor], [Competitor], and [Competitor]), onboarding larger brands such as [Brand] and won over a few previously churned customers last month. This signifies the investments we’ve made across product, sales, and support these last few months.

-

Financial

[Reminder: Underscore’s SaaS Metrics overview is here.]

-

-

$X in the bank

-

-

-

X total customers (+X% MoM)

-

-

-

$XX Ending MRR | $XX Ending ARR (+X% MoM)

-

-

-

X months of runway, cash out date

-

-

-

New sales bookings (% of target for month or quarter)

-

Product Updates

-

-

We announced integrations with [Product/Company] and [Product/Company].

-

-

-

Launched a beta of our [Product Feature].

-

-

-

Expanded carrier support for numerous carriers throughout South America and Europe.

-

-

-

Built integration with XYZ (not yet announced).

-

Challenges

MRR was a bit flat in July despite having a strong month in net new customers as we’re recovering a bit from last month’s churn and there’s a lag in reporting usage-based revenue, which will reflect in future months.

August Focus

We’re continuing to focus on:

-

-

Building a great [Product] and officially rolling it out to all customers.

-

-

-

Onboarding Marketing Manager – step on the growth pedal and prepare content and marketing campaigns ahead of [Event].

-

-

-

Preparing for our Q4 fundraise.

-

Happy customer quote of the month: “XYZ”

Cheers,

Founders

A quick reminder of what we do:

[Insert two-sentence pitch here. website.url.]

Series A Investor Update Template (Option 1)

Investors,

[Company]’s mission is to… [Company] is a [Boilerplate Description]. In September, we crossed over XX [Customer/User Milestone].

Company Update

[Reminder: Underscore’s SaaS Metrics overview is here.]

Sales

We had a solid month for new bookings, primarily customers that upgraded from the freemium funnel. [Customer X] was the largest at 50 seats @ $XXX MRR. Our first AE is still ramping but managed to close $XXX in new MRR.

Product

We released one new feature: [Feature Description]. We believe this will accelerate [Customer Goal].

Cash

$XX in cash, burn was $X in [Month].

Issues

-

- Hiring: Unfortunately, we are still having difficulty hiring engineers. Resolution: We are now using Hired.com to help fill the pipeline.

-

- Low Morale: The team was feeling low after we lost a big contract to a competitor. Resolution: Installed cold brew coffee on tap.

How You Can Help

-

- VP Sales: We are narrowing in on final candidates for our VP Sales search. Please send me comps for total compensation (base, bonus, and equity) for VP Sales roles at similar stage startups?

-

- Office Space: We are bursting at the seams in our current office and we can’t fit another desk unless we move [CEO] to the basement. @Investor: I saw you are connected with real estate broker X. Please email an introduction: “Hi X, I’d like to connect you with CEO of [Company]. CEO is looking for a 3,000-3,500 sqft office in Cambridge near Kendall Sq targeting November move-in. Please connect directly.”

Thank you for your continued support. I specifically want to thank:

-

- Lily Lyman of Underscore VC for helping us hire our first content writer last month. Content marketing is a key driver of our funnel and our new hire is already making an impact. Thanks, Lily!

Best,

CEO

Series A Investor Update Template (Option 2)

Investors,

June was a solid month where we continued to focus on transitioning to the new platform and shipping new features. Revenue decreased a bit in June, but many of the updates, launches, and features we shipped will lead to increased revenue in the coming months. Big things are happening in July already!

We also decided to delay the launch of our website/branding a few weeks longer, but we are very close. You’ll have another update there in a few weeks.

Business wins:

-

- [Name] is joining [Company] as our new [Title]. She’s coming over from [Company], where she was [Title]

-

- Record number of applications for the month (XX)

-

- Signed X new client contracts

-

- Record number of API calls for the month (XX), up from XX in May

-

- Negotiated better contracts with X vendors to increase margins on [Service]

Product wins:

-

- Released [Feature] and [Feature] for [Product]

-

- Transitioned to a new design system, which will…

-

- Completed designs on new data analysis, which will…

Business losses:

-

- Did not hit the target for revenue ($XX), down to ~$XX, below target for the month

-

- X client launches pushed back to July

-

- Revenue fell from $X per [Service] to $X per [Service] due to new feature/product releases

-

- Average deal size decreased to $XX which was the 2nd lowest of the year

Product losses:

-

- Did not launch new branding

-

- Did not switch over to new website yet, will be doing this over the next couple weeks

-

- Delayed start of development of [Feature] to next month

Goals for July:

-

- Reach $XX in revenue

-

- Fill senior Marketing, Sales, and Customer Success roles

Asks:

-

- Still looking for great frontend and backend engineers

-

- We’d love to speak with anyone who is thinking about launching any kind of [Service] that requires any [Industry Expertise]

Reminder: [Company] does [Boilerplate].

Onward,

Founder

To use templates and distribute Investor Updates via Quoroom platform create your account here or book a call to see a demo.